Key Moments:

- Carlsberg confirmed its full-year organic operating profit growth forecast of 1% to 5%.

- First-quarter global revenue climbed 17.4% to 20.12 DKK, narrowly missing expectations. Organic sales volume dropped 2.3%, while total volume jumped 14.5% following the Britvic acquisition.

- Tuesday saw the company’s share price fall 1.45% to 978 DKK (around $147.6).

Stable Forecast Despite Uncertainty

Danish brewer Carlsberg A/S reaffirmed its full-year outlook for an organic operating profit growth range of 1-5% despite global economic uncertainty and falling sales volume in key areas. The company emphasized resilience in China and consistent consumer behavior across most markets, though it flagged persistent volatility in overall sentiment.

Q1 Revenue Rises But Missed Forecasts Drive Stock Downwards

For the first quarter of 2025, Carlsberg posted global revenue of 20.12 billion DKK ($3.07 billion), representing a 17.4% increase from the same period in 2024. However, that figure came in slightly below analysts’ average projection of 20.4 billion DKK, according to company-compiled estimates.

Organic sales volumes declined by 2.3%, even as total volumes rose 14.5%, largely due to the previous year’s acquisition of British soft drinks maker Britvic. “It was a soft start to the year,” CEO Jacob Aarup-Andersen noted in a statement, referring to the broader consumer environment.

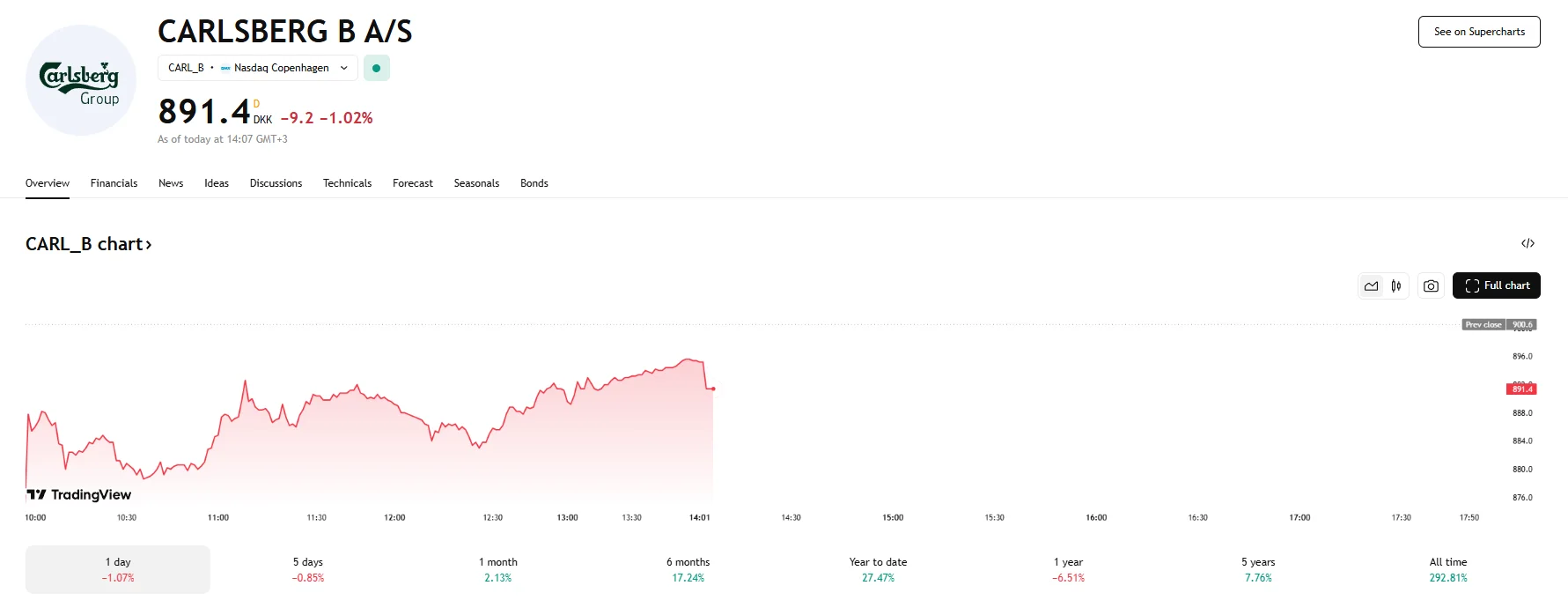

Following the above figures’ disclosure, Carlsberg’s class B shares experienced a downward trend. The stock’s price fell to 891.4 DKK, a drop of 1%.

Mixed Results in Asia

According to the report, Carlsberg’s revenue growth in Asia stood at 1.2%. China remained Carlsberg’s largest market in the first quarter thanks to the company’s strong premium brand performance and sales in major urban centers.

Geopolitical Risks Remain a Concern

Carlsberg noted that while it has minimal direct exposure to US tariffs, given the US accounts for only a small portion of its overall revenues, there are concerns about broader global repercussions. Companies worldwide have raised alarms about possible economic aftershocks, including waning consumer confidence, elevated inflation, and rising material input costs. Carlsberg’s operations involve key inputs such as barley, aluminum, and glass. “The global macroeconomic environment and consumer sentiment are volatile and uncertain,” the company stated, although it added that no significant changes in consumer behavior had been observed across its markets during the first quarter.