Key Moments:

- JPMorgan lifted ULTA Beauty’s price target from $477 to $525.

- ULTA reported a Q1 EPS of $6.70 and revenue of $2.85 billion, both exceeding expectations.

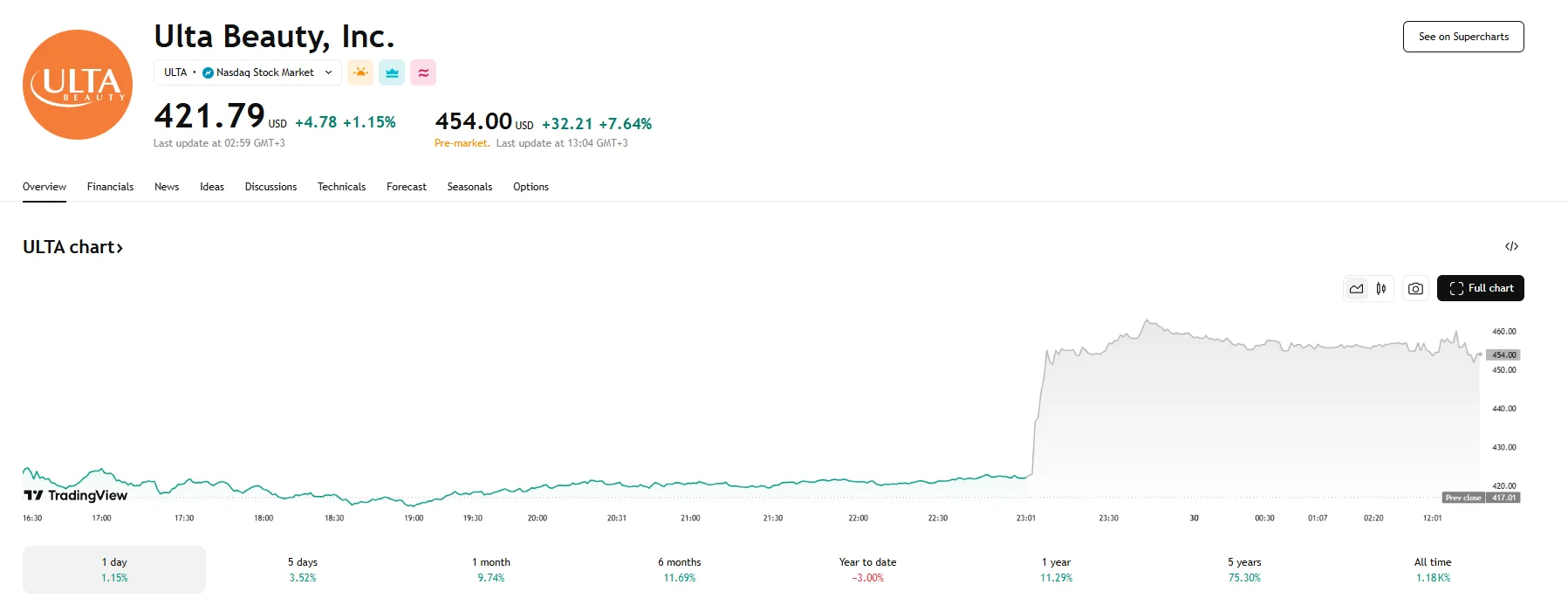

- The company’s shares rose by over 7% to $454 during pre-market hours.

JPMorgan Sees Upside in ULTA’s Fundamentals

Friday saw Christopher Horvers, Senior Analyst at JPMorgan, raise his ULTA Beauty price target to $525. He also chose to maintain the company’s Overweight rating. Investors were swift to react to the reassessment, as the company’s shares jumped over 7% and reached $454 ahead of Friday’s US market opening.

The upward revision was attributed to stronger-than-expected first-quarter results, where comparable store sales rose 2.9%, far surpassing forecasts of 0.7%. Horvers also contrasted these results with Sephora’s more modest growth of 1%.

ULTA’s operating margin of 14.1% was also among the factors highlighted by Horvers, as it surpassed the anticipated 12.4% and led to earnings per share (EPS) rising by 15%. He also went on to highlight the marginal increase in ULTA’s annual guidance. Attention was also drawn to ULTA’s ability to expand market share across multiple segments in the competitive environment in the US, particularly when it comes to the operations of Amazon.

According to Horvers, the company’s operating efficiency and profit metrics under the leadership of recently promoted CEO Kecia Steelman justified a higher valuation. Updated EPS estimates could range between $25 and $26, he added.

Momentum in Earnings and Market Share

Following its Q1 performance, which delivered adjusted earnings per share of $6.70 and revenue of $2.85 billion compared to the expected $2.79 billion, ULTA has seen renewed confidence from multiple entities in the financial sphere. Citi reiterated a Neutral rating and pushed its target upward to $450, while Raymond James boosted its price target to $500 with an Outperform rating.

Morgan Stanley was another financial institution to raise its ULTA price objective, which now stands at $550. BofA Securities was more conservative with its estimates, increasing the target to $455.