Forex trading strategy – combining two sets of Fibonacci retracements

You will learn about the following concepts

- Indicators used with this strategy

- Signals to look for

- Entry point

- Stop-loss

- Profit target

Generally, traders use Fibonacci retracements or extensions to identify confluences with other key levels, such as support and resistance, pivot points, etc. The aim of combining two sets of Fibonacci retracements is to identify at least two strong Fibonacci levels within an area of possible support or resistance. Traders know that such confluences are likely to trigger a reaction, which they can use when deciding how to position themselves.

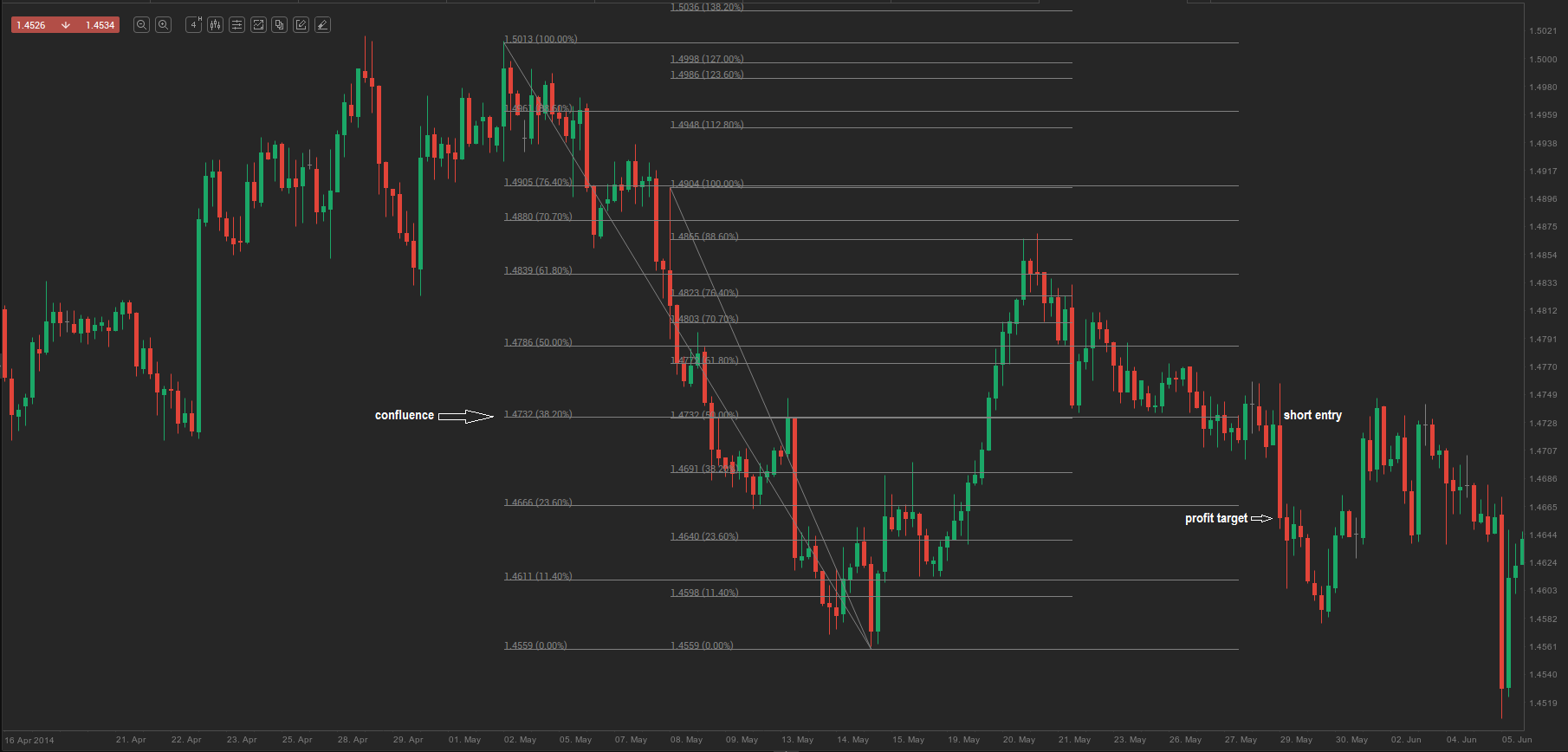

Let us look at the 4-hour chart of EUR/AUD below. There was a prominent bearish trend and a few large retracements. We select the most recent prominent swing high and the swing low in the middle of the screen. We use these points to draw the first set of Fibonacci retracement levels. Next, we take a lower swing high and the same swing low and draw another set of Fibonacci retracements. As can be seen on the chart, there is indeed a confluence between the 38.2% retracement level from the first Fibonacci set and the 50.0% retracement level from the second set. This presents an opportunity to enter the market in the direction of the underlying bearish trend.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Such a combination of two Fibonacci sets may produce even more reliable signals when viewed in the context of other key price levels and patterns – support and resistance, pivot points, round numbers and, of course, candlestick formations.

In the example above, the protective stop may have been placed at the high of the bullish candle that marked the end of the retracement, while the profit target may have been set at a round number – the 1.4650 level in this case.