Key moments

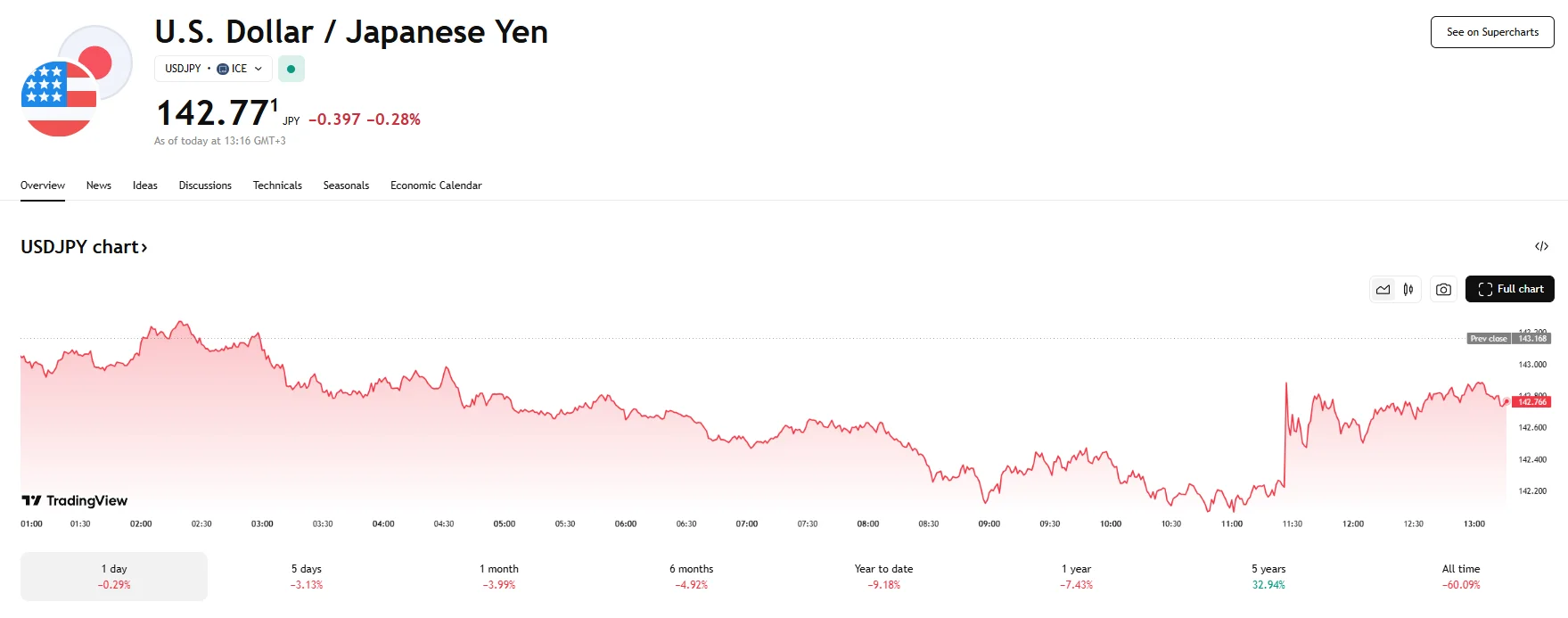

- The USD/JPY pair’s exchange rate fell on Wednesday, dropping 0.28% to 142.77. This followed an even steeper decline that saw the USD/JPY edge toward its six-month low.

