Supply chain shortages have been one of the biggest issues for the US industry over the past few years. The pandemic, the war in Ukraine, and the over-reliance on China, all rightfully blamed for the lack of raw materials, semiconductor chips, and car parts actually shed some light on a domestic problem that has been around for at least a decade – a shortage of skilled laborers.

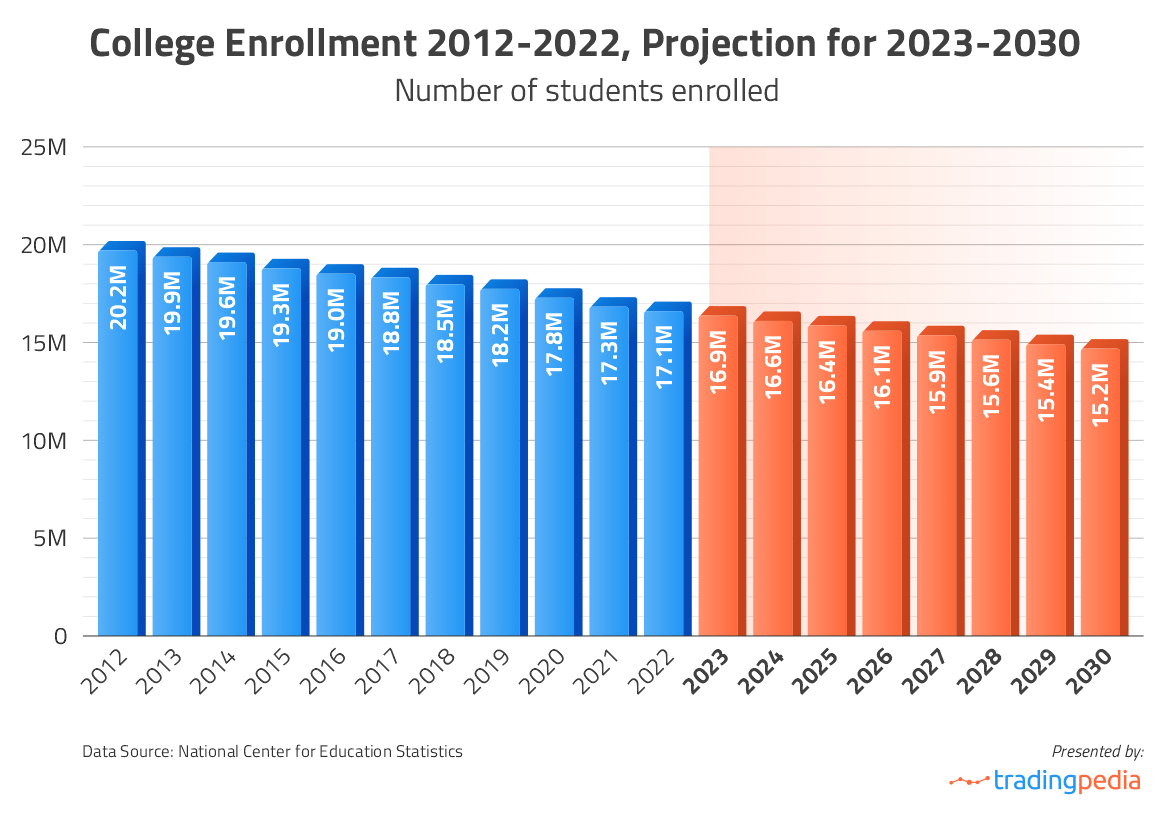

The latest statistics show that college enrollment in the United States declined once again this fall. In September, over 190,000 fewer young people chose to go to college than in 2021. Since 2012, college enrollment has dropped by more than 15%, which equals roughly 3 million people. An even more unsettling statistic reveals that more and more young people drop out of college, with only 60% graduating on schedule. Looking at these alarming numbers, our team at TradingPedia decided to try to get to the root of the problem – why is Gen Z choosing to work and not study? And how do their choices impact the economy?

If the same negative trends last for another few years, by 2030, college enrollment could drop to just over 15 million. This means that within the next 7 years, colleges across the U.S. could lose more than 2 million students. Certain fields, such as information technology, business, medical and healthcare majors remain fairly popular, and as these sectors are expected to grow, demand for new talent will grow as well.

Persistent Decline in College Enrollment

In the 1960s, around 11% of young adults between the ages of 25 and 34 in the U.S had at least a bachelor’s degree, according to the nonprofit organization College Board. In the 1980s, this percentage had climbed to 24%, and in 2018, 39% of Americans in this age group held a bachelor’s degree. But each year, fewer people go to college, with rising tuition fees and the growing burden of student debt keeping those who are already struggling financially out of school.

