Key Moments:

- Stock futures declined by over 0.3% on Tuesday following the previous session’s strong close.

- The Trump administration has reportedly requested countries submit top trade proposals by June 4th.

- Financial reports by Dollar General and other major companies are set to affect market sentiment.

Futures Dip After Positive Start to the Month

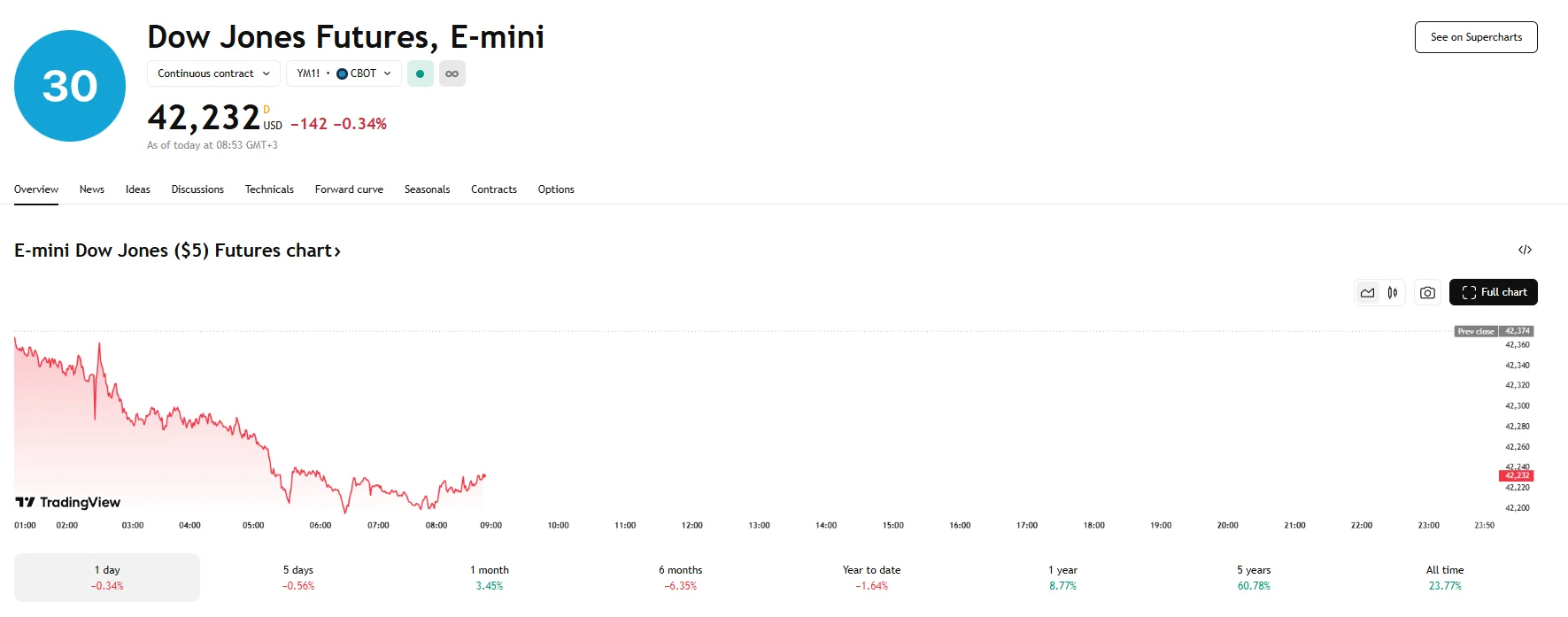

US equity futures were lower in early trading on Tuesday, as S&P 500 contracts dropped 0.35% and hit 5,926.25. Nasdaq 100 e-minis, meanwhile, ticked 0.33% lower and reached 21,463.25. Contracts related to the Dow Jones Industrial Average were not doing well either, with a decline of 0.34% reflecting a loss of 142 basis points.

The losses pared gains achieved during the June 2nd trading session when stocks ended in positive territory. The S&P 500 added 0.41%, and the Dow advanced slightly by 35.41 points. The tech-heavy Nasdaq Composite rose the highest by climbing 0.67% on Monday.

Nations Urged to Submit Strongest Trade Offers by Wednesdays

Today’s decline coincided with Trump’s latest move regarding US tariff policy, as the president has issued a call for expedited trade negotiations. Countries now have until Wednesday to present their strongest proposals.

As reported by Reuters, a draft letter originating from the Office of the US Trade Representative (USTR) asks countries actively involved in talks to submit detailed proposals for tariffs and quotas on US industrial and agricultural goods, plus plans to adjust non-tariff barriers. The White House will reportedly review the responses swiftly and might propose a potential compromise.

Limited Progress Dampens Sentiment Ahead of Key Earnings and Economic Data

Despite official assurances of imminent trade deals, progress remains limited. Only a tentative framework agreement has been reached with the United Kingdom among major partners.

Discussions with the EU, meanwhile, have been turbulent. In late May, Trump threatened the EU with a 50% tariff, which was supposed to be imposed in June but was later postponed to early July. This week, the EU criticized Trump’s plan for a 25% tariff hike on steel, calling it damaging to negotiations and warning it was willing to implement countermeasures.

Investor focus is turning toward corporate earnings and macroeconomic data. Dollar General, Signet Jewelers, and Nio report quarterly results later on Tuesday, and Market participants also await fresh data on April job openings, durable goods, and factory orders.