Key moments

- Target’s adjusted earnings for the quarter ending February 3 reached $2.41 per share.

- The company projects comparable sales to remain relatively stable in 2025, with earnings estimated between $8.80 and $9.80 per share.

- Target’s group revenues were $30.92 billion for a 3% decline, slightly surpassing the analyst predictions of $30.82 billion.

Target Saw 20% Drop in Adjusted Earnings per Share

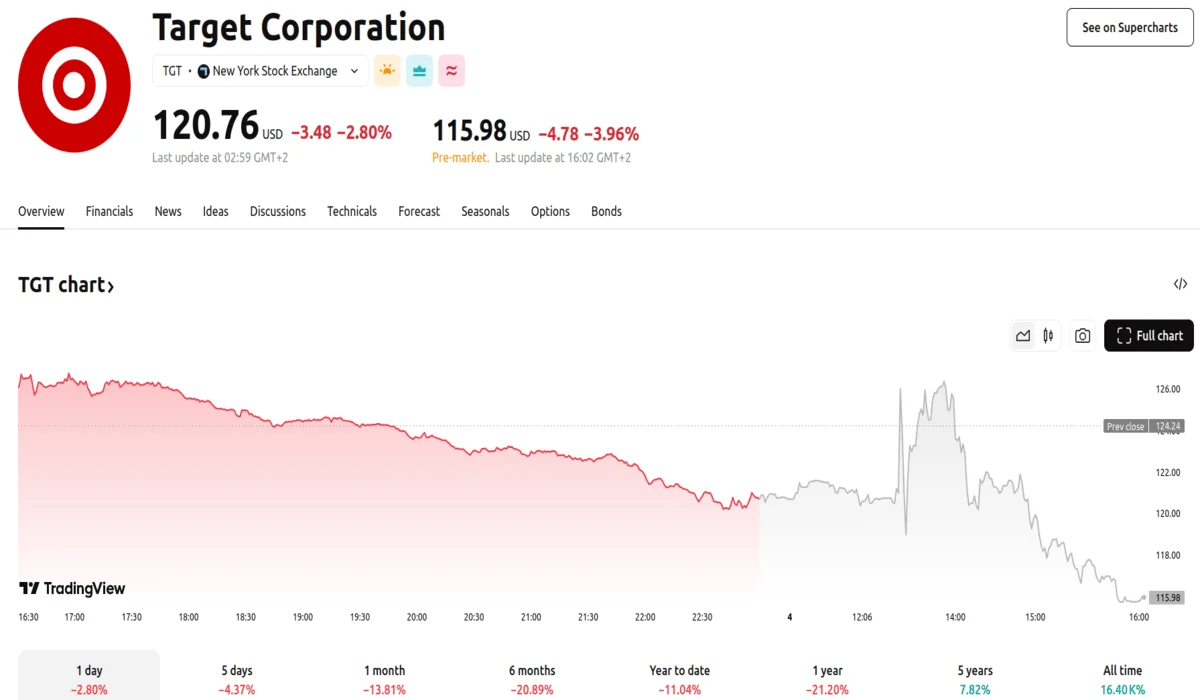

Target Corporation reported its fourth-quarter earnings, delivering results that exceeded Wall Street’s expectations, despite a year-over-year decline. The company’s adjusted earnings reached $2.41 per share for the three months ending February 3rd, which, while representing a 20% decrease compared to the same period last year, still surpassed the anticipated $2.26 per share. Group revenues totaled $30.92 billion, a 3% decrease from the previous year, but managed to slightly exceed the estimated $30.82 billion. Despite the solid earnings, the company’s stock dropped 2.80% to $120.76.

Same-store sales saw a 1.5% increase, outperforming analysts’ predictions, while digital sales experienced a 10.8% rise. However, the company’s gross profit margins narrowed to 26.2%, attributed in part to heavy holiday discounting that led to a decrease in overall transactions by approximately 0.6%.

Looking forward to the current financial year, Target anticipates comparable sales to remain largely flat compared to 2024 levels, with projected earnings falling within a range of $8.80 to $9.80 per share. CEO Brian Cornell has warned that tariffs imposed on goods from Canada, Mexico, and China are expected to result in price increases for consumers in the coming days. Despite Target’s efforts to diversify its supply chain over the past few years, the company still expects to implement price adjustments across a range of goods.

Finance chief Jim Lee noted a softening in consumer spending trends, particularly in apparel sales, which were affected by uncharacteristically cold weather across the U.S. and declining consumer confidence. However, the company projects a moderation in this trend as apparel sales respond to warmer weather and consumers turn to Target for upcoming seasonal moments like the Easter holiday.

Target’s leadership emphasized its commitment to ongoing investments in digital capabilities, stores, and supply chain infrastructure, aiming to further differentiate its unique physical and digital shopping experience. The company plans to continue monitoring consumer trends closely and will maintain a cautiously optimistic outlook for the year ahead.