Key Moments:

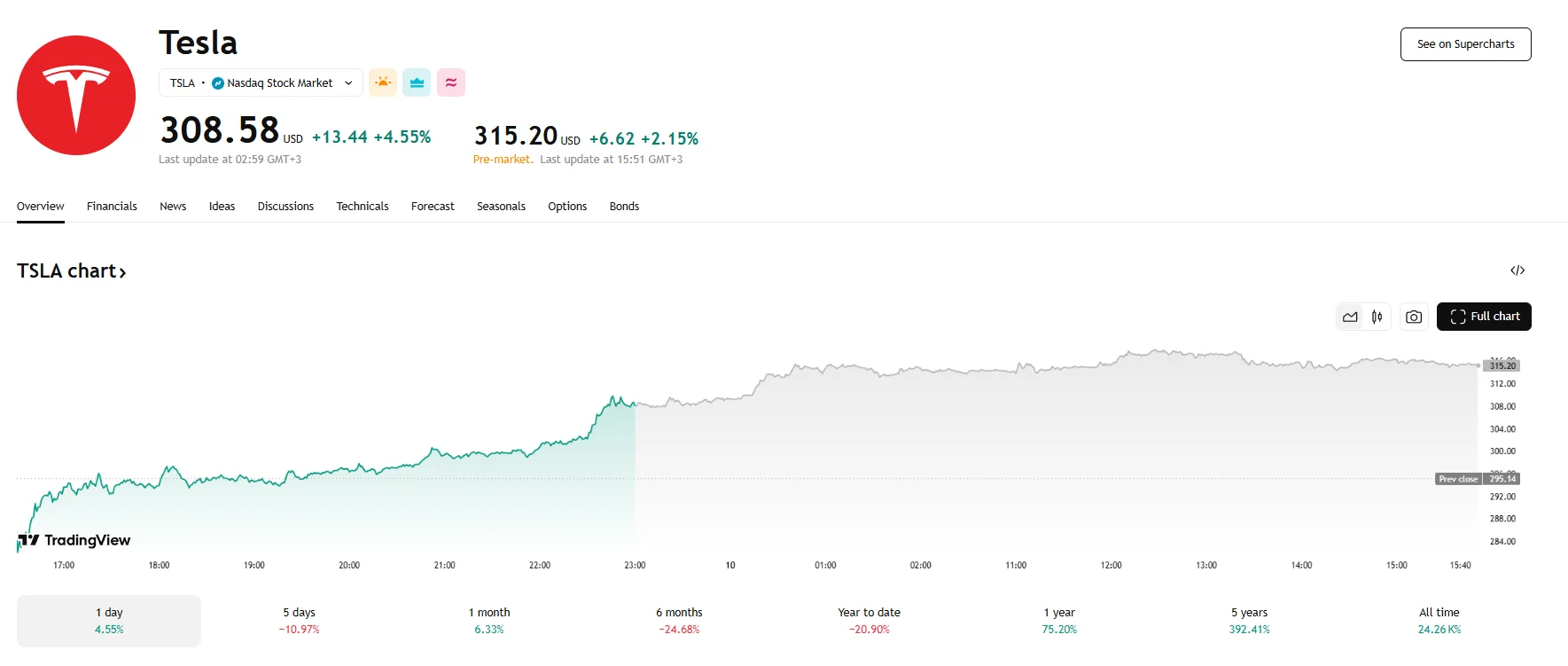

- Tesla’s share pric rose over 2% in pre-market hours, extending yesterday’s 4.55% gains that saw the stock close at $308.58.

- Investors appeared optimistic ahead of Tesla’s expected robotaxi launch in Austin, Texas.

- Trump’s public olive branch and Musk’s recent online endorsement of his stance on the Los Angeles protests suggested a possible reconciliation after last week’s spat, which also aided market enthusiasm.

Market Rebound Driven by Robotaxi Optimism

Tesla’s shares rose 2.15% to $315.2 during Tuesday’s pre-market trading, extending a winning streak that now stands at three consecutive sessions. This momentum comes amid heightened anticipation over the company’s planned rollout of its robotaxi service, which is rumored to launch as early as June 12th in Austin, Texas.

Political Drama Sparks Volatility

The recent rally comes on the heels of a tumultuous week that followed a public disagreement between Tesla CEO Elon Musk and former President Donald Trump. Musk criticized a major taxation and spending initiative supported by Trump, prompting Trump to fire back with accusations about Musk’s business motives. The confrontation triggered a 15% plunge in Tesla shares last week.

However, this week saw a de-escalation of the dispute that signaled a potential truce. Trump publicly extended well wishes to Musk and offered to converse with the Tesla CEO, a gesture that followed Musk’s apparent online endorsement of Trump’s stance on the Los Angeles protests.

Analysts Turn Cautious Despite Long-Term Confidence

While investors appear to be looking ahead to product innovation, some analysts remain wary. Both Argus Research and Baird shifted their ratings on Tesla to “hold,” although they did emphasize that Tesla continues to be viewed favorably over the longer term despite near-term volatility.

Even with the recent uptick, Tesla stock has slipped more than 20% year-to-date as of Monday. The current gains suggest a possible shift in market tone as attention pivots from political headlines to upcoming product developments.