Key Moments:

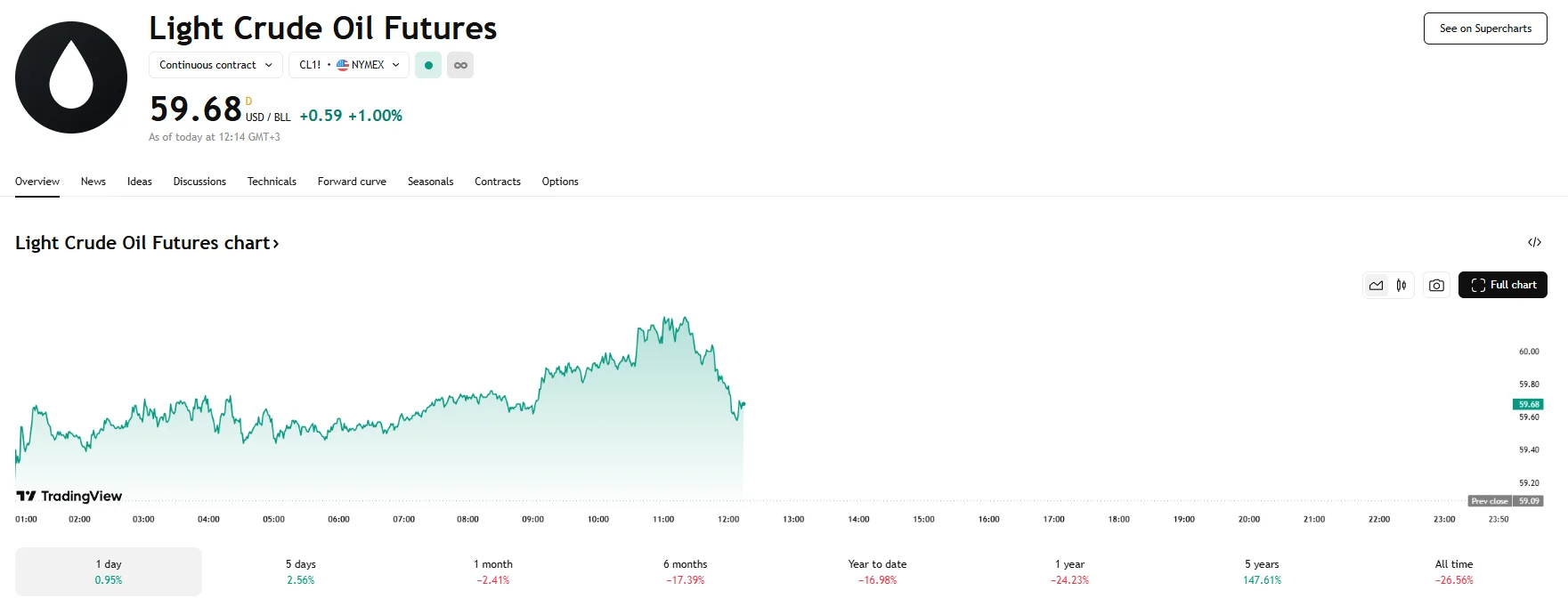

- WTI crude futures rose to $59.68 on Wednesday, an increase of 1%.

- Brent futures also edged higher, reaching $62.66.

- The American Petroleum Institute reported that last week saw a sharper-than-expected 4.49 million-barrel drop in US crude inventories.

Oil Futures Rise as Trade Outlook Shifts

Crude oil futures advanced on Wednesday following news that Washington and Beijing plan to meet soon to address ongoing tariff-related issues. The potential thaw in trade tensions helped buoy oil markets, with both global and domestic contracts seeing gains. Brent crude futures reached $62.66, marking a 0.82% increase. Meanwhile, West Texas Intermediate contracts rose 1% to $59.67.

This price optimism followed news that US and Chinese officials will be meeting in Switzerland later this week. The discussions will be centred around the ongoing trade dispute between the two nations. Seeing as both countries are key crude oil consumers, recent tariff developments have weighed heavily on demand sentiment, and hopes of a potential de-escalation of tensions boosted trader confidence in crude oil benchmarks.

In addition, industry data added further support to oil prices. The American Petroleum Institute (API) revealed a 4.49 million-barrel drop in US crude inventories. This figure, which concerns last week’s supply, is far higher than the forecasted reduction of 2.5 million barrels.

OPEC+ Supply Hikes May Add Pressure to Oil Markets.

ING’s Warren Patterson and Ewa Manthey commented in their Commodities Feed report that Brent prices have continued to gain on optimism over renewed dialogue. They did caution, however, that although negotiations could help bolster sentiment in the oil market, substantial progress on reducing tariffs would be necessary to improve the demand outlook.

They continued, highlighting that while growing optimism on trade talks has supported prices, the supply side of the equation may cap gains. OPEC+ countries have implemented aggressive supply increases, which can result in an oversupply situation in 2025’s upcoming months

According to the report, it is crucial for members with a history of exceeding their production targets to begin to comply with those targets. The report also noted that Kazakhstan was reportedly considering different approaches to achieve its targets. Their oil balance calculations were based on the assumption that OPEC+ would maintain aggressive supply increases throughout the third quarter, mirroring the increases already announced for May and June. Patterson and Manthey concluded by stating that a reversal of this policy had the potential to change their outlook.