Key moments

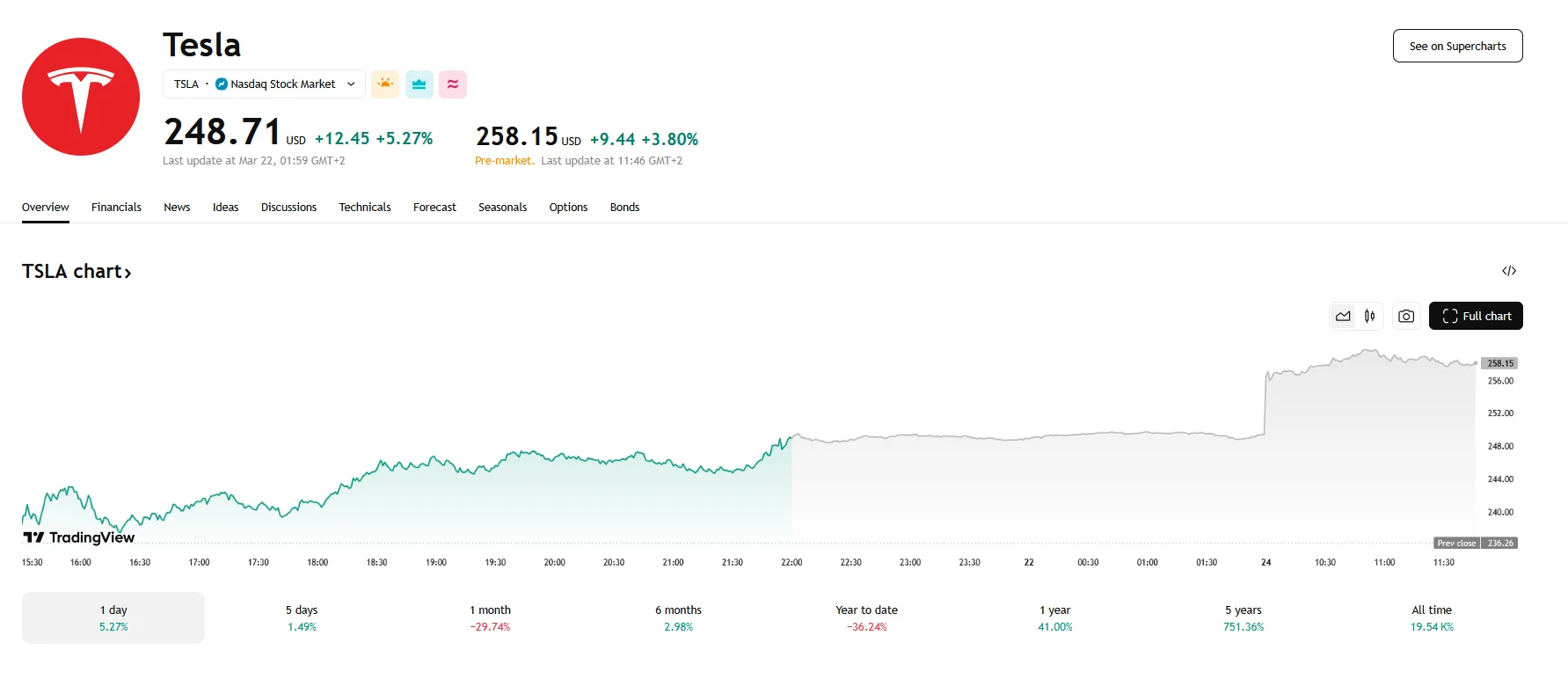

- On Monday, Tesla’s share price hit $258.15.

- Tesla’s announcement of its plan to release advanced driving-assistance capabilities in China, contingent on local approval of Tesla software, likely played a role in the surge in confidence.

- Analysts and market participants await Tesla’s first-quarter results, which will offer deeper insights into the company’s performance.

Tesla Stock Climbs 3.8% Pre-Market

Monday’s pre-market hours saw a significant uptick in Tesla’s stock value, with the share price rising 3.80% to reach $258.15. This surge builds upon the momentum established last week when the company’s shares experienced a substantial 5.27% rise. The optimistic market response may be fueled by evolving perceptions regarding potential trade policy adjustments by the Trump administration.

Adding to the positive sentiment, Tesla announced its intention to launch its advanced driving-assistance feature in China, pending the completion of necessary software approvals. The announcement was made on the company’s customer support account on Weibo after an apparent delay of the Full Self-Driving (FSD) service’s planned free trial.

The recent stock performance reflects an attempt by Tesla to break a prolonged period of weekly declines. The initial post-election surge, which saw Tesla’s stock surge to $480, had created expectations of favorable regulatory conditions for the company’s self-driving initiatives, particularly its planned robotaxi service slated for 2025.

Market analysts are now anticipating upcoming sales data, including European monthly sales figures and Tesla’s first-quarter sales results, to provide further insights into the company’s performance. Forecasts for first-quarter sales vary, with Wall Street estimates ranging from 360,000 to 414,000 vehicles.

However, it should be noted that Tesla’s share price value is now half of the post-election peak mentioned above. This is attributed to factors such as outdated products and stronger competition, along with the reduction of federal spending tied to Musk’s political influence. In a related development, recent protests against Musk’s policies took place outside Tesla dealerships in Washington and other cities across the U.S. and abroad. Demonstrators voiced their discontent with Musk’s actions, and in Canada specifically, protests arose due to new tariffs on Canadian goods.