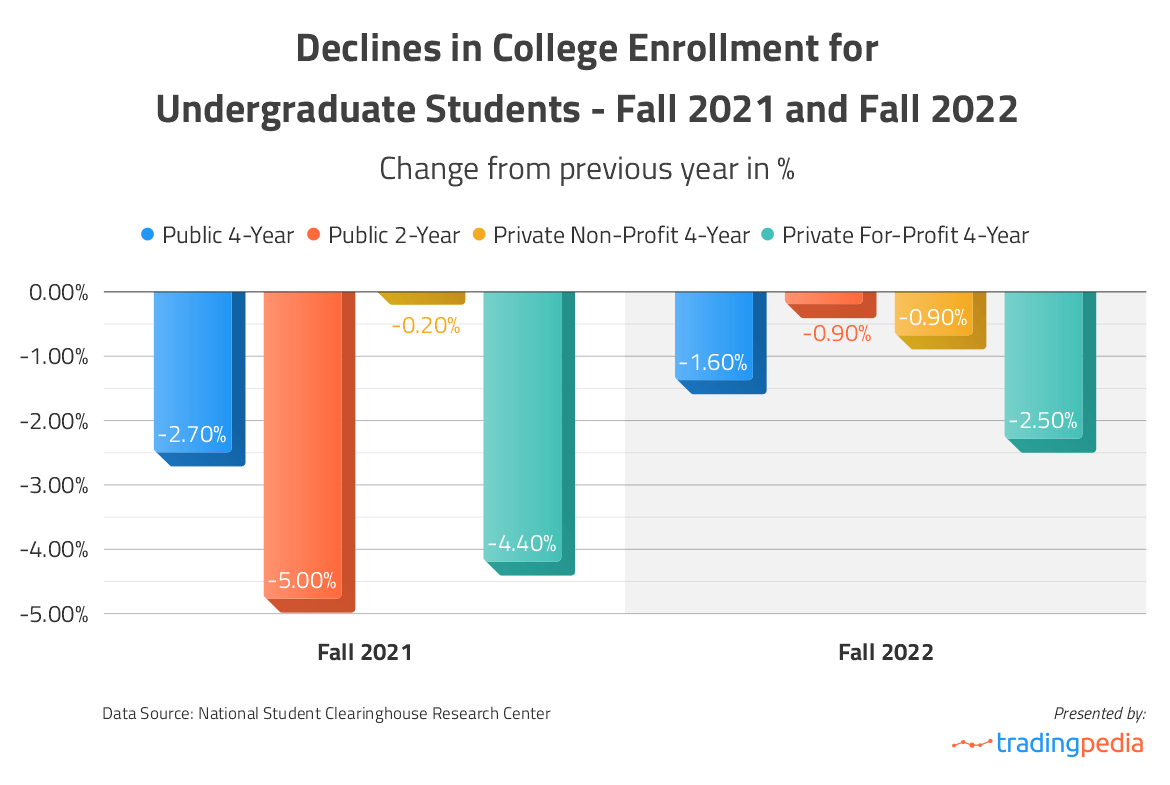

Data from the National Student Clearinghouse Research Center shows that in 2022, the overall college enrollment declined by 1.1% from 2021. The drop could be seen across all sectors – in both private and public colleges and universities, and for both male and female students. Interestingly, when comparing the overall figures, the largest decline was reported for female students – down 2.1% for undergraduates and 1.9% for graduate students, versus 0.7% for male undergraduates and 1.3% for male graduate students.

Digital learning publication My eLearning World estimates that over the past decade, enrollment has fallen by 15% or 3 million students. And while in the 2022-2023 academic year there are fewer students in colleges, the labor market has changed significantly from what it was just one or two decades ago, following the wider adoption of technology and robotization in certain industrial processes. Manual repetitive tasks are increasingly taken over by machines, although this does not mean workers are out of jobs. On the contrary, workers now interact with the technology, control and program it, performing tasks that require more skill, technical expertise and a higher level of education.

Skilled trades programs and vocational training certainly help, and many young people are now turning to shorter, cheaper courses which they can attend while working. However, the skilled labor shortage does not apply only to workers in the construction, electrical and machining sectors – a college diploma is also needed for many jobs in healthcare, finance, insurance and other fields.

Dropping out of College: A New Trend?

The falling numbers of new college students are concerning, but there are more negative tendencies which have been shaping education over the past few decades. Dropping out of college has been made to seem trivial by newspaper stories about famous billionaire dropouts who then somehow miraculously built the first personal computer or invented the biggest social media website. Unfortunately, most college dropouts will never repeat the success of Bill Gates, Steve Jobs or Mark Zuckerberg. In fact, students who drop out have frequently amassed substantial student debt without getting the degree that would help them earn more and pay off this debt.

Figures from the U.S. Department of Education and the National Center for Education Statistics show that in 2020, only 64% of undergraduate students who entered college in 2014 managed to finish with a degree. These were students who studied in 4-year programs and should have graduated in 2018. Even 2 years later, more than a third still did not have their certificates and degrees. While this 6-year graduation rate was 63% at public institutions and 68% at private nonprofit colleges, it was barely 29% at private, for-profit universities.

