Key Moments:

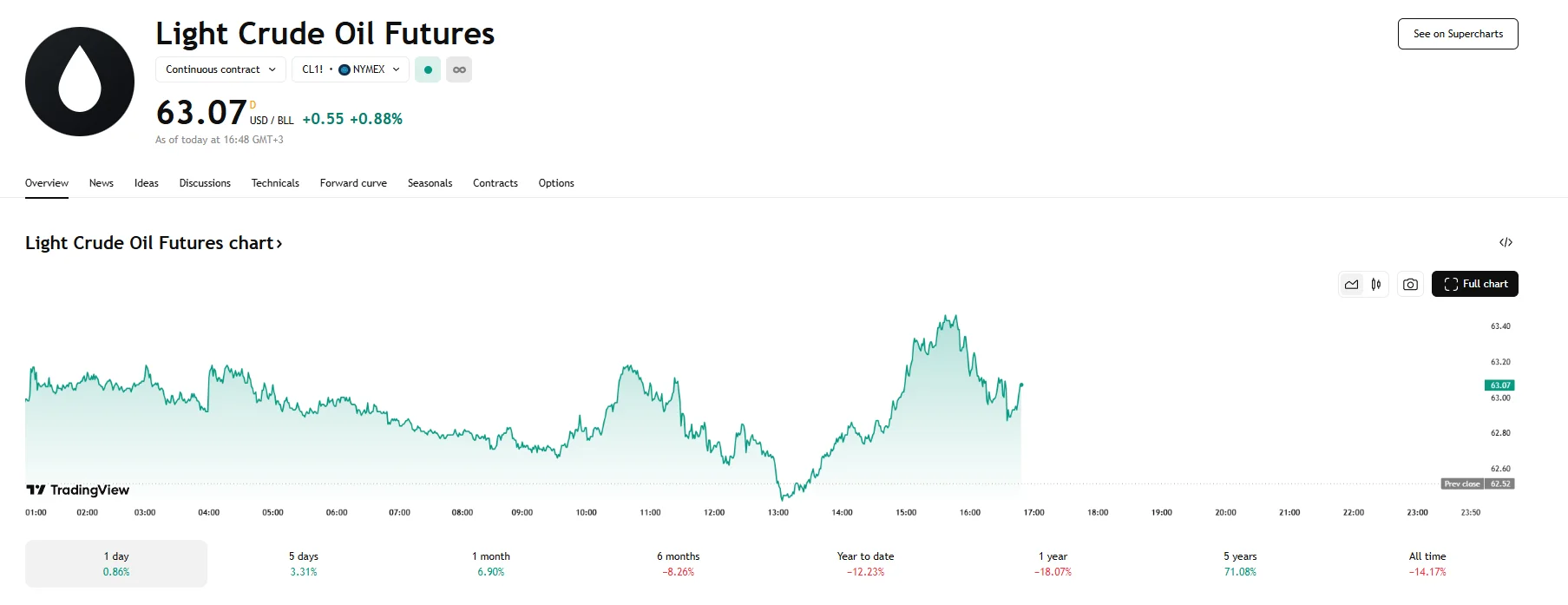

- WTI and Brent crude futures have advanced 0.88% and 0.84%, respectively.

- Production cuts totaling 274,500 barrels per day reported from Canadian operators due to wildfires

- OPEC+ moved forward with an additional 411,000-barrels-per-day output hike for July.

Supply Pressures Boost Energy Markets

Oil prices extended gains early Tuesday, supported by mounting supply constraints and geopolitical headwinds. WTI oil futures advanced by 0.88% and reached $63.07, while Brent contracts went up by 0.84% to $65.17 per barrel. The upward momentum marked a second consecutive day of increases, as disruptions in northern Alberta and setbacks in Iranian nuclear negotiations weighed on market expectations.

Alberta Wildfires Prompt Significant Output Curtailments

In Canada, wildfires blazing across northern Alberta have forced major oil producers to halt operations. Cenovus Energy and Canadian Natural Resources collectively suspended 274,500 barrels per day of production as a precaution and evacuated staff from facilities that could be affected by the fires.

Geopolitical Tensions Undermine Supply Recovery

Talks between the United States and Iran aimed at curbing Tehran’s nuclear ambitions have not progressed, contributing to market uncertainty. Separately, ceasefire negotiations between Ukraine and Russia held on Monday concluded without a resolution to the ongoing conflict, further fueling risk premiums in the energy space.

OPEC+ Output Increases Temper Market Sentiment

Despite tightening conditions, OPEC+ added to global supply with a second consecutive monthly hike. The group increased production by 411,000 barrels per day starting June 1st, with an equivalent boost planned for July. These additions come amid waning demand tied to escalating US trade disputes.

Outlook Weighed Down by Demand Risk and Non-OPEC+ Supply Growth

Analysts have cautioned that further supply-side additions from non-OPEC+ producers may limit price gains. PVM Oil Associates analysts indicated that the principal uncertainty lay in the trade war’s effect on economic growth, stressing the need to closely monitor Donald Trump’s volatile decisions and their adverse impact on bond and dollar markets.

They added that non-OPEC+ supply was also predicted to be a negative influence. PVM cited Energy Intelligence’s calculations, which suggested that Atlantic Basin producers (like the US, Brazil, Guyana, Canada, Argentina, and Norway) would collectively increase production by 880,000 bpd this year, predominantly in the latter half.