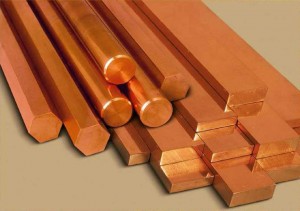

Copper fell today after hitting a five-week high on Monday amid a broadly weaker dollar. However, the industrial metal was supported by speculation the Chinese government will step in and take action to boost economic growth.

Copper fell today after hitting a five-week high on Monday amid a broadly weaker dollar. However, the industrial metal was supported by speculation the Chinese government will step in and take action to boost economic growth.

On the Comex division of the New York Mercantile Exchange, copper futures for September delivery traded at $3.174 a pound at 11:53 GMT, down 0.36% on the day. Prices held in range between days high and low of $3.194 and $3.164 a pound respectively. The industrial metal hit a five-week high at $3.204 a pound on Monday and settled the day 1.2% higher, extending current weeks advance to over 0.8% so far.

Copper was well supported yesterday by a broadly weaker dollar, which was further pressured as negative U.S. economic data was released at 14:00 GMT. The National Association of Realtors reported Existing Home Sales plunged to 5.08 million in June, mismatching projections for a 0.6% rise to 5.25 million. Meanwhile, May’s reading was revised downwards to 5.14 million from 5.18 million, further worsening the situation.

This caused the dollar index to plunge, thus boosting raw materials up. The dollar, which trades inversely to dollar-denominated commodities, hit a new one-month low on Tuesday, after which a rebound followed and laid pressure on commodities. The September contract traded at 82.42 at 11:54 GMT, up 0.12% on the day. The U.S. currency gauge ranged between 82.17, a one-month low, and day’s high at 82.47. Futures fell for the past two days and settled last week 0.45% after plunging 1.87% the previous one following Ben Bernanke’s statements.

However, the industrial metal was supported against the advancing dollar as speculation arose that Chinas government might take steps towards boosting growth in the worlds second biggest economy. Chinese news organizations reported that Premier Li Keqiangs cabinet will not tolerate an economic slowdown below 7%, causing China stocks to gain. The prime minister said before the State Council last week that a reasonable 7.5% growth target was set with labor market stability being the main goal. The Asian country accounts for 40% of global copper consumption.

Xu Liping, an analyst at HNA Topwin Futures Co. in Shanghai., said for Bloomberg: “Market participants believe that the Chinese government will take actions when they think necessary to boost the economy.”

Copper and other raw materials were also supported last week as Fed Chairman Ben Bernanke reiterated his preceding week’s statement at his two-day testimony to Congress on Wednesday and Thursday. Bernanke reinforced Fed’s view that Quantitative Easing is still expected to be tapered within the year and brought to an end by mid-2014, if the requirements are fulfilled. However, the Fed chief stated the U.S. economy currently needs Fed’s accommodative monetary policy in the foreseeable future and it can even be accelerated, if recovery slows its pace.