Key Moments:

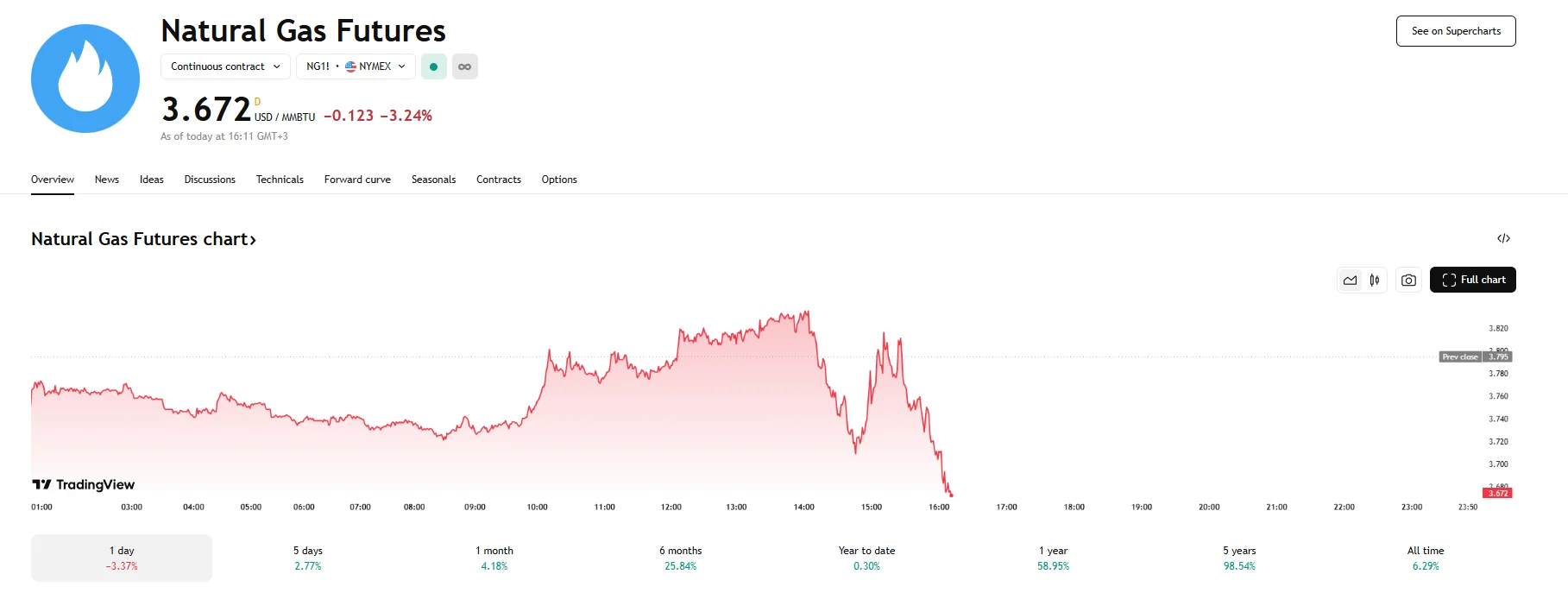

- US natgas futures declined 3.24% to $3.672/mmBtu on Monday.

- Storage levels rose to 2.15Tcf, exceeding the five-year average by 1.4%.

- Second consecutive triple-digit inventory increase raises supply concerns.

Inventory Surge Weighs on Prices

Natural gas futures managed to climb above $3.830/mmBtu on Monday before plummeting by 3.24% to $3.672/mmBtu. According to ING commodities analysts Ewa Manthey and Warren Patterson, a growing supply surplus is starting to outpace near-term weather-driven demand.

The latest data from the US Energy Information Administration showed another triple-digit increase in weekly gas inventories. Total stockpiles climbed to 2.15 trillion cubic feet (Tcf), now 1.4% above the five-year seasonal average. This marked the second consecutive week of steep inventory builds, reversing a 230 billion cubic feet deficit from early March into a surplus.

Market Shrugs Off US-China Tariff Truce for Gas Prices

Monday’s disclosure of a 90-day tariff agreement between the US and China sparked gains in oil markets, but failed to push US natural gas toward a consistent upward trajectory. Moreover, today’s slump marked the end of a two-week streak of gains.

According to EBW Analytics’ Eli Rubin, while the pause in trade tensions may support the near-term landscape by boosting Chinese demand and enhancing sentiment around US economic resilience, it could also indirectly pressure gas markets. Higher oil prices, he said, may lead to increased volumes of associated gas from oil wells, potentially adding to oversupply concerns.