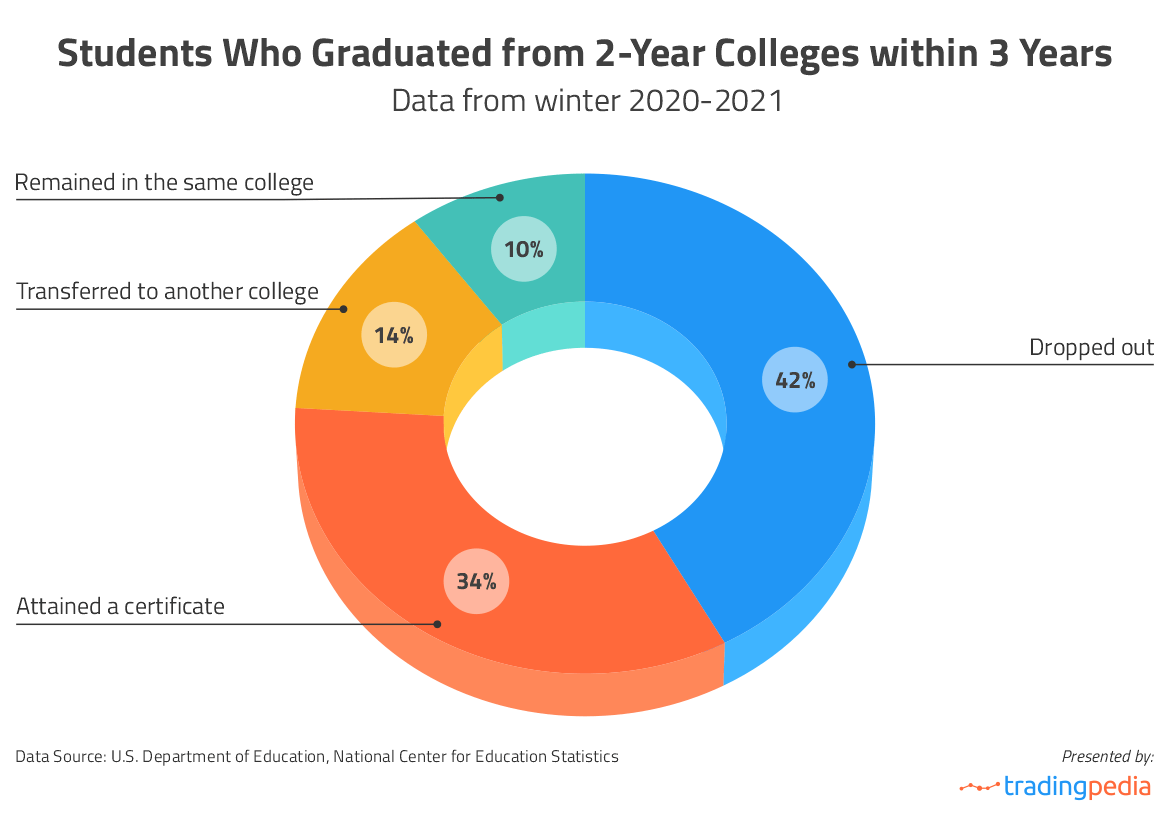

Even fewer managed to finish community college, although these institutions offer shorter, 2-year programs that focus on career-oriented education and the development of skills rather than on academic studies. Of those students who started community college in 2017 and should have graduated in 2019, roughly 34% attained their certificate or associate’s degree within 3 years. Around 14% transferred to another college, while another 10% stayed at the same institution. The remaining students, or 42%, were no longer studying at the college where they originally enrolled, and did not transfer to another college.

Why Colleges Fail to Attract and Keep Students?

