Key Moments:

- Shopify projected second-quarter revenue growth in the mid-twenties percentage range, exceeding average estimates of 22.4%.

- Gross profit is expected to rise at a high-teen percentage rate. This forecast fell short of analysts’ expectations of a 20.2% increase.

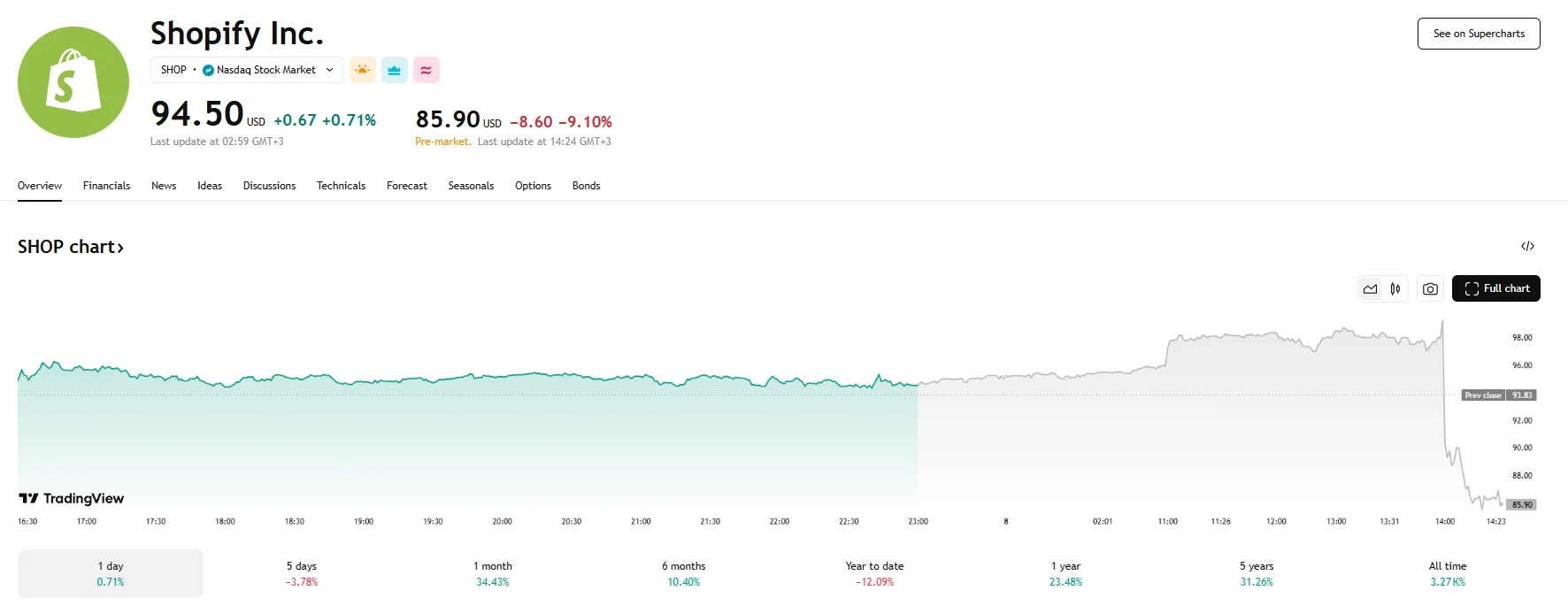

- Shopify’s US shares declined more than 9% during pre-market hours.

Shopify Sets Optimistic Tone for Q2

Shopify has said it anticipates its revenue to expand at a mid-twenties percentage pace in Q2 of 2025. According to data provided by LSEG, the average analyst forecast stood at 22.4%, making Shopify’s projected figures exceed expectations. This confidence suggests that the Ontario-based e-commerce platform is enjoying steady momentum in seller adoption even as uncertainties in global trade continue to cast a shadow over the retail landscape. For the quarter ended March 31, Shopify reported revenue of $2.36 billion, a result that narrowly beat the average analyst estimate of $2.33 billion.

The company also expects gross profit in the current quarter to increase at a high-teen percentage rate. However, this was slightly below the 20.2% rise that Wall Street experts had been anticipating.

Although the Shopify’s revenue projection offered some relief amid a wave of lowered or withdrawn outlooks from other firms facing trade-related volatility, investor sentiment remained largely pessimistic. The e-commerce company’s US shares tumbled drastically in the pre-market trading session, falling by 9.10% to $85.90.

Shopify’s positive sales outlook came on the heels of a similar forecast from Amazon, which last week projected second-quarter sales that exceeded expectations. Amazon also noted that, for now, neither a weakening in demand nor significant shifts in customer conduct have been observed despite ongoing trade tensions.