Key moments

- While a widespread market downturn impacted various stocks, Oracle’s 4.47% decline significantly outpaced Microsoft’s 1.80% drop.

- Oracle’s trading volume dropped below its 50-day average.

- Although the company exhibits strong operational efficiency and cost control, as shown by high EBIT and gross margins, its high debt-to-equity ratio and potentially overvalued PEG ratio raise concerns about its long-term financial health and growth prospects.

Oracle’s Stock Price Continues to Slump

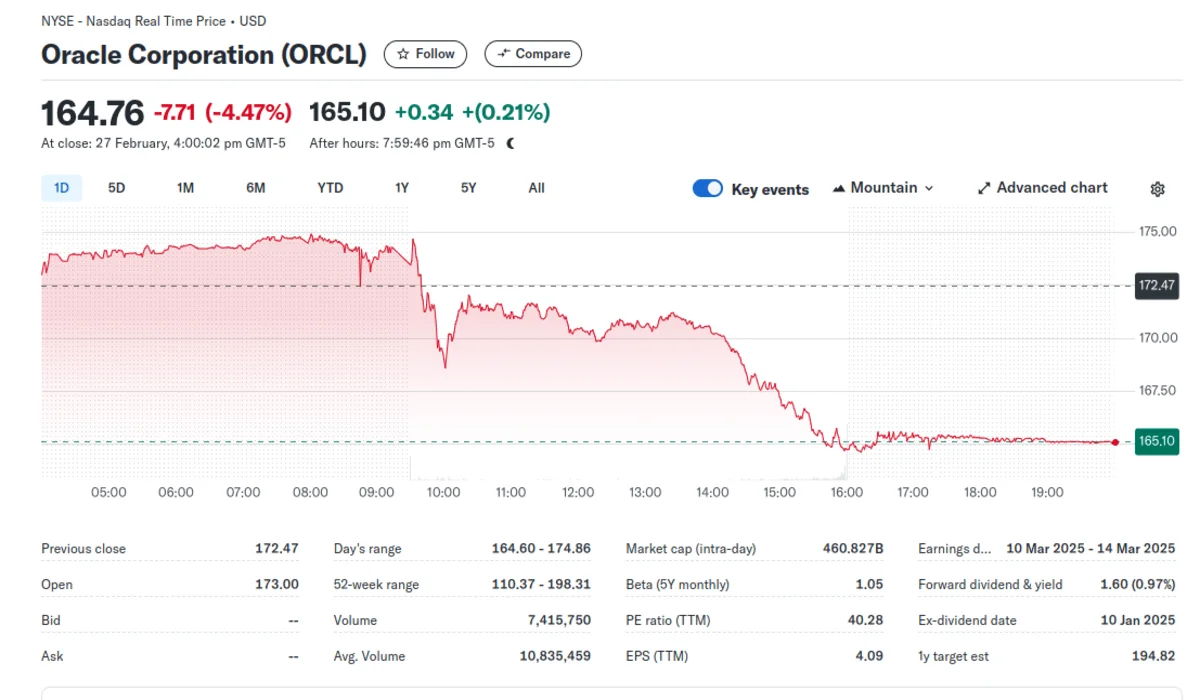

Oracle Corp. experienced a significant downturn in its stock value, with shares dropping by 4.47% to close at $164.76 on Thursday. This decline occurred amidst a broader market slump, as evidenced by the S&P 500’s 1.59% decrease and the Dow Jones Industrial Average’s 0.45% fall. This week proved challenging for Oracle overall, with the stock previously dipping to $183.60 and continuing to slide downwards.

The company’s performance trailed behind companies like Microsoft and Alphabet, which also saw declines but to a lesser degree. Furthermore, Oracle’s trading volume fell below its 50-day average, suggesting reduced investor interest.

Several factors contributed to Oracle’s downward trend. Broader market anxieties stemming from new tariff announcements by U.S. President Donald Trump may be to blame. These tariffs have cast a shadow over the tech sector, creating uncertainty about global trade. Additionally, investor sentiment may have been influenced by concerns regarding Oracle’s financial metrics. While the company boasts a high EBIT margin and strong gross margins, its profit margin and high debt-to-equity ratio raise questions about long-term profitability and financial stability.

Analyst estimates for Oracle’s upcoming earnings report project increases in both earnings per share and revenue. However, recent downward revisions to these estimates indicate a shifting landscape and potential challenges. The Zacks Rank system, which considers these estimate revisions, currently classifies Oracle as a “Hold,” suggesting a cautious outlook.

Oracle’s valuation metrics, such as its forward P/E ratio and PEG ratio, provide further insight into its market position. While its forward P/E ratio is slightly lower than the industry average, its high PEG ratio suggests that the stock may be overvalued relative to its expected growth.

Despite these challenges, Oracle’s diverse portfolio, strong asset base, and strategic investments offer potential for recovery. However, investors should closely monitor the company’s financial performance and its ability to navigate the evolving global economic landscape.