Key Moments:

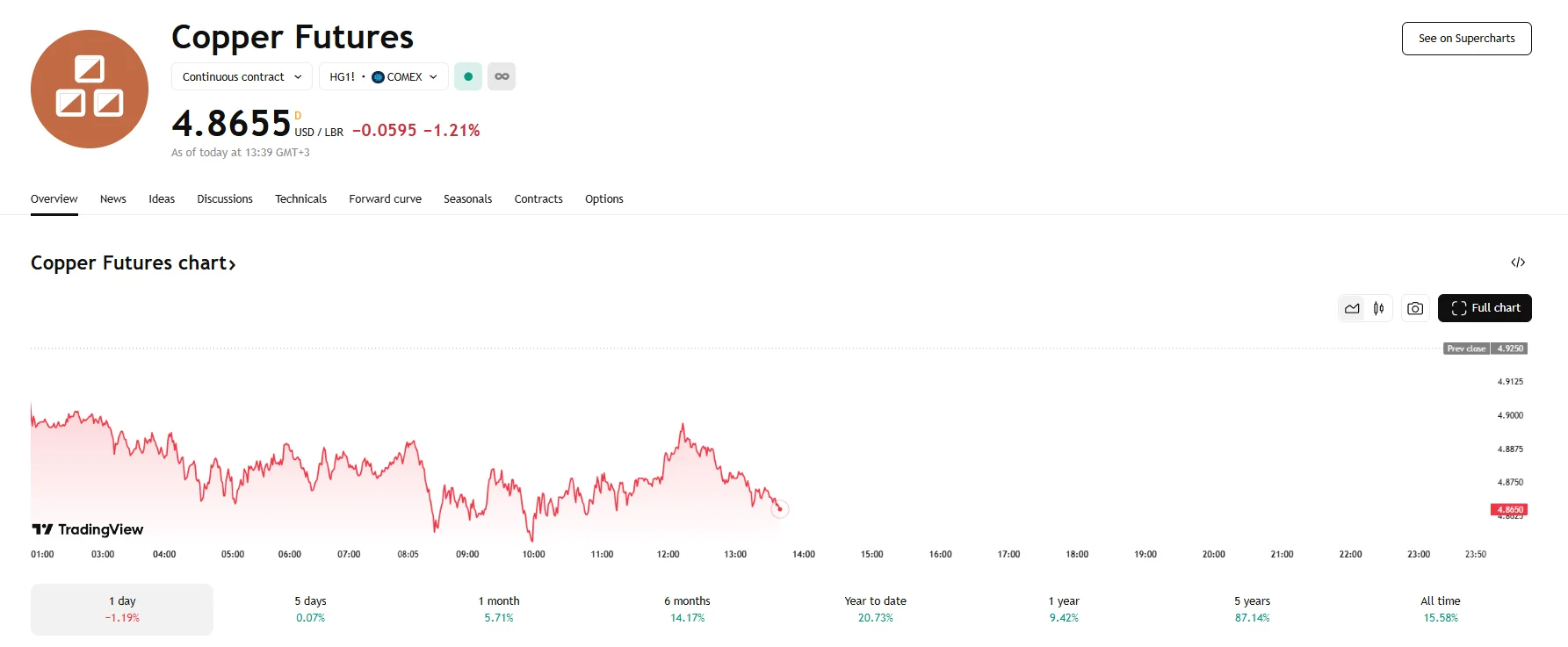

- US Comex copper futures declined 1.2% to $4.8655 on Tuesday.

