Key moments

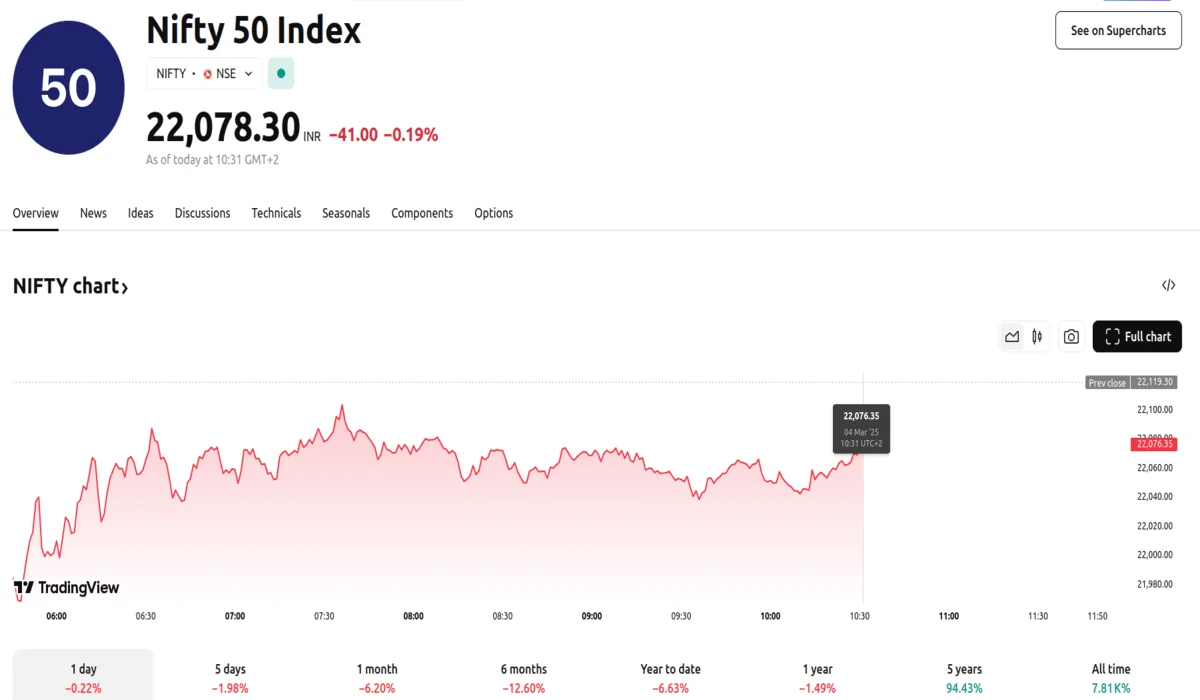

- India’s Nifty 50 index concluded its tenth consecutive trading session with losses, reflecting a period of sustained market downturn.

- Over these ten sessions, the Nifty 50 experienced a decline of approximately 4%, dropping 16% from its September peak.

- Companies from the IT, pharmaceutical, and automotive sectors suffered the most significant price reductions.

Nifty 50 Falls 0.20% to 22,076, Sensex Drops 0.18% to 72,953

The Indian stock market has been experiencing a prolonged period of decline, with the Nifty 50 index recording ten consecutive sessions of negative performance. This sustained downward trend is attributed to global market uncertainties and is largely driven by the implementation of new tariffs by the United States on key trading partners.

The Nifty 50 index fell 0.20% to 22,076.1, while the BSE Sensex decreased by 0.18% to 72,953.23. The market downturn has resulted in a cumulative loss of about 4% for the Nifty 50 over the past ten trading sessions, and a 16% fall from the September peak. The prolonged losing streak has caused concern among investors, who are closely watching the unfolding global economic landscape.

Several key sectors experienced substantial losses, with export-oriented industries taking the most significant hit. The information technology sector, heavily reliant on U.S. revenue, saw a 1% decline, with companies like Infosys and Tech Mahindra each falling approximately 2%. The pharmaceutical and automotive sectors also registered notable losses, contributing to the overall market volatility. The impact of the looming tariffs is expected to extend beyond immediate market reactions, potentially affecting long-term trade relationships and economic growth.

The global market’s reaction to the new tariffs, coupled with concerns about rising price pressures in the U.S., contributed to the overall market instability. Investors are now assessing the potential for prolonged inflation and the subsequent impact on interest rates, which could further influence emerging markets like India. The movement of the MSCI Asia ex-Japan index (down 0.4%) also reflected the overall negative sentiment, mirroring the overnight declines observed on Wall Street.

Conversely, ASK Automotive experienced a 5% increase following a partnership announcement with Japan’s Kyushu Yanagawa Seiki for manufacturing alloy wheels. This positive development offered a brief respite amidst the broader market downturn, highlighting the potential for individual companies to thrive despite challenging market conditions.