Key moments

- Revised GENIUS Act, addressing consumer protections and issuer regulations, scheduled for vote.

- Bipartisan consultations lead to significant updates, impacting foreign stablecoin standards.

- Potential competitive advantage for US-issued stablecoins through new regulatory clarity.

Updated GENIUS Act Focuses on Consumer Protection and Regulatory Clarity

The United States Senate Banking Committee has announced a vote scheduled for March 13th on the updated Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act. This Republican-led stablecoin framework bill has undergone significant revisions following consultations with committee Democrats, aiming to establish a comprehensive regulatory structure for stablecoins. The updated version, spearheaded by Senator Bill Hagerty, aims to address critical aspects such as consumer protections, authorized stablecoin issuers, risk mitigation, state pathways, insolvency, and transparency.

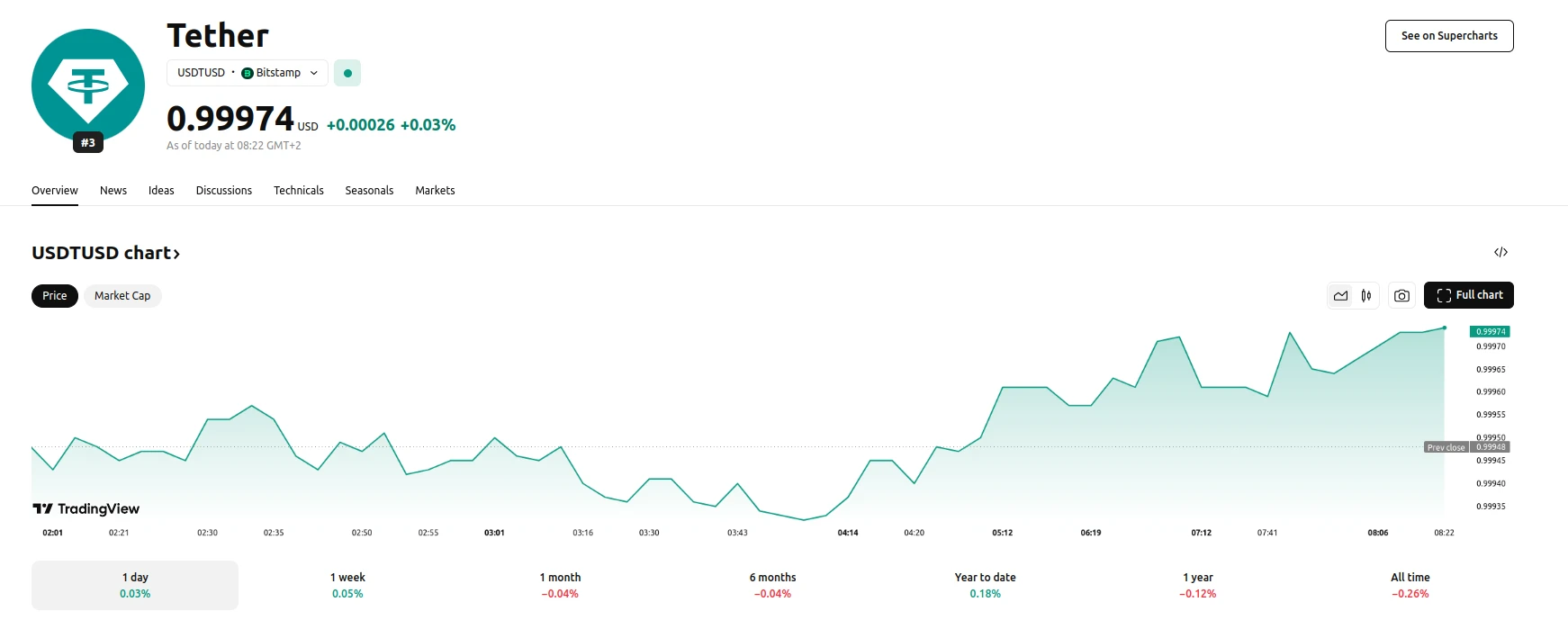

The revised GENIUS Act introduces a tiered regulatory approach, primarily targeting stablecoins with market capitalizations exceeding $10 billion. These issuers, currently limited to Tether (USDT) and Circle (USDC), would fall under Federal Reserve regulations. Smaller issuers, with market caps below $10 billion, would have the option to operate under state-level regulatory frameworks. A key aspect of the updated bill is its focus on enhancing consumer protection measures, ensuring greater security and stability within the stablecoin market.

Furthermore, the revised legislation places heightened regulatory scrutiny on foreign stablecoin issuers. The updated act imposes “extra high standards” concerning reserve and liquidity requirements, as well as stringent anti-money laundering and sanctions compliance checks. This move has been interpreted by industry observers, like EasyA co-founder Dom Kwok, as a strategic effort to provide US-issued stablecoins with a competitive advantage in the global market. By establishing clear and stringent regulatory standards, the bill seeks to foster a more secure and transparent environment for stablecoin transactions, potentially solidifying the United States’ position in the digital asset space.