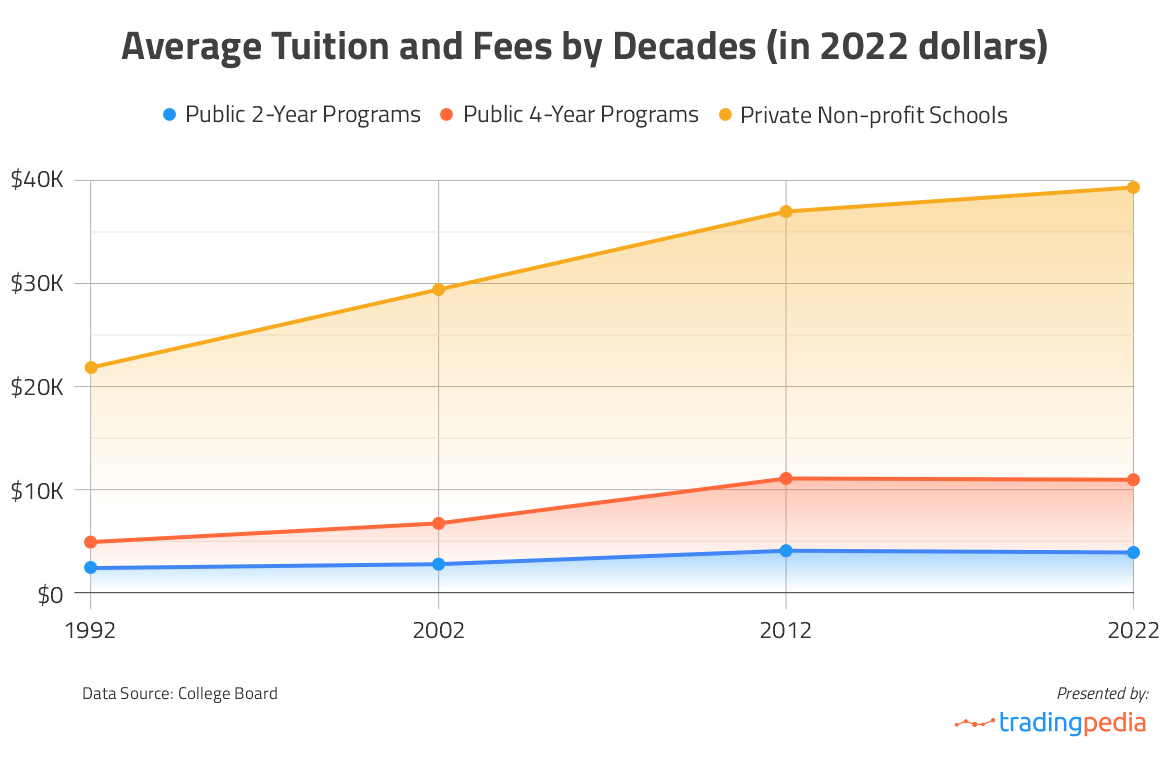

While enrollment and graduation rates are dropping, tuition fees have been on the rise for years, although the increase is not rapid or alarming enough to put young people off college. Tuition has largely remained the same over the past decade, peaking in 2019 and 2020, while fees fell significantly this past year.

The average tuition at a public two-year college was $3,860 in 2022, down 9% from $4,250 in 2020 according to the latest figures published by the non-profit organization College Board, adjusted for inflation. In 2012, it was $4,030, while back in 1992, the average tuition at community colleges was $2,340. In 2022, the average tuition at public 4-year colleges and universities dropped nearly 9% from 2020 to $10,940, and at private 4-year institutions, it fell by 7% to $39,400.

The pandemic, which brought lockdowns and distance learning, also took its toll on young people’s plans after high school. Many simply chose to find a job rather than remain on their devices and attend yet another tedious online course. The constantly rising prices and an inflation rate that Gen Z have not seen in their lifetimes, created the perfect conditions for the current enrollment and graduation levels. The massive student debt, which is larger than the 2021 GDP of Australia, did not help either.

