Key moments

- Palm oil futures experience a 1.5% drop, reversing recent gains due to profit-taking and trade concerns.

- February export data reveals a four-year low, with a 16.27% monthly decrease.

- Supply constraints, including flood disruptions and pest infestations, limit further price declines.

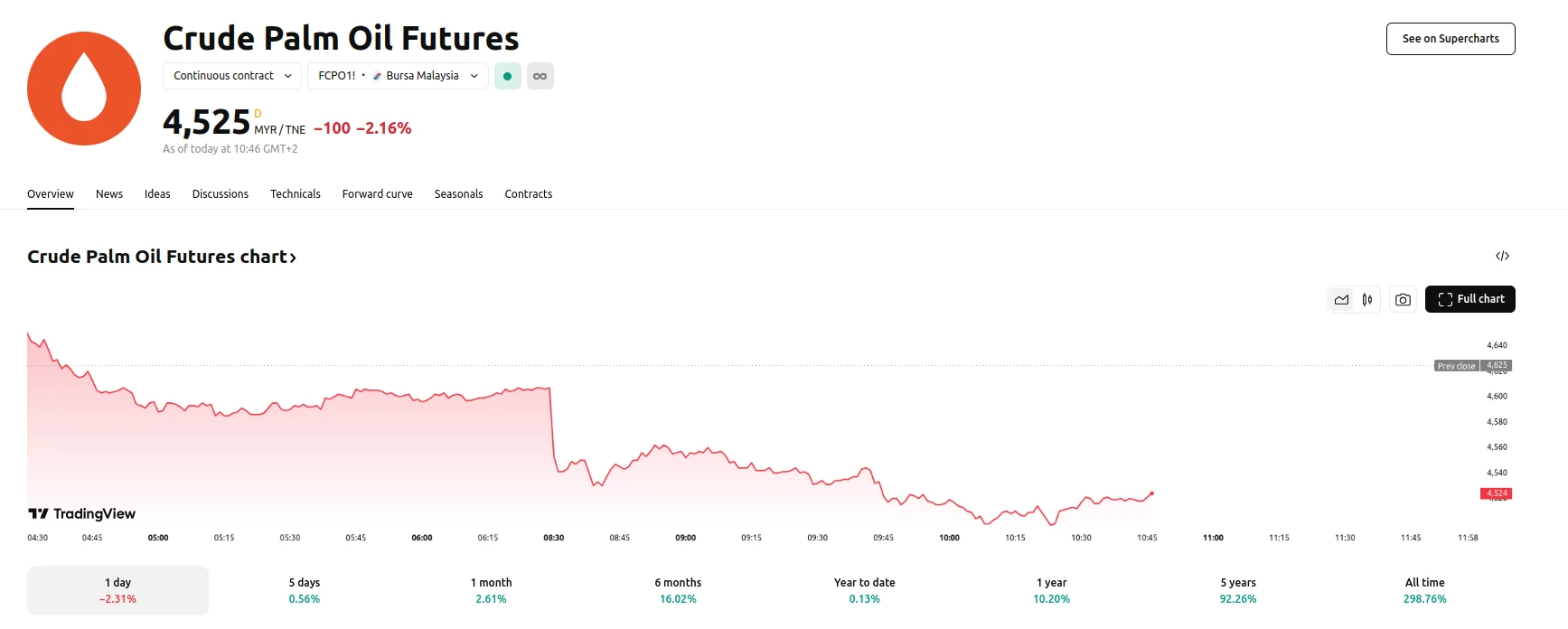

Profit-Taking and Trade Tensions Pressure Malaysian Palm Oil Futures Prices Below MYR 4,600

Malaysian palm oil futures experienced a decline, falling below MYR 4,600 per tonne, as traders opted to secure profits following a recent two-week high. This downward trend was further influenced by escalating concerns regarding global trade tensions, particularly China’s plans to impose import tariffs on Canadian rapeseed oil and rapeseed meal, which created wider agricultural commodity market uncertainty.

Data released by the Malaysian Palm Oil Board indicated a significant drop in February exports, falling 16.27% from the previous month to a four-year low of 1 million tons. This decline signaled a weakened demand during the month. However, the extent of the price drop was moderated by industry figures revealing a 4.31% reduction in palm oil stocks, reaching 1.51 million metric tons. This fifth consecutive monthly decrease, the lowest since April 2023, reflected tightening supply conditions.

Production in February also saw a decrease, falling 4.16% to 1.19 million tons, the lowest level in three years. This reduction was attributed to flood disruptions and reports of pest infestations in palm oil plantations across Malaysian states, further impacting supply. Conversely, there are early indications that India, a major palm oil importer, may increase its purchasing in March to replenish its stocks, which could provide some support to the market.