Key Moments:

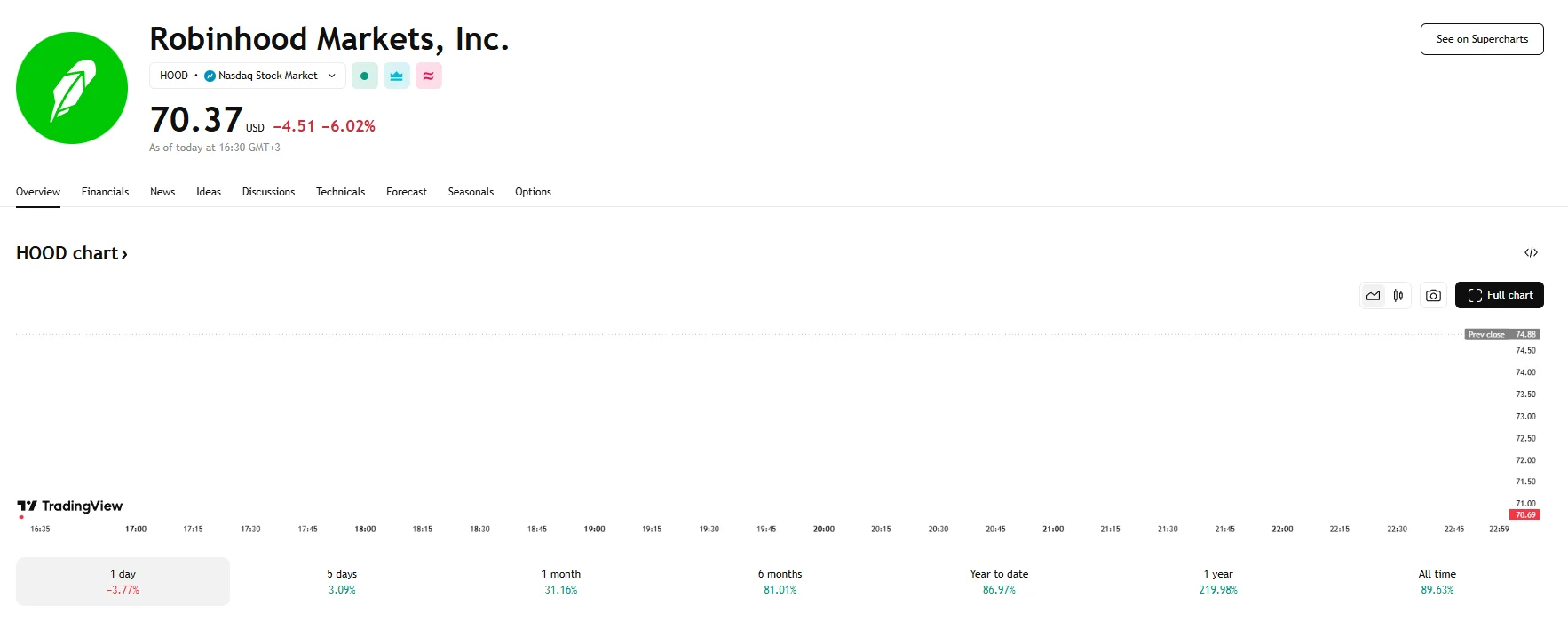

- Robinhood started off this week’s trading with a 6% drop.

- Recent speculation suggested that Robinhood could be added to the S&P 500.

- However, Friday saw S&P Dow Jones Indices opt not to adjust the S&P 500 membership during its latest quarterly rebalancing, causing Robinhood’s price to slip today.

No Changes in S&P 500 Composition

On Friday, S&P Dow Jones Indices confirmed that there would be no changes to the constituents of its flagship S&P 500 index as part of its quarterly review. The decision left companies like Robinhood Markets and AppLovin, which had gained traction on speculation of inclusion, out of the widely tracked benchmark.

Earlier in the month, Bank of America analysts had identified Robinhood as the “prime candidate” for inclusion in the S&P 500, further fueling investor bets. As they ultimately did not pay off, the crypto giant’s shares slipped 6% to $70.37 once markets opened on Monday, extending its pre-market decline after the anticipated announcement did not materialize.

AppLovin mirrored this decline. In addition, the slump follows a recent surge that saw the Robinhood stock reach its highest level since Robinhood’s public debut four years ago.

Meeting the Bar for Inclusion, Traders Navigate Volatility

To qualify for entry into the S&P 500, companies must meet several criteria, including being headquartered in the US and listed on a recognized US exchange. Their market capitalization must also stand at at least $20.5 billion. As of Friday’s close, Robinhood’s valuation stood at $66.1 billion, with shares more than doubling year-to-date and trading well above its IPO price of $38.

Ladenburg Thalmann Asset Management CEO Phil Blancato observed that when smaller companies sought inclusion in indices like the S&P, it signified a potential influx of millions of dollars without requiring a fundamental shift in their operations. He then elaborated that, consequently, speculative traders should anticipate market volatility, as it is frequently the case that expectations and the actual outcome diverge in such situations.