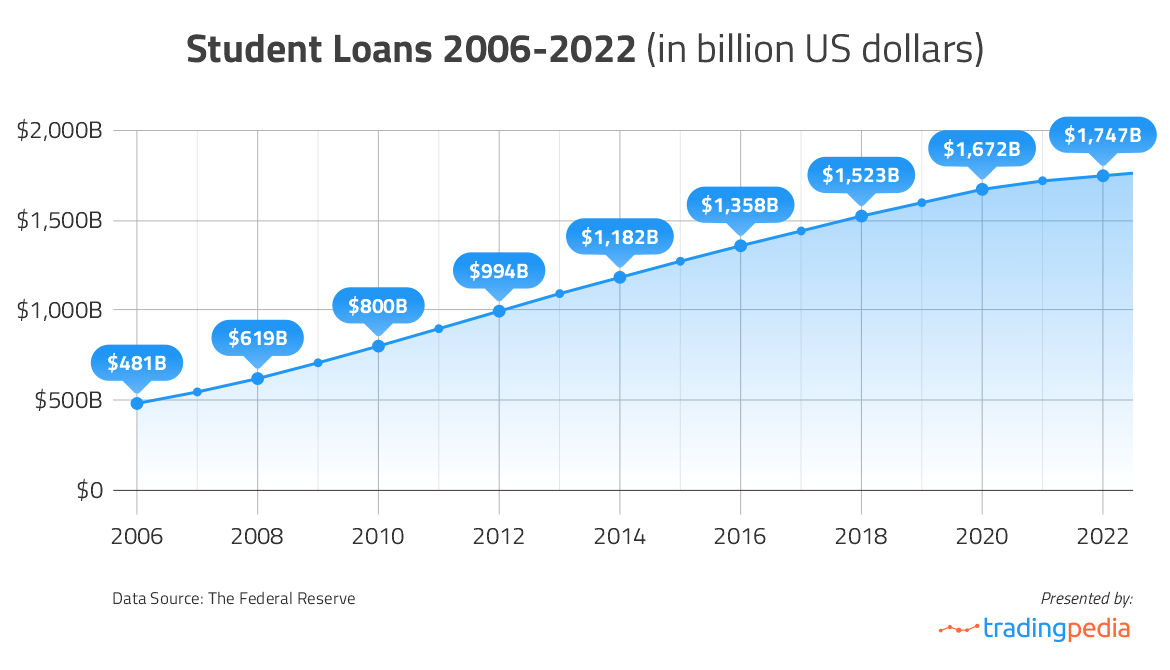

Collective Student Debt in the U.S. Reached $1.76 Trillion

The student debt burden in the U.S. is estimated at $1.76 trillion in the third quarter of the year, more than the cumulative debt related to financing an automobile purchase – it is $1.4 trillion, according to the most recent data by the Federal Reserve. Roughly 30% of all adults in the country and more than 40% of college grads say they incurred some debt for their own education. Approximately 40% of those attending public colleges have borrowed money, compared to 57% of students in private non-profit colleges and 59% of those who attended private for-profit institutions.

Most borrowers owe less than $25,000, with the median amount being between $20,000 and $24,999. Around 26% say they have less than $10,000 in outstanding student debt, 19% owe between $10,000 and $19,999, while 10% of borrowers still have $100,000 or more in student debt. In 2019, before the pandemic, 17% of people with an outstanding student debt were behind on their payments. This percentage fell to 12% in 2021.

With the proposed student loan forgiveness plan, President Biden’s administration plans to reduce some of what borrowers owe. For some, loan payments may be cut to $0 based on the outstanding debt and the person’s income. It is still unclear if and when the plan will be enacted, but even if it is, with a current interest rate between 4.99% and 7.54% for federal loans (around 92% of student loans are federal), fewer people are now willing to sign up for a student loan. Without it, many simply cannot afford college.

What Percentage of Candidates Do Really Need a College Degree?

But why is a college degree so important? In order for employees to break the cycle and escape low-paying jobs, they need to acquire new skills and get additional certificates or a college degree. College grads are more likely to find a job than those who have only a high school diploma. They are also more likely to get paid more generously and receive better health and retirement benefits.

