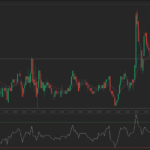

The SEK/NOK currency pair settled below recent high of 1.0697, its strongest level since October 17th, in the wake of Norges Bank’s and Sweden’s Riksbank policy decisions.

Sweden’s central bank left its key policy rate intact at 1.75% at its November 5th meeting, in line with market consensus.

Policy makers signaled that borrowing costs would likely remain at this level for some time.

Inflation continues to be above the central bank’s 2% medium-term target. Yet, it has eased broadly in line with the September projection, solidifying the view that the current price pressures are temporary.

GDP growth was slightly stronger than expected in the third quarter, but the labor market still showed signs of weakness, the central bank said.

Meanwhile, Norges Bank left its key policy rate without change at 4% at its November 6th meeting, in line with market consensus.

The central bank reiterated that in case the economy developed broadly as projected, the policy rate would likely be reduced further next year.

The exotic Forex pair lost 0.10% for the week.