Key Moments:

- US equities advanced Thursday, driven by Nvidia’s strong quarterly results.

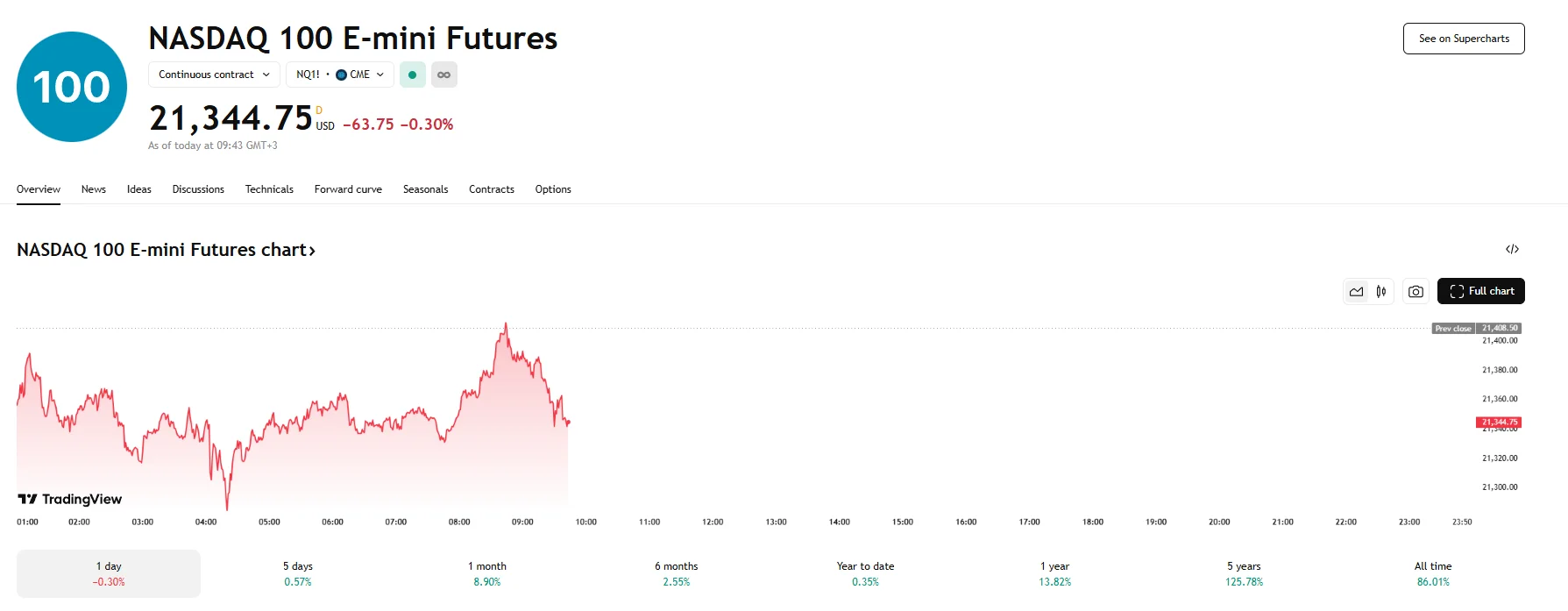

- Friday’s futures contracts inched down as investors reacted to a federal appeals court ruling reinstating Trump’s tariffs.

- Nasdaq 100 e-minis dropped 0.3%, S&P 500 contracts fell 0.24%, and Dow futures edged 0.13% lower.

Wall Street Rallies on Nvidia, Faces Reversal in Futures

Major Wall Street indices closed over 0.2% higher on Thursday, largely supported by gains surrounding Nvidia following the company’s latest earnings report. The rally helped drive broad equities upward, balancing investor sentiment even as legal developments injected renewed tariff risks into the market.

However, the momentum faltered in early futures trading on Friday. Contracts tied to the Dow Jones Industrial Average dipped 0.13% to 42,212, a loss of 55 basis points. S&P 500 e-minis also dropped 0.24% to 5,908.75. The steepest decline thus far was observed in the tech sector, with Nasdaq 100 features falling 0.3% and hitting 21,344.75.

Appeals Court Temporarily Reinstates Tariff Program

On Thursday, a US federal appeals court issued a temporary halt to a recent tariff ban on the Trump administration’s tariff policies. Imposed by the Court of International Trade, the initial ruling had deemed the president’s enactment of the International Emergency Economic Powers Act illegal. The appeal’s court will review the case in-depth, and the White House has until June 9th to submit its arguments. The sudden reinstatement of global tariffs has added fresh complexity to the market as investors parse out potential trade policy implications and inflationary risks.

Reacting to the appeals court’s move, the Trump administration indicated it is ready to escalate the matter to the Supreme Court if necessary. At the same time, officials are reportedly evaluating alternative strategies for enforcing the tariff regime without invoking emergency powers.

Market focus will now shift to Friday’s April reading of the Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred measure of inflation. Analysts are closely watching for any early signs that tariffs could be fueling price pressures, although many do not expect to see these effects reflected in the upcoming data.