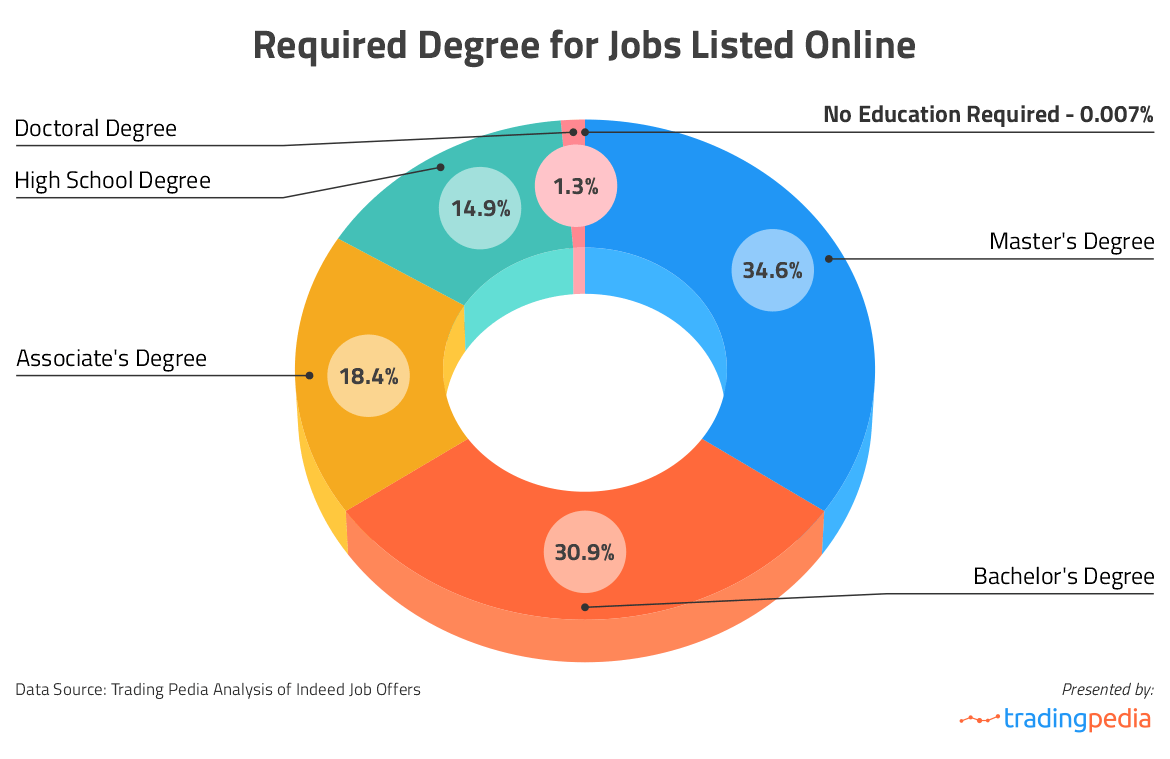

According to the latest Employability Report by education technology company Cengage Group, 62% of all employers surveyed require a degree for entry-level positions, and around 67% of graduates say the jobs they applied for required a degree. Meanwhile, less than 40% of all adults in the U.S. are estimated to have a college degree, according to the survey.

We decided to check the numbers for ourselves as there are no official statistics about job vacancies where a college degree is a requirement. We looked at one of the largest job search websites in the US, Indeed, which at the time of writing showed a total of 5.1 million job listings for positions in the United States with “full time” as a key word. Using the Education filter, we found only 696 jobs that had no education requirements, while those that required a high school diploma amounted to 1,361,350, jobs for candidates with an Associate’s degree to 1,678,727, with a Bachelor’s degree to 2,822,778, and with a Master’s degree – 3,162,308. Positions that required a Doctoral degree amounted to 121,703.

These figures, however, contradict the official BLS projections. When looking at platforms such as this, it should be pointed out that many of the job ads list multiple educational requirements, while the websites show not only the relevant listings but also job ads by fee-paying employers.

As a result, many of the requirements will overlap. It is also important to bear in mind that some employers might not have filled out the job listing forms correctly. Still, there is a clear tendency in these job postings – most employers look for prospective candidates who have a college or university degree.

This Is How Things Can Change for the Worse

In the 1960s and 70s, the economy in the U.S. exploded, with millions of baby boomers and women entering the workforce. The working-age population (ages 15-64) began to increase by 2 million each year, while modernization was seen across every industry, fueling economic growth. In the 2020s, however, things look very different.

The population is aging – in 2020, roughly 17% of all people in the country were of retirement age. In 2030, about one in five Americans will be 65 or older, and by 2034, older adults will outnumber children for the first time in U.S. history. In December 2022, there were 207.4 million people aged 15 to 64. The BLS expects the growth in labor force to slow down in the years up to 2031, when employment is said to reach 168.9 million. By that time, all baby boomers will be 65 or older, and while scores of Americans will reach the traditional retirement age, fewer will be aged 16-18 due to the lower birth rate over the past two decades (compared to the 1970s and 80s).

Still, employment will grow and more jobs will be created across various sectors, especially jobs that require higher education. If college enrollment continues to decline at the same rate, i.e by 1.5% each year on average, it can be estimated that by 2030, student numbers will have declined to 1990s levels. In this scenario, there will be 15,163,225 students in the winter of 2030-2031. Even if the decline continues at a more moderate rate – by 1% or 0.5% annually – the number of students will fall dramatically within just 7 years – amounting to between 15.2 and 15.3 million in 2030, according to our calculations.

Meanwhile, as more technology is incorporated in every sector of the economy, companies will seek employees who can work with these technologies. The more skills and the higher education job candidates have, the more employable they will be. College grads are and will continue to be in particular demand in certain sectors such as health care, information technology, finance and insurance, education, and professional and business services.

