Key moments

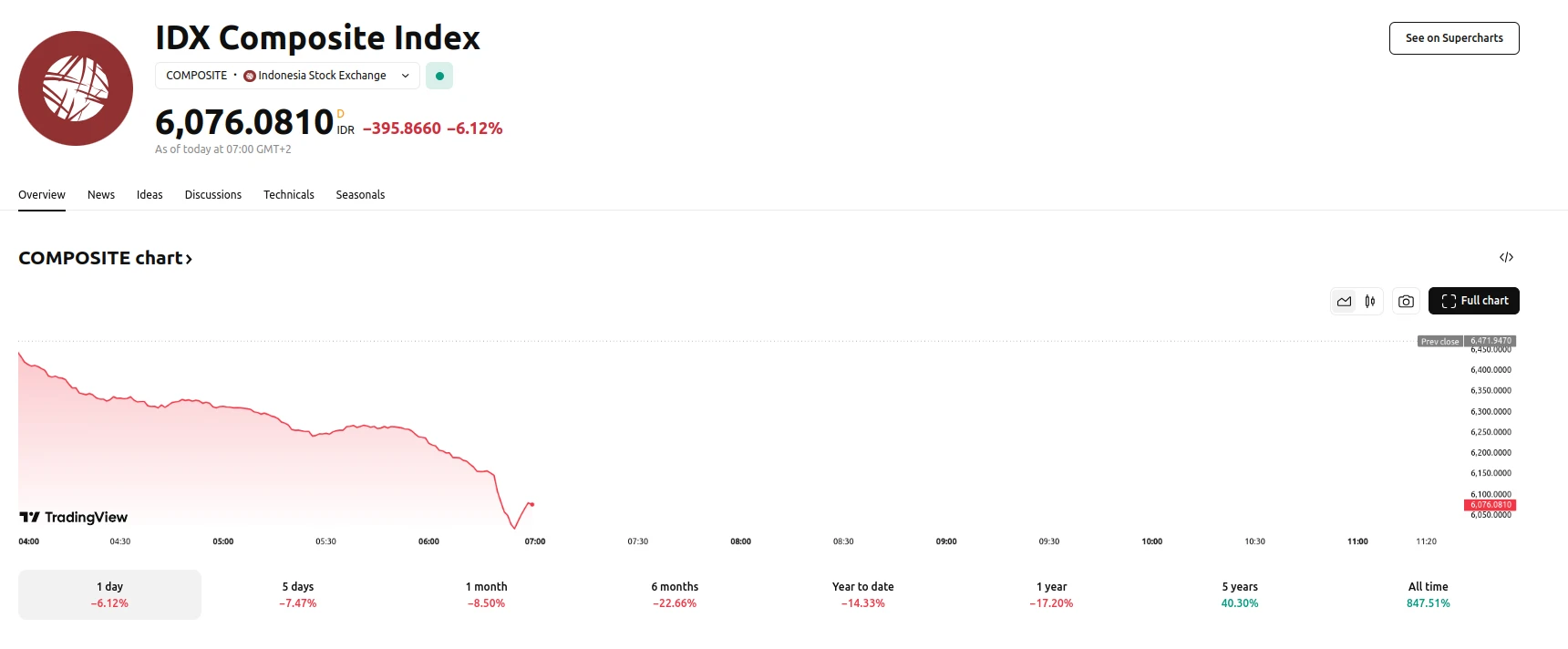

- The Jakarta Composite Index (JCI) experienced a sharp decline, triggering a temporary trading halt.

- Trading resumed after a 30-minute pause, but the JCI registered significant losses.

- Market analysts cite multiple factors, including job cuts, credit rating concerns, and global economic uncertainties, as contributing to the downturn.

IDX Volatility Amid Economic Headwinds

The Indonesian Stock Exchange (IDX) witnessed a substantial market correction on Tuesday, with the Jakarta Composite Index (JCI) plummeting to its lowest point since September 2021. The trading session was marked by a temporary halt, implemented after the JCI registered a 5 percent drop, adhering to the exchange’s emergency protocols. This automatic circuit breaker, designed to mitigate excessive volatility, paused trading for 30 minutes. Following the resumption of trading, the JCI continued its downward trajectory, ultimately closing the first half of the session with a 6.12 percent loss, representing a decline of 395.8 points.

The precipitous drop in the JCI can be attributed to a confluence of factors, both domestic and international. Of particular concern are the significant job cuts reported by major manufacturing entities, including Yamaha Music Product Asia, Adis Dimension Footwear, and Victory Ching Luh Indonesia. These layoffs, occurring in the lead-up to the Eid holiday, have stoked fears of an impending economic slowdown. Adding to the market’s anxiety are concerns surrounding upcoming credit rating assessments from Fitch, S&P, and Moody’s. Recent downgrades by Goldman Sachs and Morgan Stanley, with the former reducing Indonesia’s stock market rating from overweight to market weight and the latter cutting its MSCI Indonesia to underweight, have already eroded investor confidence.

Furthermore, the market is grappling with broader global economic uncertainties. Looming interest rate decisions in Indonesia, Japan, and the United States are creating a climate of apprehension. Speculation regarding potential resignations of key economic ministers has also contributed to market instability. The combined effect of these factors has created a volatile trading environment, prompting investors to reassess their positions and contributing to the significant sell-off observed on Tuesday. The heavy losses sustained by banking and large-cap stocks underscored the widespread impact of these economic headwinds on the IDX.