Gold advanced to the strongest level in three weeks on speculation the recent slump in prices spurred increased Chinese demand. However, assets in the SPDR Gold Trust, the biggest bullion-backed ETF, remained at the lowest since January 2009, adding to bearish sentiment.

Gold advanced to the strongest level in three weeks on speculation the recent slump in prices spurred increased Chinese demand. However, assets in the SPDR Gold Trust, the biggest bullion-backed ETF, remained at the lowest since January 2009, adding to bearish sentiment.

On the Comex division of the New York Mercantile Exchange, gold futures for settlement in February rose by 0.10% to trade at $1 239.80 per troy ounce by 08:10 GMT. Prices touched a session high at $1 245.70, the strongest level since December 17th, while day’s low was touched at $1 232.30 an ounce. On December 31st, prices touched $1 181.90 per troy ounce, the lowest since June 28th, when the metal bottomed at $1 180.35 per troy ounce. Gold futures settled last 5-day period 1.95% higher, the largest advance in ten weeks. However, the precious metal settled last year 28% lower, the steepest annual decline since 1981.

Fed stimulus outlook

According to the median analysts forecast data due later today will probably show that US services and factory orders rose in December, supporting the Feds December 18th decision to cut monthly bond purchases by $10 billion to $75 billion, this month. Gold was pressured after a recent series of unexpectedly upbeat economic data from the US supported Fed’s tapering decision and sent equities rallying. The data raised speculations that the Fed might extend the reduction of its monetary stimulus program sooner-than-expected.

On January 2nd, a report by the US Department of Labor revealed the number of people, who filed for unemployment benefits for the week ended December 28th, declined to 339 000 from upwardly revised 341 000 the previous week. Analysts projected that the jobless claims will increase to 342 000.

Meanwhile, the Institute for Supply Management reported that manufacturing activity in the US expanded at the second fastest pace for the year in December, albeit retreating slightly from November, as new orders grew by the most in nearly four years. The ISM manufacturing PMI posted at 57.0, beating analysts’ projections for a drop to 56.9 after jumping to 57.3 in November. The strong reading was based on a solid expansion in new orders.

Fed’s balance sheet has swelled to almost $4 trillion as an attempt to revive the US labor market and put millions of unemployed Americans back to work. The central bank’s asset purchases will be divided between $40 billion in Treasuries and $35 billion in mortgage bonds, Bernanke said.

According to the median estimate of economists surveyed by Bloomberg on December 19th, the Federal Reserve may reduce the purchases in $10 billion increments over the next seven meetings, before ending the program in December 2014.

The U.S. dollar index, which measures the greenback’s performance against a basket of six major peers traded little changed at 81.01 by 08:30 GMT. Prices shifted in a daily range between a 1-1/2 month high of 81.08 and 80.93. The US dollar index settled last week 0.7% higher. Strengthening of the dollar makes commodities priced in it more expensive for foreign currency holders and limits their appeal as an alternative investment.

Assets in the SPDR Gold Trust, the biggest bullion-backed ETP, remained at 794.62 tons, the lowest since January 2009, data on the website showed. The fund has lost 41% of its holdings in 2013. Billionaire hedge-fund manager John Paulson who holds the biggest stake in the SPDR Gold Trust told clients on November 20 that he wouldn’t invest more money in his gold fund because it isn’t clear when inflation will accelerate.

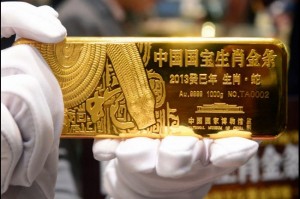

China demand

On the Shanghai Gold Exchange, the trading volume for bullion of 99.99 percent purity rose to 10 400 kilograms on January 2nd from 7 849 kilograms on December 31st, the lowest since December 2nd.

“Demand in China has been very strong, market sentiment is positive and technically the momentum is bullish” said Wallace Ng, a Shanghai-based trader at Gemsha Metals Co., cited by Bloomberg.

According to the World Gold Council, China probably overtook India as the largest consumer in 2013.