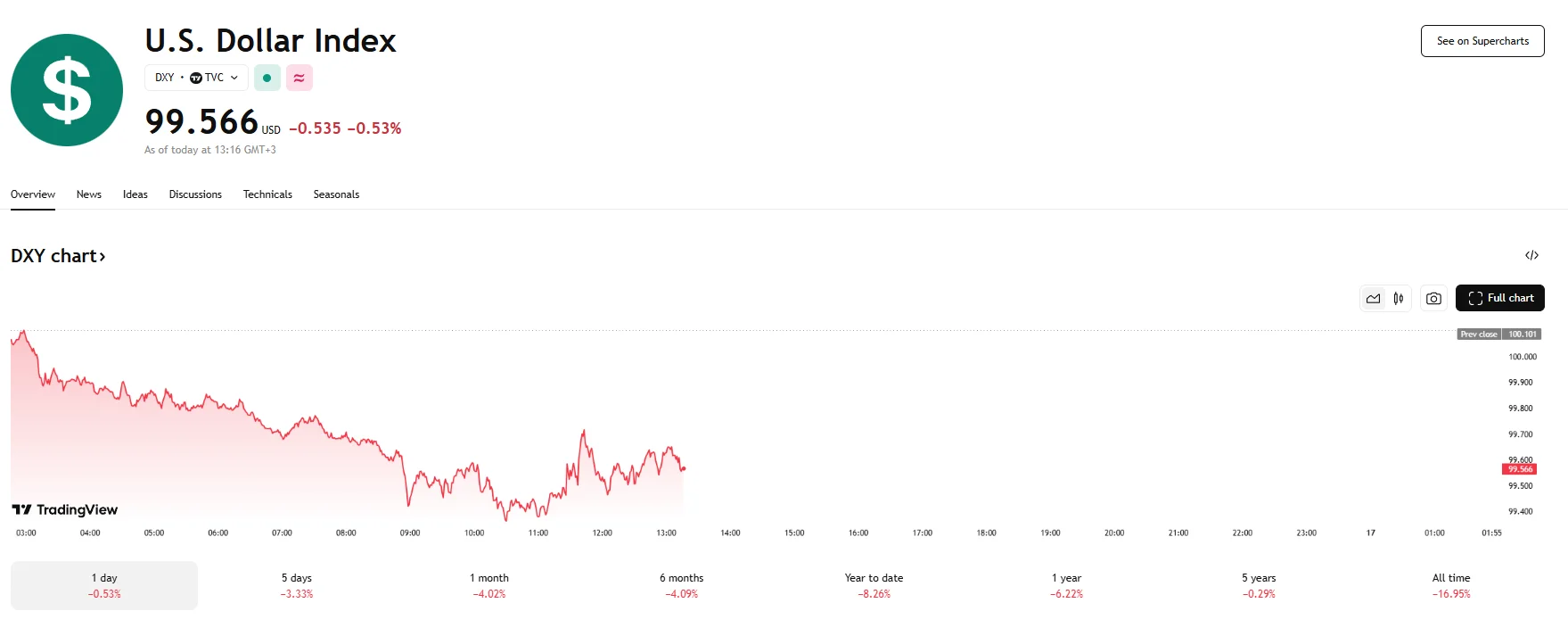

- The US Dollar Index also sank, reaching 99.566.

- Increasing concerns over the fallout of US President Donald Trump’s erratic tariff policies weigh on the US dollar.

USD/JPY Loses Ground Amid Trade Conflicts

Wednesday’s trading landscape witnessed a strengthening of the Japanese yen against the US dollar, resulting in a downward movement of 0.28% to 142.77 for the USD/JPY currency pair. Earlier in the day, the yen’s upward momentum was even more pronounced, forcing the USD/JPY down to almost hit 142.02, its lowest point in the past six months. These movements occurred amid a broad depreciation of the US dollar, as indicated by the US Dollar Index, which registered a fall of 0.53% to 99.566.

Several factors appear to be contributing to this shift in the USD/JPY dynamics, with the primary driver being a rise in apprehension regarding the potential economic repercussions of new trade tariffs imposed by the United States. The latest development in US trade policy involves President Trump’s directive to investigate the possibility of tariffs on all mineral imports. This development, reported by Bloomberg on late Tuesday, has further stoked fears of an intensifying trade conflict.

Adding to these concerns, a report from the Wall Street Journal suggests that the Trump administration is strategically using tariff negotiations to pressure US trading partners into reducing their economic ties with China. This caused a spike in investor anxiety, further diminishing the appeal of the US dollar.

Conversely, the Japanese yen’s established position as a safe-haven currency has lowered the USD/JPY pair’s rate, according to ING analysts Francesco Pesole and Chris Turner. As the yen’s inherent strength traditionally attracts investors seeking stability amidst market volatility, this characteristic has once again come into play as concerns surrounding US trade policies escalate. Adding to the yen’s positive momentum is the anticipation of upcoming trade discussions between Japan and the United States. Tokyo has expressed its intention to push for the complete removal of tariffs previously imposed by the Trump administration. Positive developments in these negotiations could further bolster the yen’s value against the dollar.

On the domestic front, Japan’s economic data also provided some support for its currency. Recent figures revealed that manufacturing sentiment in Japan reached an eight-month high this month, with manufacturing orders climbing 3%. Non-manufacturing orders also increased, rising by 11.4%.

Looking ahead, the prospect of the US Federal Reserve implementing interest rate cuts later in the year could exert further downward pressure on the USD/JPY pair. Conversely, speculation remains regarding the potential decision of the Bank of Japan (BoJ) to increase interest rates as early as July. However, a significant strengthening of the yen could potentially lead the BoJ to reconsider the timing of such a move.