Coca-Cola Co. gave in to investor pressure and agreed to curb a senior-executive compensation plan which was categorized as “excessive” by Warren Buffet and faced criticism by other large shareholders.

“Coca-Cola has finally conceded that the equity compensation plan it put to a vote of shareholders in April was outrageously excessive and inconsistent with past plans,” said David Winters, chief executive of Wintergreen Advisers, who has been the most outspoken investor against the share award plan. He added that the compensation framework was a “raw deal” for shareholders that was too generous and diluted the stock.

Coca Cola said that according to the plan, which will come into effect next year, it will issue no more than 0.8% of its total outstanding stock in 2015 and an average of 0.4% for the remaining time. The plan comes at a moment when the companys Chairman and Chief Executive Officer Muhtar Kent and other members of Coca-Colas board of directors are trying to soothe investors concern regarding recent performance.

The company mismatched its revenue growth forecast last year and could trail expectations again this year. Defecting consumers, who are turning away from fizzy drinks, as well as artificial sweeteners in diet sodas, caused sales and net profit to drop in the second quarter, with sales in the US, the companys biggest market, remaining flat. To address the growing tendency, Coca Colas main rival, PepsiCo Inc. is launching a new soda which uses real sugar and the natural sweetener stevia, packing up only 60 calories per 7.5-ounce can.

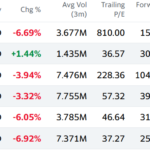

The Coca-Cola Co. closed 0.19% higher on Wednesday in New York to close at $42.74 per share, marking a one-year change of +12.62% and valuing the company at $187.45 billion. According to CNN Money, the 20 analysts offering 12-month price forecasts for The Coca-Cola Co. have a median target of $45.00, with a high estimate of $53.00 and a low estimate of $42.00. The median estimate represents a +5.29% increase from the last price of $42.74.