Key moments

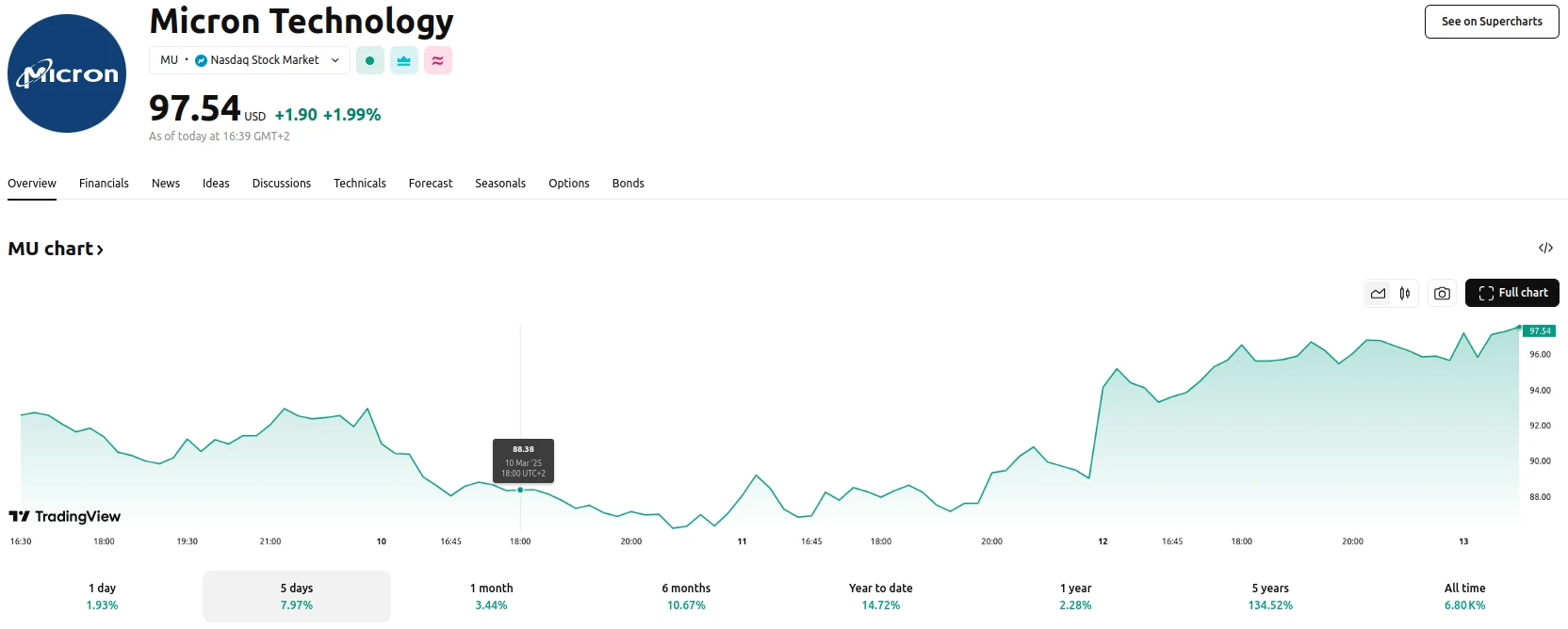

- Micron stock experienced a 7% surge following the release of the February CPI report. As of Thursday, Micron stock price is up 2%.

- Increased institutional buying in Q1 2025 contributed to upward market momentum.

- Analysts project substantial growth for Micron, driven by its position in the HBM3E semiconductor market and AI demand.

CPI Data, Analyst Optimism, and Institutional Investment Fuel Micron’s 7% Stock Rally

The release of the February CPI report, which indicated a cooling of inflation compared to the previous month, provided a significant boost to Micron’s stock. The data alleviated market concerns about persistent inflation, fostering a more optimistic outlook among investors. This positive sentiment, coupled with Micron’s perceived undervaluation, triggered a notable 7% surge in the company’s share price.

Further contributing to Micron’s upward trajectory was a marked increase in institutional buying during the first quarter of 2025. This surge in investment activity, representing 5.3% of the company’s market capitalization, signals strong confidence in Micron’s future performance. The influx of institutional investment, coupled with Micron’s advantageous position in the HBM3E semiconductor market, has significantly propelled its stock’s momentum.

Analysts maintain a bullish outlook for Micron, citing the company’s critical role in the AI sector. Micron’s HBM3E technology, essential for NVIDIA’s GPU production, positions it to capitalize on the growing demand for AI-related semiconductors. Projections indicate substantial growth in Micron’s revenue and earnings, with forecasts suggesting a potential doubling of the stock price within the next 12 to 18 months. While analyst price targets have seen some moderation, the overall sentiment remains positive, with a large majority of analysts rating the stock a “Buy” or better. The strong demand for AI semiconductors, coupled with potential normalization in other end-markets, suggests continued growth for Micron throughout the year.