Key Moments:

- China’s May CPI fell 0.1% year-over-year, beating forecasts of a 0.2% drop, while the PPI declined 3.3%.

- Exports to the US sank 34.5% in May despite 90-day tariff pause.

- Mainland and regional equities advanced as investors awaited the upcoming round of US-China trade negotiations.

Stocks Climb Amid Reignited Trade Optimism

Monday saw Asian equity markets push higher as investors assessed the latest inflation and trade figures from China. Market participants appeared cautiously optimistic while awaiting new developments from renewed trade talks scheduled to take place in London later in the day.

Economic Data Offers Mixed Signals

China’s inflation numbers showed signs of softness but exceeded economists’ forecasts. Last month, the consumer price index (CPI) slipped 0.1% YOY, a milder decline than the 0.2% drop anticipated by analysts. Meanwhile, factory-gate prices, measured by the producer price index (PPI), sank 3.3%, worse than the expected 3.2% decline and April’s 2.7% drop.

Trade data painted a more somber picture, with China’s exports growing just 4.8% in May compared to a year earlier. That figure decelerated from the 8.1% gain reported in April and missed the 5.0% growth forecast. Imports, meanwhile, plunged 3.4%, deepening from the previous month’s 0.2% drop and falling short of the 0.9% decline expected.

Shipments to the US were hit particularly hard, plummeting 34.5% in May and marking the sharpest YOY fall in around five years. Imports from the US also deteriorated by a further 18.1%.

Markets React Positively

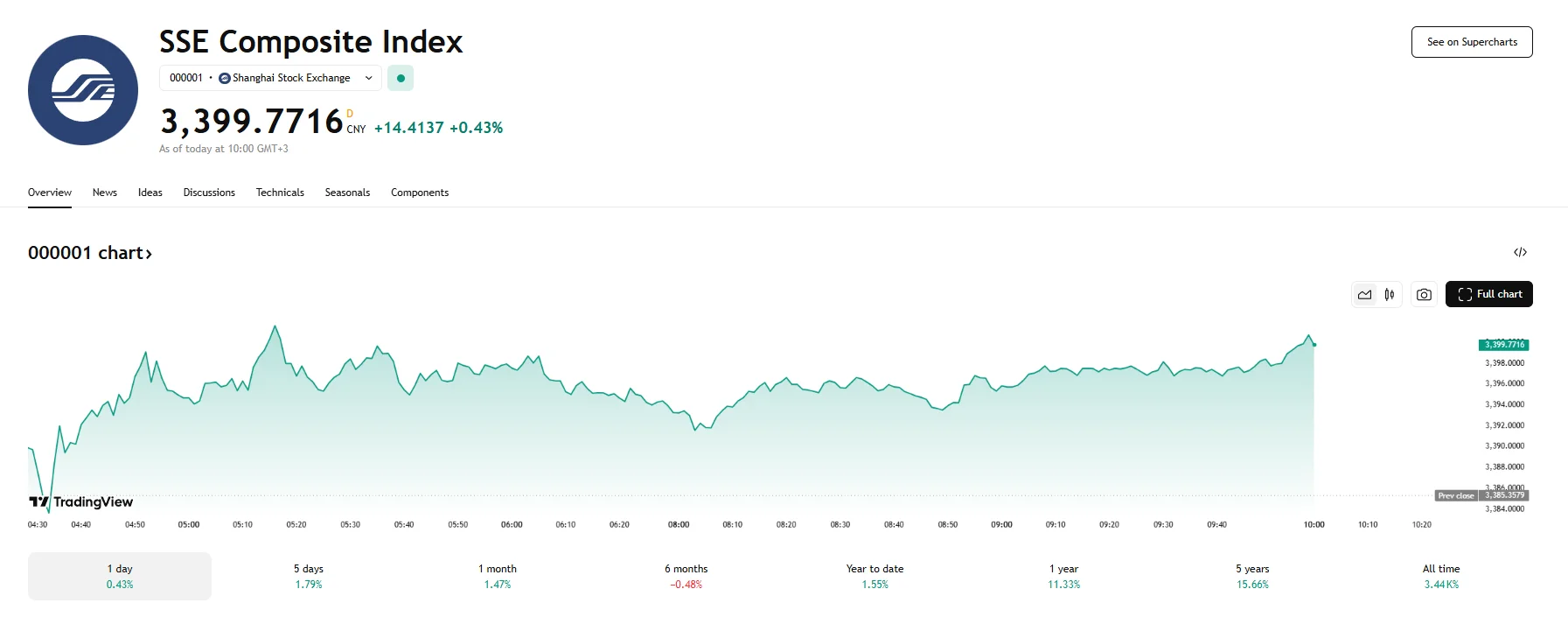

Despite the tariff-impacted trade data, equities climbed as market participants responded to fresh signs of easing tensions between Beijing and Washington. Mainland China’s SSE Composite gained 0.43% and reached 3,399.77, while the CSI 300 advanced by 0.3%.

In Hong Kong, the Hang Seng Index jumped by 1.41% to hit 24,128.80. An even more impressive climb was observed in the tech sector, as the Hang Seng Tech Index soared by over 2%.

Elsewhere across Asia, the Japanese Nikkei 225 gained over 340 basis points. In Korea, market sentiment was positive as the local KOSPI enjoyed upward momentum of 1.5%.

The enthusiasm was underpinned by signs of softening trade rhetoric. Recently, Chinese importers were given the go-ahead to accept jet deliveries from Boeing Co. China also issued temporary export permits for rare earth elements vital to US industries. These steps suggest a willingness on both sides to prevent further escalation and serve to bolster optimism as markets brace for Monday’s meeting between US and Chinese officials.