Key Moments:

- On Tuesday, Target reported Q1 adjusted EPS of $1.30 and revenue of $23.85 billion, both missing analyst expectations. GAAP EPS, meanwhile, reached $2.27, surpassing the estimated $1.64.

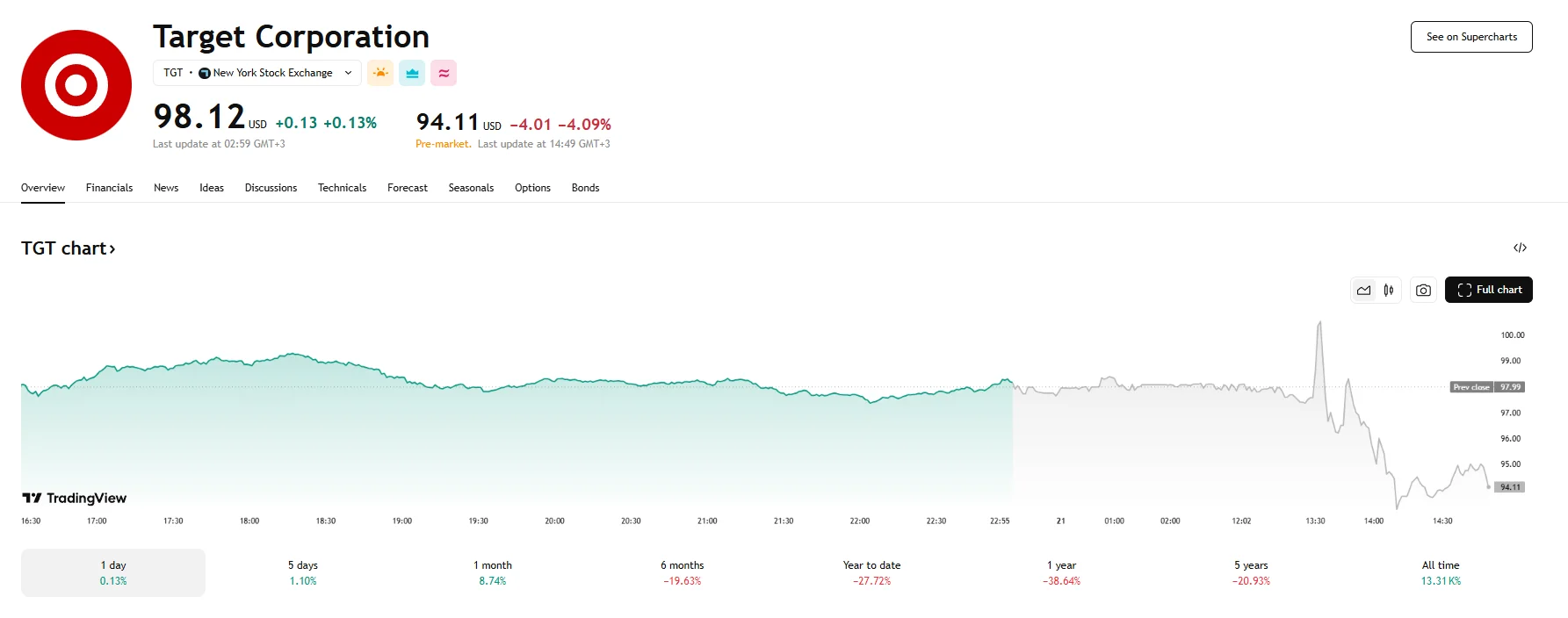

- The company’s stock sank 4.1% in pre-market trading following the publication of the financial report.

- Target now anticipates that sales will decline in FY 2025.

Quarterly Results Undershoot Forecasts

Target’s Q1 earnings release on Wednesday resulted in a substantial decline of the company’s stock during pre-market hours, with shares tumbling 4.1% to $94.11. The retailer disclosed first-quarter revenue of $23.85 billion, translating to adjusted earnings per share of $1.30. This reflected a nearly 3% year-over-year decline, and the figures were notably lower than the forecasts of analysts polled by Visible Alpha, who had expected adjusted EPS of $1.64 and revenue of $24.34 billion.

Despite the revenue shortfall, the company’s GAAP earnings per share came in at $2.27, buoyed by gains from litigation settlements. The figure exceeded the $1.64 consensus forecast.

Sales Trends Weigh on Performance

Other concerning results include the company’s comparable sales, which fell 3.8% in the first quarter, a steeper decline than earlier estimates of a 1.68% contraction. The decrease was largely attributed to waning in-store traffic, which outweighed the results of Target’s digital sales business.

CEO Brian Cornell commented that despite sales falling short of projections, the quarter had presented various encouraging signs, such as strong digital expansion. He further communicated that the company was dissatisfied with its current results and recognized opportunities to accelerate progress on its strategic growth plan.

Full-Year Outlook Trimmed

For fiscal 2025, Target now projects a single-digit decline in sales, a reversal from its earlier guidance of an approximately 1% increase. The company also adjusted its full-year earnings range. It now expects GAAP earnings per share between $8.00 and $10.00. On an adjusted basis, excluding the impact of Q1 litigation gains, EPS is forecast between $7.00 and $9.00, down from the prior $8.80-9.80 range.

The report also revealed the formation of a new internal group called the “Enterprise Acceleration Office.” This initiative, set to be helmed by Chief Operating Officer Michael Fiddelke, aims to enhance coordination across different functions and drive progress on strategic priorities. Target further stated that the office will focus on simplifying internal processes and leveraging technology and data more effectively.