Key Moments:

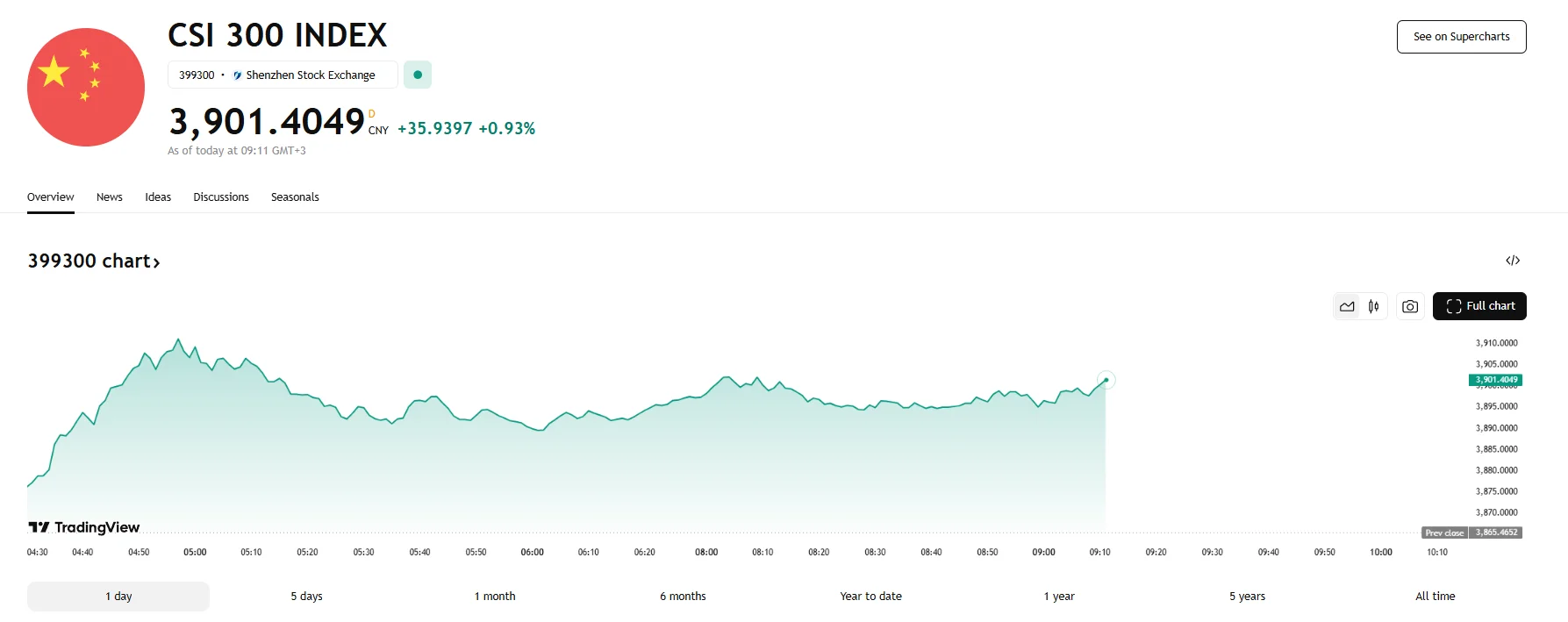

- The CSI 300 Index is trading above 3,800 after an earlier climb of 1.2% allowed it to reach its highest level since May 23rd.

- The CSI Rare Earth Index went up 3.64%, while auto stocks jumped by 2%.

- A newly agreed upon trade deal between the US and China lifted sentiment.

Chinese Markets Tick Higher on Optimism Over Trade Talks

Chinese equity markets advanced strongly on Wednesday, driven by renewed hope surrounding the trade relations between the USA and China. Investors welcomed signs of momentum as officials from both countries announced progress in negotiations, lifting sentiment across sectors.

The blue-chip CSI 300 Index rose as much as 1.2% earlier in the session, touching its highest point in weeks, and is still hovering above the 3,800 threshold. The SSE Composite advanced as well, rising by 0.58% to around 3,404. Other Asian markets also enjoyed gains, with both Hong Kong’s Hang Seng and the Korean KOSPI climbing by over 1%, while in Japan, the Nikkei 225 surged by 0.55%.

It should be noted that, for now, there is a lack of clarity regarding the long-term prospects of the trade relations between Washington and Beijing. According to Pepperstone’s head of research, Chris Weston, specifics, such as the volume of rare earths going to the US and the freedom of US chips to be exported East, were important. However, he also stressed that risk assets should nonetheless remain supported as long as the reported discussions between the two sides appeared constructive.

Trade Developments Drive Sector Gains

As per comments by US and Chinese officials, both parties established a framework that is set to revive the trade truce. As part of the deal, China agreed to halt the restrictions imposed on rare earth exports, a move that significantly boosted investor confidence.

“This is positive news to the market,” started Minority Asset Management co-founder Mark Dong, who highlighted that at least now, a clear bottom line neither side was willing to cross has been established. He continued, saying that the future would see both sides taking steps to decrease the trade imbalance.

The agreement fueled a surge of over 3.6% in the CSI Rare Earth Index, which rose above the 1,820 mark. Semiconductor shares also saw mild strength by climbing around 0.2% to 6,318. Another sector to enjoy gains was China’s auto industry, as the CSI All Share Automobiles Index rallied by around 2%.