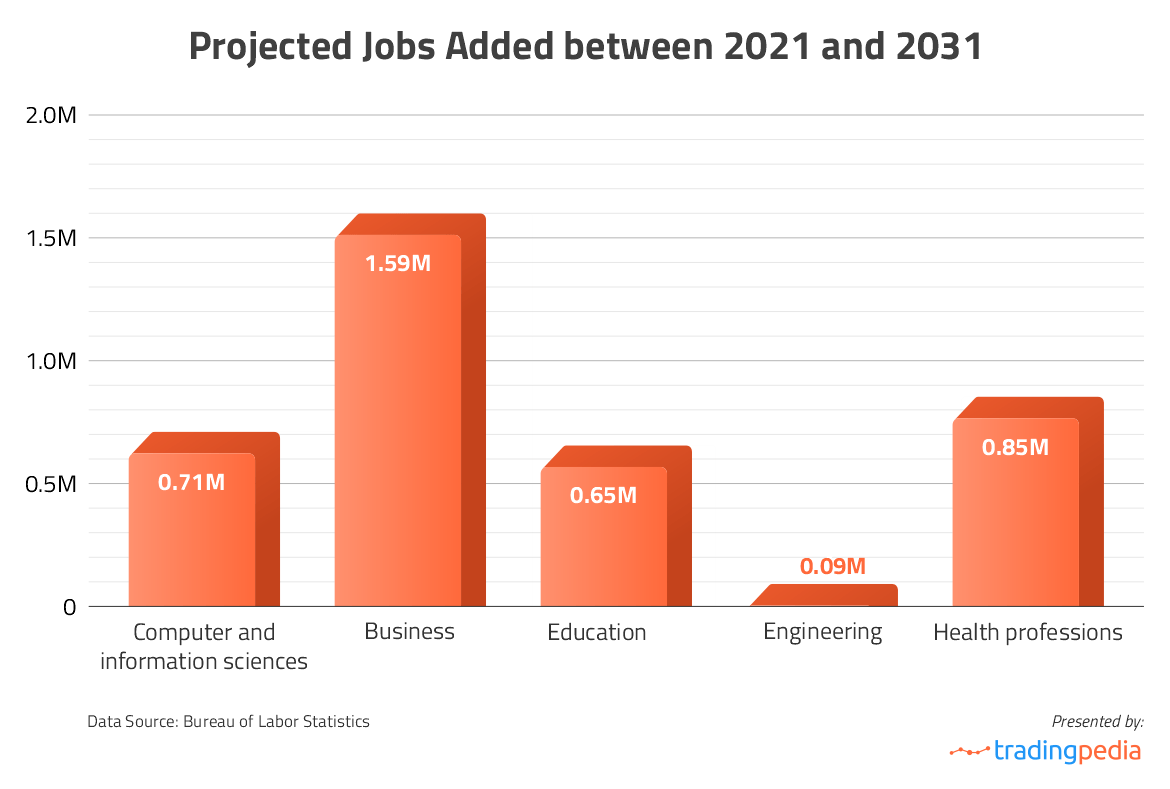

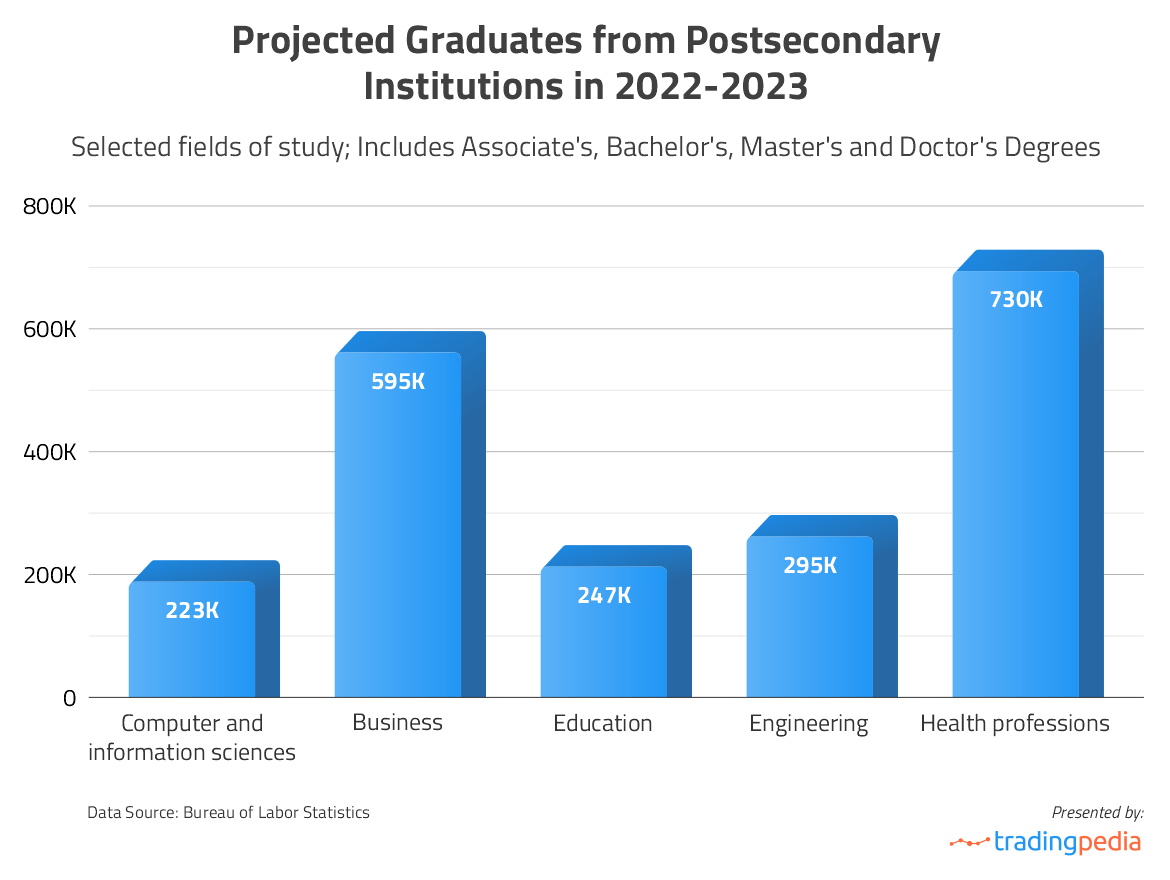

How the Labor Market Will Change in the 2020s

In 2021, the U.S. Bureau of Labor Statistics (BLS) projected that between 2021 and 2031, the healthcare and social assistance sector will add roughly 2.6 million jobs to the labor market, the most of any sector. In total, 8.4 million jobs will be created, up 5.3 percent from 2021. We looked at the raw data from the BLS Career Outlook, which includes the latest employment figures from 2021, as well as projections for the upcoming decade, by occupation. We compared them with the number of students expected to graduate in 2023 from selected fields of study, namely computer and information sciences, business, education, engineering, and health care professions.

According to the BLS, the occupations that will add the most jobs in the next ten years are home health and personal care aides (924,000), restaurant cooks (459,900), and software developers (370,600). However, the jobs we focused on require a degree – an Associate’s degree or higher. These are computer related occupations, including computer and information systems managers, which will increase by 711,200 between 2021 and 2031 or 71,120 each year on average. At the same time, we calculate that around 223,700 students with a computer or information technology major will graduate in 2023. That includes students in 2-year and 4-year institutions, both public and private.

These figures, however, are a huge underestimation of the current trends. The tech sector is considered to be one of the fastest growing in the past decade, despite the massive layoffs in 2022. Still, Silicon Valley companies continue to hire, struggling to find talent amid the labor shortage. At the end of November 2022, there were roughly 10.5 million job vacancies in the U.S., of which 211,000 were in the information sector. Preliminary data shows that 120,000 people were hired, up 20% from October.

Business and management occupations will increase by 159,900 per year on average, while in 2023, the expected business majors graduating with an Associate or higher degree is 596,000. Those who graduate with a degree in education will be 247,800, while some 65,820 new jobs will be added to the sector this year. At least 295,800 students with engineering degrees are expected to graduate this year and around 9,130 new jobs will be awaiting them, along with the thousands already existing. Also, around 730,000 medical and healthcare students are expected to graduate and enter the sector, which will add some 85,800 new jobs this year.

