Key moments

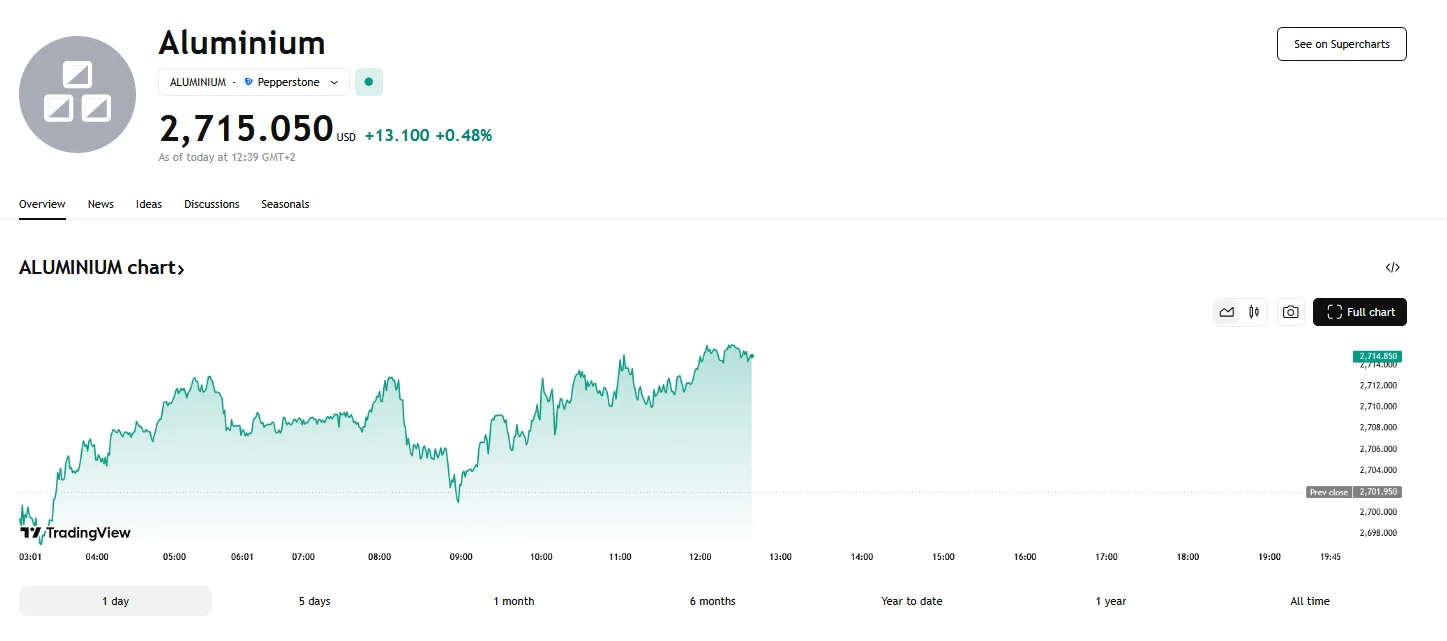

- Aluminum futures rose to $2,710 on Wednesday.

- The surge followed a brief drop to $2,690.

- U.S. trade disputes continue to escalate, with China announcing retaliation plans.

Aluminum Surges As Trade Tensions Continue

Wednesday saw aluminum futures surge, breaching $2,710. This increase occurred amidst a confluence of factors, notably the tightening of supply from major producers and the market’s reaction to newly implemented U.S. tariffs. Aluminum started off Wednesday with figures around the $2,690 mark, but at press time prices have stabilized at above 2,710.

A key factor influencing aluminum prices is the U.S. government’s decision to impose a 25% tariff on imports from all countries. This action, however, saw the U.S. refrain from doubling tariffs on Canada, its primary aluminum supplier, a decision that came after a period of escalating trade tensions and presidential threats. Even with these tariffs, the U.S. maintains a high reliance on overseas aluminum, importing 80% of its needs, which sustains upward pressure on domestic prices.

China, a significant player in the aluminum market, produced a record 44 million tonnes in 2024. However, Beijing has since imposed a 25 million tonne production cap to manage excess supply and meet environmental targets. A significant reduction in production rates was mandated, and simultaneously, the removal of export tax rebates led to a decline in overseas sales. This combination resulted in increased domestic sales and, subsequently, elevated international prices.

In the domestic Chinese market, SMM A00 aluminum prices witnessed an increase, rising by 190 yuan to 20,900 yuan per tonne. Conversely, the secondary aluminum market, represented by SMM ADC12 prices, remained relatively stable, hovering between 21,200 and 21,400 yuan per tonne. The import market saw overseas ADC12 prices maintain a high level, close to $2,500 per tonne.

Amidst trade tensions, China has voiced strong opposition to the U.S. tariffs. A Chinese Foreign Ministry spokesperson, Mao Ning, emphasized that protectionism benefits no one, and trade wars yield no winners. Mao Ning made these comments during a press conference on Wednesday, responding to questions about China’s potential retaliation measures. China views the U.S. tariff approach as a severe violation of WTO rules, damaging the multilateral trading system. China has stated that it will take all necessary measures to protect its legitimate rights and interests.