Forex trading strategy – combining exponential moving averages and Parabolic SAR

You will learn about the following concepts

- Indicators used with this strategy

- Signals to look for

- Entry point

- Stop-loss

- Profit target

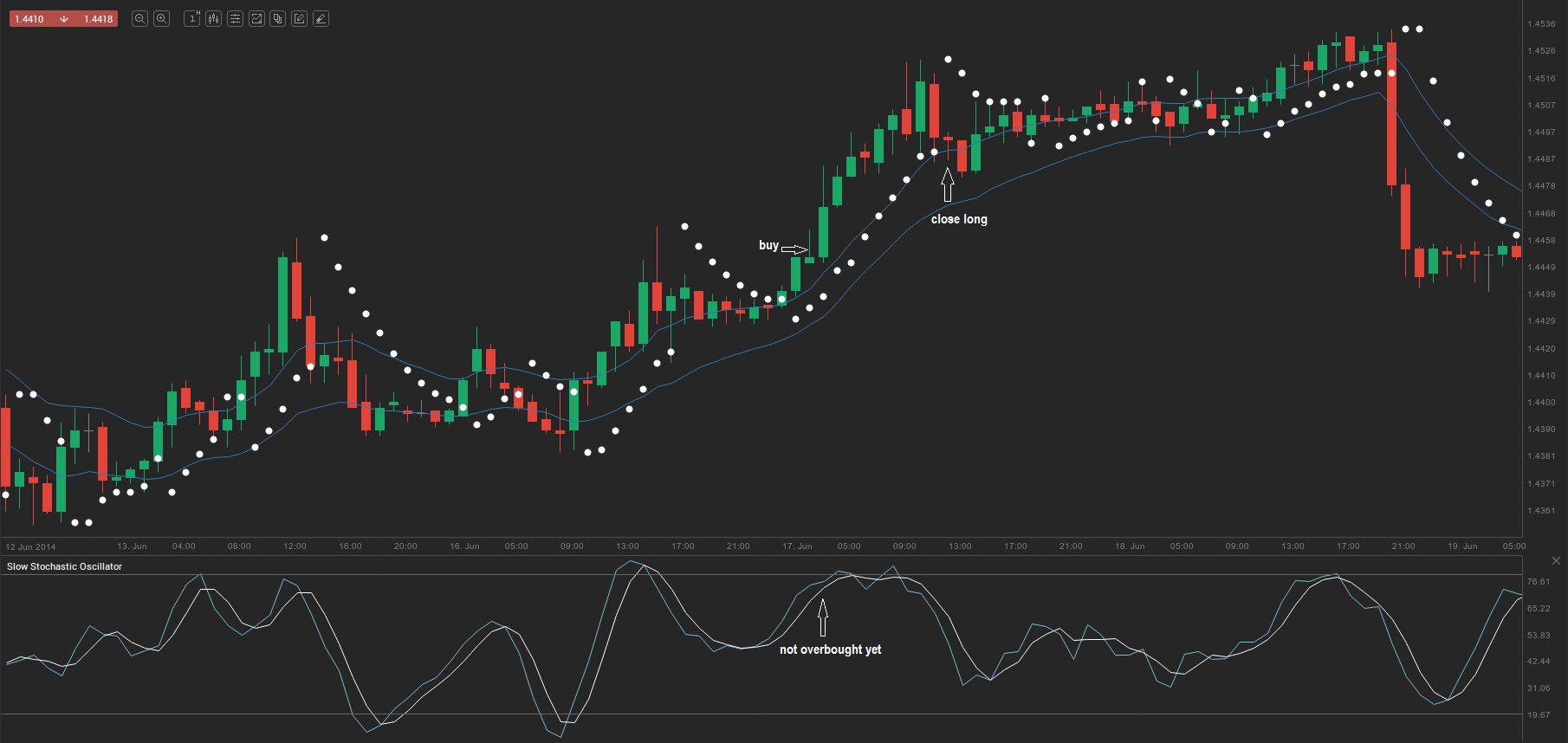

For this strategy, we will examine the 1-hour chart of EUR/AUD. The indicators we will use are: a 14-period Exponential Moving Average (EMA) set to high (blue on the chart below); a 14-period EMA set to low (also blue); the Parabolic SAR with default settings (0.02; 0.2); and the Slow Stochastic Oscillator with settings 5,3,3.

As soon as a candle closes above the 14-period EMA (high), the Parabolic SAR positions itself under the candle and the Slow Stochastic is not overbought; this is a setup to go long. A trader may set a trailing stop at the 14-period EMA (low). Once the Parabolic SAR changes its position, the trader needs to exit.

As soon as a candle closes below the 14-period EMA (low), the Parabolic SAR positions itself above the candle and the Slow Stochastic is not oversold; this is a setup to go short. A trader may set a trailing stop at the 14-period EMA (high). Once the Parabolic SAR changes its position, the trader needs to exit.

- Trade Forex

- Trade Crypto

- Trade Stocks

- Regulation: NFA

- Leverage: Day Margin

- Min Deposit: $100

Below we visualise one long and one short trade based on this approach.