According to BLS data, the most prospective careers for candidates with a Bachelor’s degree in 2023 are those in the business and technology sectors. One of these is an information security analyst, a job that is expected to grow 35% in the coming years, adding 56,500 new vacancies. The average annual wage for this position in 2021 was $113,270. Other great jobs for Bachelor’s degree holders are medical and health services managers and software developers, growing 28% and 25%, respectively.

Using the Occupation Finder tool on the BLS website, we can see that the best jobs that do not have any education requirement at all are athletes and sports competitors, who in 2021 earned, on average, $116,930. The projected job openings until 2030 are 5,700 or 36% above the current levels. The flight attendant is the profession requiring a high school diploma that will see the greatest increase – 22,100 jobs or 21%. The average annual wage for this position in 2021 was $62,280.

| The Most Promising Jobs for Candidates with Bachelor’s Degrees or Less in 2023 | ||||

|---|---|---|---|---|

| Occupation | Average Wage (annual, 2021) | Projected Job Openings 2021-2031 | Projected Job Growth 2021-2031 (in %) | Educational Requirement |

| Computer and information systems managers | $162,930 | 82,400 | 16% | Bachelor’s degree |

| Financial managers | $153,460 | 123,100 | 17% | Bachelor’s degree |

| Software developers | $120,990 | 411,400 | 25% | Bachelor’s degree |

| Personal financial advisors | $119,960 | 50,900 | 15% | Bachelor’s degree |

| Medical and health services managers | $119,840 | 136,200 | 28% | Bachelor’s degree |

| Information security analysts | $113,270 | 56,500 | 35% | Bachelor’s degree |

| Athletes and sports competitors | $116,930 | 5,700 | 36% | No formal educational credential |

| Management analysts | $100,530 | 108,400 | 11% | Bachelor’s degree |

| Gambling managers | $89,190 | 19,900 | 17% | High school diploma or equivalent |

| Lodging managers | $67,770 | 9,200 | 18% | High school diploma or equivalent |

| Flight attendants | $62,280 | 22,100 | 21% | High school diploma or equivalent |

| Rotary drill operators, oil and gas | $61,840 | 2,100 | 18% | No formal educational credential |

| Hearing aid specialists | $59,960 | 1,800 | 16% | High school diploma or equivalent |

| Industrial machinery mechanics | $58,780 | 69,700 | 14% | High school diploma or equivalent |

| Service unit operators, oil and gas | $55,660 | 6,300 | 18% | No formal educational credential |

| Farm labor contractors | $54,400 | 300 | 22% | No formal educational credential |

| Derrick operators, oil and gas | $52,140 | 1,400 | 17% | No formal educational credential |