Key Moments:

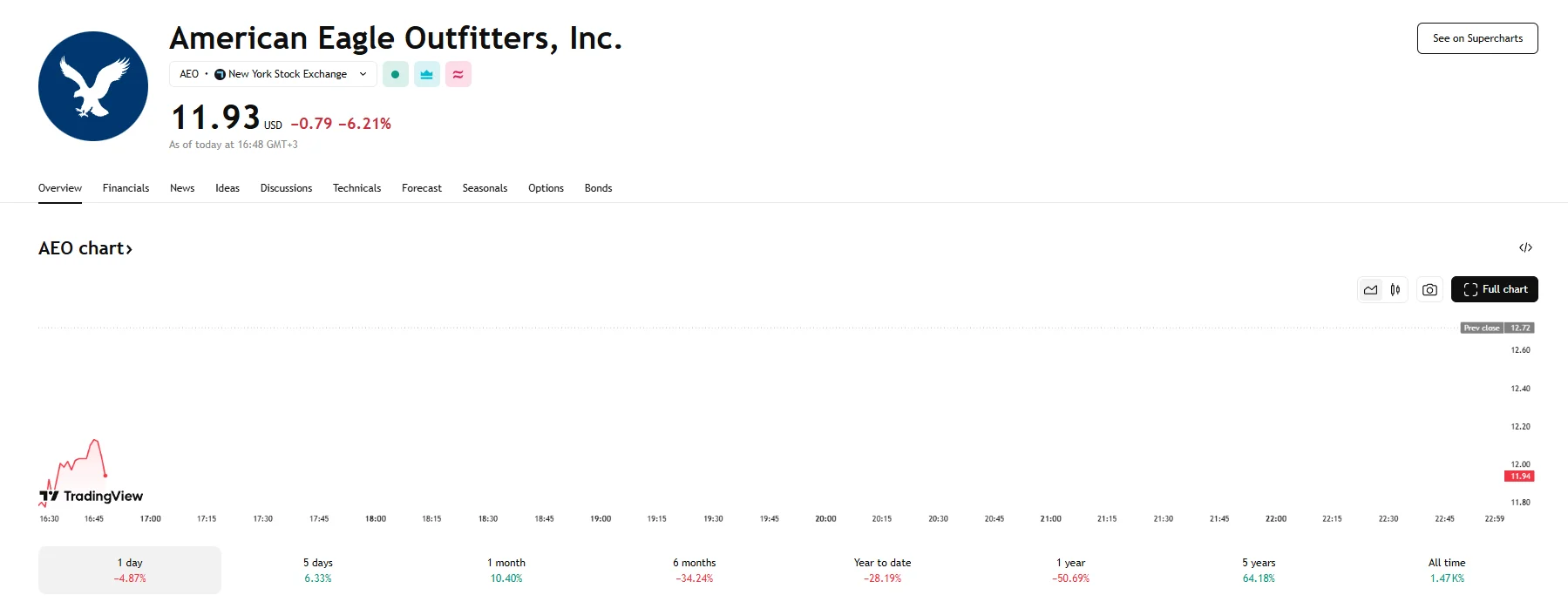

- American Eagle’s stock price declined to $11.93 on Wednesday following the company’s decision to retract its full-year guidance.

- Weak sales of fleece items in the Aerie brand raised concerns as consumers resisted price increases.

- JPMorgan maintained a “neutral” rating on the stock but opted to downgrade its price target by $1.

Stock Dips as Guidance Pulled

Wednesday witnessed shares of American Eagle suffer a substantial decline of 6.21% to $11.93 after the company announced on Tuesday that it was withdrawing its full-year outlook due to ongoing macroeconomic uncertainty. In response, JPMorgan analysts cut their price target for the stock.

The revised price target now stands at $9, down $1 from the previous $10. JPMorgan also chose to keep its “neutral” rating. Despite the new target falling well below the $14.84 average shown by Visible Alpha data, JPMorgan’s rating remains in line with the broader analyst consensus.

Preliminary Results Signal Sales Pressure

In its preliminary financial update released after markets closed on Tuesday, American Eagle said it expects first-quarter revenue to decline 5% YoY. The company also expects a 3% drop in comparable store sales. Broader economic challenges and ongoing reassessments of future strategies were cited as American Eagle’s rationale for pulling its full-year guidance.

JPMorgan highlighted softness in the company’s Aerie fleece products as a notable weak point, though overall sales fell within previously guided ranges. The firm reduced its revenue and margin estimates accordingly. Rising production costs for fleece garments further pressured profit margins, and an anticipated increase in average unit retail failed to materialize as consumers pushed back on price hikes. According to executives, demand was weaker than expected in this category, which contributed to the subdued outlook.