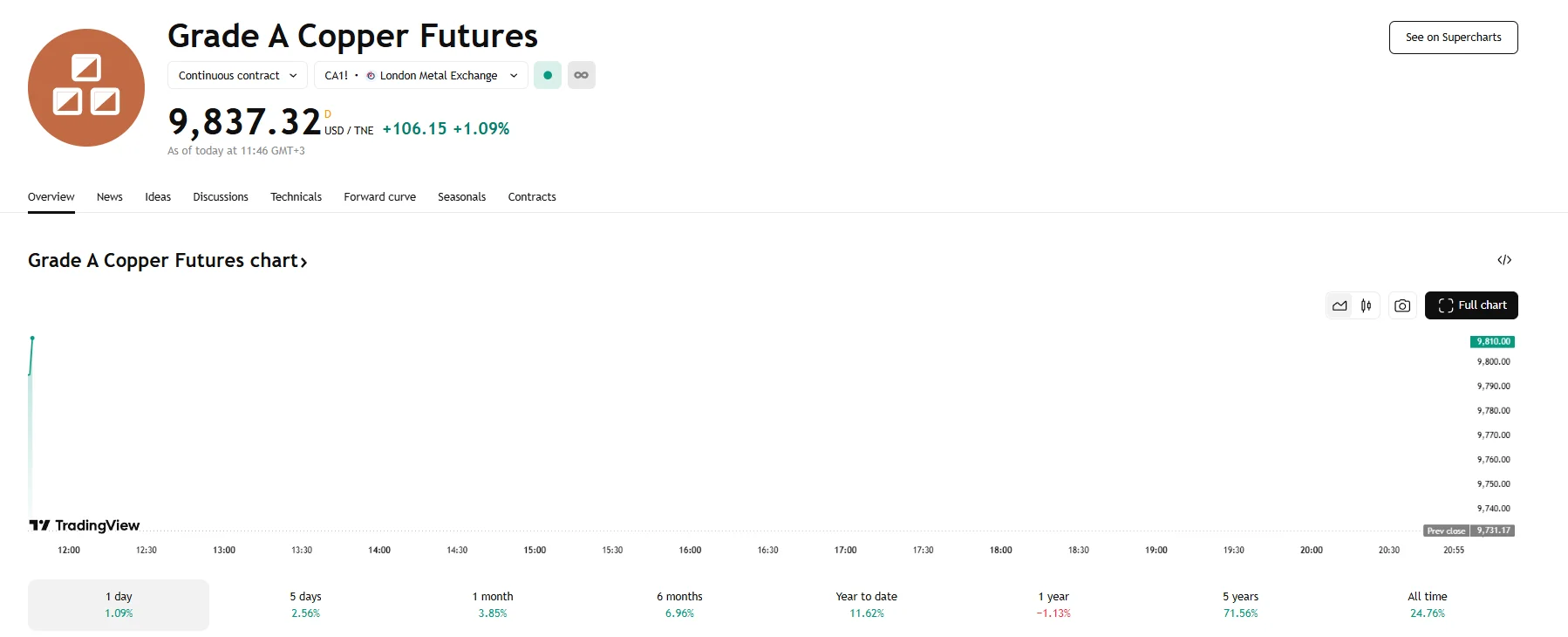

- London Metal Exchange copper rebound and rose by 1.1%.

- LME copper warehouse stocks dropped by another 2,000 tons to 120,400 tons.

Trade Tensions Weigh on US Copper Market

US copper prices slid by 1.21% to $4.8655 on Tuesday as investors remained cautious ahead of progress in US-China trade negotiations. Ongoing trade tensions between the two largest global economies have continued to stir concerns over global economic growth and demand for industrial metals.

In contrast, the grade A copper contracts on the London Metal Exchange (LME) advanced by 1.09% and hit $9,837.32. This marked a significant rebound from the two-year lows suffered in April.

These mixed movements came as market participants appeared to be bracing for the possible outcome of an investigation initiated by US President Donald Trump in February regarding potential tariffs on copper imports. Saxo Bank’s head of commodity strategy, Ole Hansen, observed that there was considerable market complacency at the moment. He added that volatility appeared to be decreasing across various markets despite a lack of significant progress in trade negotiations with China.

Tariff Prospects Drive US Price Premiums

Representatives from the United States and China met on Monday and continued trade discussions earlier today. The London meetings should hopefully see officials make headway on an agreement concerning export restrictions for rare earth elements.

Meanwhile, copper inventories at LME-monitored warehouses declined by another 2,000 tons. They now stand at 120,400 tons, with traders reportedly capitalizing on the stronger US prices amid expectations of further tariffs. The anticipated move, which follows existing duties on aluminum and steel, has led to heightened premiums in US markets.