Combining the Relative Strength Index and Bollinger Bands

You will learn about the following concepts

- Indicators used in this strategy

- Signals to look for

- Entry point

- Stop-loss

- Profit target

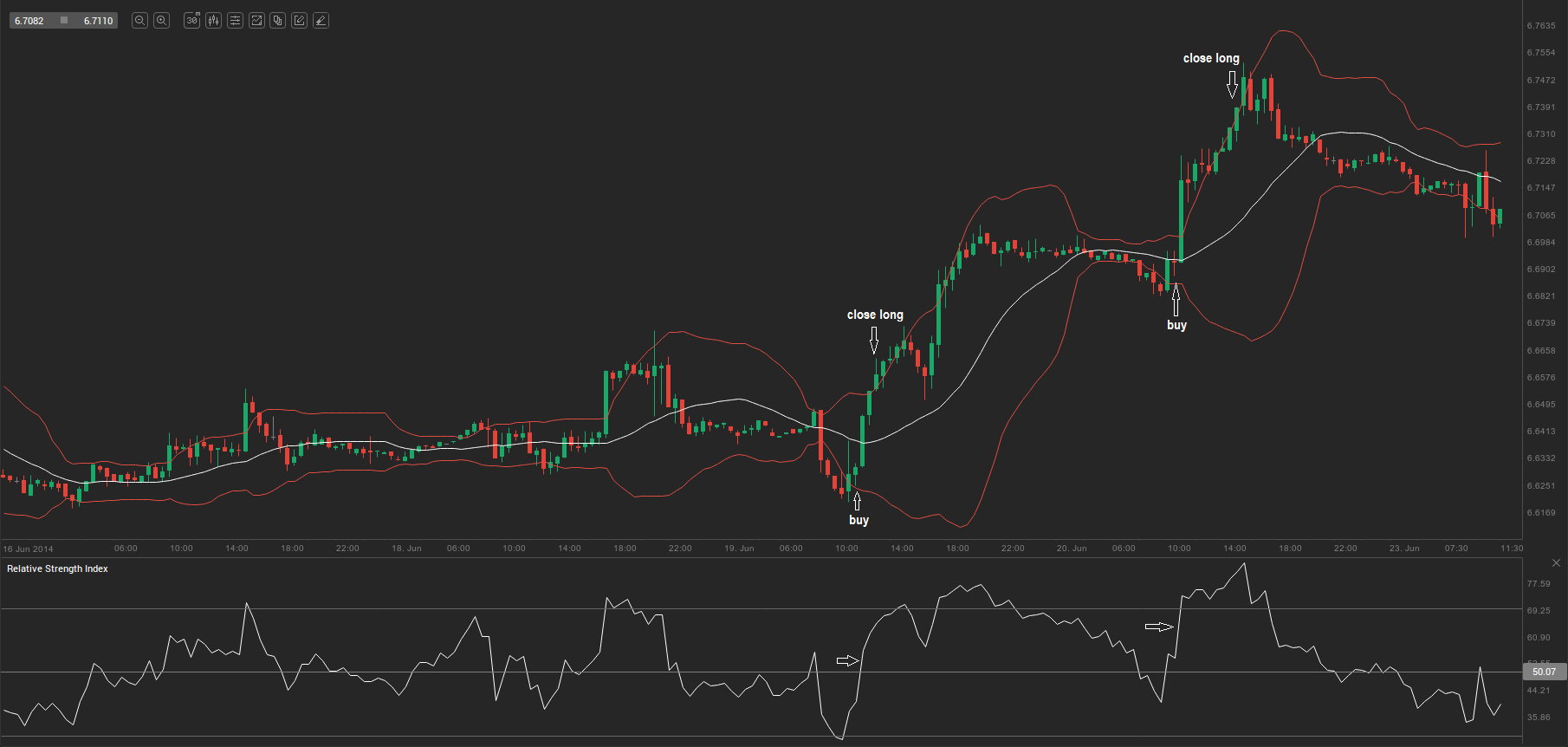

For this strategy, we examine the 4-hour and 30-minute time frames of the USD/SEK chart. We will use the Relative Strength Index (RSI) with a period of 14 (overbought level 70, oversold level 30) and apply Bollinger Bands with their default settings. We mark the 50.00 level on the RSI to determine whether the market is trending up or down. On the 4-hour USD/SEK chart, an RSI reading above 50.00 indicates an uptrend, while a reading below 50.00 indicates a downtrend. To enter a trade, switch to the 30-minute time frame.

During a bull trend, if a candle closes below the lower Bollinger Band and the next candle closes above the lower band, this sets up a long entry. The protective stop should be placed at the low of the candle that closed below the lower band.

During a bear trend, if a candle closes above the upper Bollinger Band and the next candle closes below the upper band, this sets up a short entry. The protective stop should be placed at the high of the candle that closed above the upper band.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Below, we have visualised several long and short trades based on the trading approach mentioned above.