Key Moments:

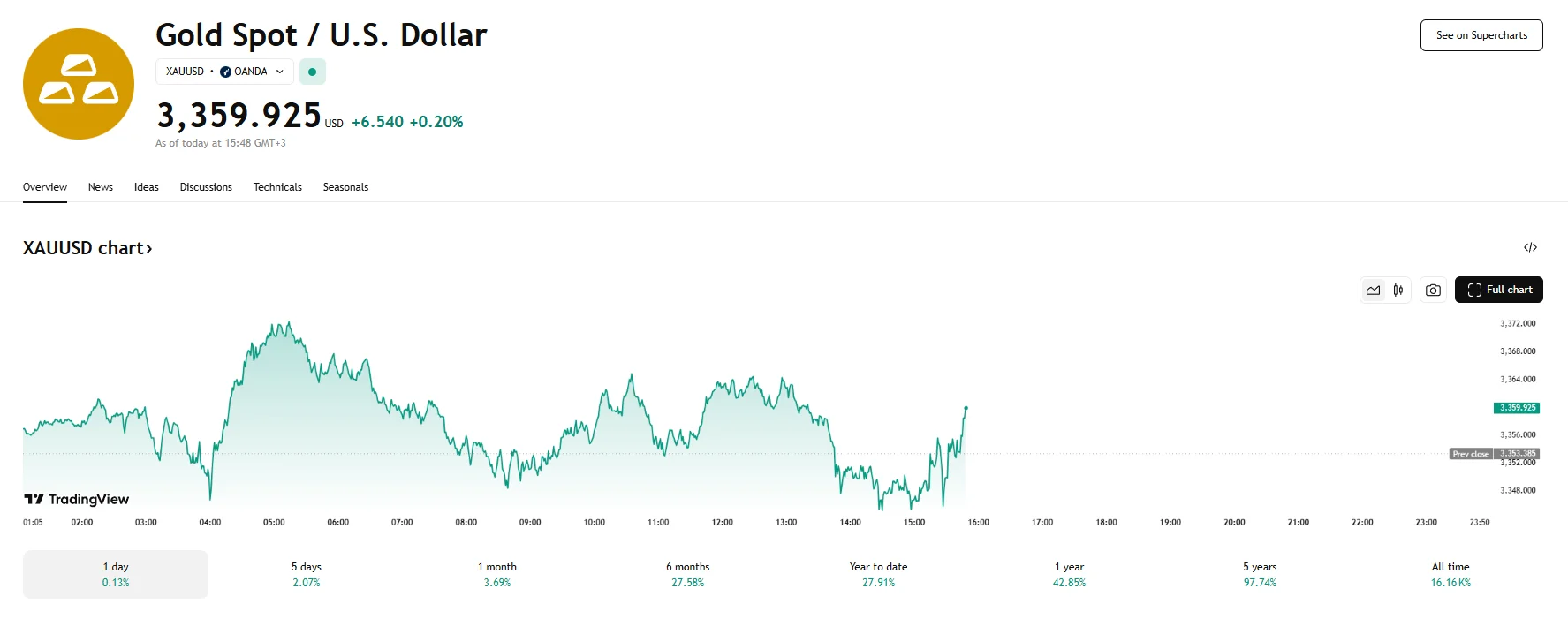

- Spot gold edged 0.2% higher to around $3,360 during Wednesday’s trading session.

- US job openings increased in April while layoffs reached a nine-month high.

- This week’s US non-farm payrolls report is poised to shed more light on the Federal Reserve’s potential direction for interest rate adjustments.

Markets Balanced Between Economic Indicators and Geopolitical Risks

Gold prices managed to climb on Wednesday, with XAU/USD rising 0.2% to $359.925. Gains were tempered as stronger-than-expected labor market data from the United States lowered investor appetite for safe-haven assets, which had been bolstered by renewed trade tensions between Washington and Beijing.

Labor Market Sends Mixed Signals

Economic data released Tuesday showed a rise in US job openings for April. Layoffs, meanwhile, surged to their highest level in nine months. These mixed signals suggest a potentially cooling labor market, which could influence upcoming policy decisions by the Federal Reserve.

Investors are now looking ahead to the US non-farm payrolls report due Friday. The data is set to offer further insight into whether the Fed may lean toward adjusting interest rates and in what direction. For now, officials appear to be sticking to a measured approach amid uncertainties surrounding tariff disputes between the US and its trade partners. According to Commerzbank’s Carsten Fritsch, unexpectedly strong figures would probably lead to a decrease in the likelihood of interest rate cuts. This, he argued, would exert downward pressure on gold prices.

Trade Tensions Fuel Uncertainty

On Wednesday, former US President Donald Trump remarked on Chinese President Xi Jinping, describing him as “extremely hard to make a deal with.” The comment came after Trump’s recent accusations of China of failing to honor its commitments to reduce tariffs and restrictions.

Meanwhile, the White House enacted a 25% tariff hike on imports of steel and aluminum on June 4th. The move coincided with a deadline for trading partners to submit their top offers to avoid the broader “Liberation Day” tariffs.