Key Moments:

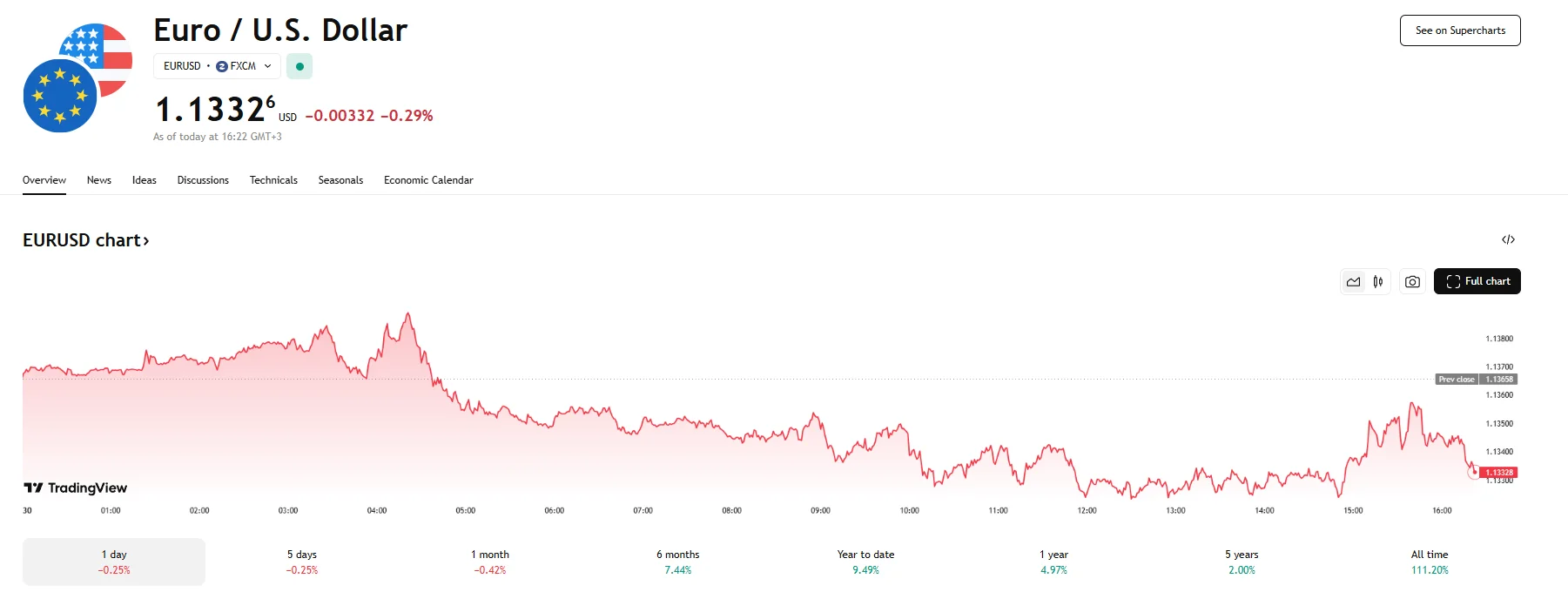

- EUR/USD fell around 0.3% on Friday, dropping to 1.1332.

- TD Securities has projected a decline in the euro to 1.1100 in the second quarter.

- German retail sales dropped 1.1% last month, while Eurozone inflation data fueled expectations of an imminent 25-basis-point ECB rate cut.

EUR/USD Slips on Friday, Euro to End May Flat Despite Volatility

The euro suffered a drop on Friday, with its exchange rate against the US dollar dropping 0.3% to hit 1.1332. However, in terms of its monthly performance, the euro has generally pared back earlier slumps. It is, therefore, set to hold steady and wrap up May near the 1.1300 level.

Traders weighed a mix of economic data from major European economies alongside developments in US trade policy, including a US appeals court decision to halt a ruling that had imposed a temporary ban on the Trump administration’s tariff policies.

Dollar Strength Pressures the Euro

The euro may face renewed downward pressure against the dollar in the short term, according to a note from TD Securities strategists. The dollar, they argued, is strengthening due to evolving interest rate differentials, making it more expensive to hedge euro exposure amidst anticipated depreciation of the shared currency. Strategists further highlighted that there has been limited evidence of a broad shift in asset allocation away from US markets.

These trends elevate the risk of further euro weakness in the coming weeks, especially if the market reassesses the impact of monetary policy divergence. According to TD Securities, the euro may be facing a decline to 1.1100 in Q2 of 2025, down from its current valuation of around 1.1300.

Mixed Signals from European Economic Data

Germany posted a 1.1% drop in retail sales for April. This is the first time in four months that the figure has contracted, and it also underperformed analyst forecasts that had anticipated an increase of 0.2%. On the inflation front, Germany’s consumer price index remained at 2.1% in May, contrary to predictions of a modest decline.

Elsewhere in the eurozone, disinflationary trends persisted in countries like France and Italy. These developments strengthened market participants’ expectations of the European Central Bank implementing a 25-basis-point interest rate cut in June.