Key Moments:

- Energy Fuels reported that its uranium mining output in the Pinyon Plain mine almost reached 260,000 pounds this May.

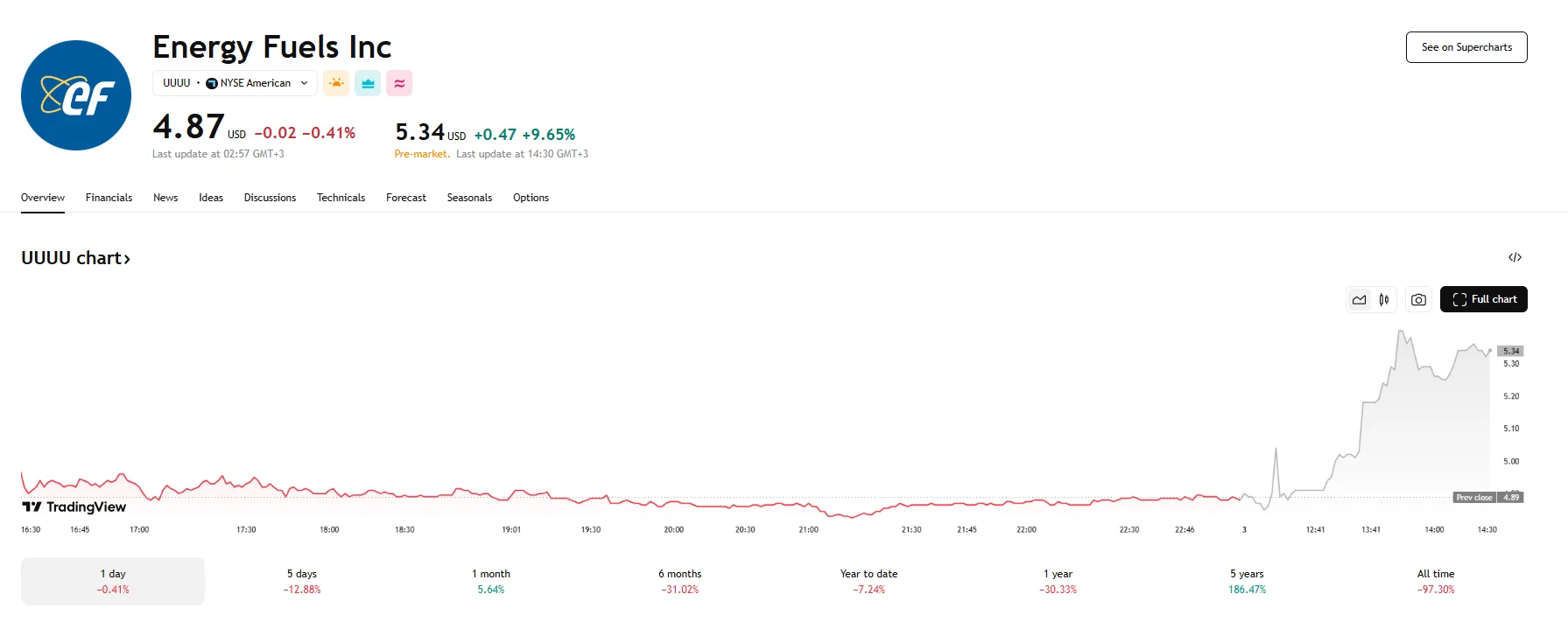

- Energy Fuels’ stock rose by almost 10% during pre-market trading following the announcement.

- The company is advancing permits for long-term projects in New Mexico and Arizona.

Energy Fuels Shares Soar on Strong Production Results

Tuesday’s pre-market trading session saw the stock price of Energy Fuels climb nearly 10% to $5.34 after the uranium producer posted record monthly production numbers in its Arizona-based Pinyon Plain mine. The company extracted close to 260,000 pounds of uranium during May, setting a new high for monthly output at the site. The jump in stock value completely reversed the 0.41% loss Energy Fuels suffered by the time markets closed on Monday.

CEO Highlights Strategic Objectives

Energy Fuels CEO Mark Chalmers stated that the company was implementing an aggressive plan to rapidly boost short-term US uranium supply. He explained this was intended to support near-term profitability and advance key aspects of President Trump’s Nuclear Energy, Energy Dominance, and Critical Mineral agendas.

Chalmers continued, stating that the company considered Pinyon Plain to be unparalleled as today’s most crucial domestic uranium mine. He elaborated that it possessed very high-grade, very low-cost characteristics and was projected to yield millions of pounds of uranium in the next few years, alongside significant exploration possibilities.

Energy Fuels is continuing to push forward with its long-term initiatives, including securing permits for the Roca Honda project, which is set to operate in New Mexico. Expansion in Arizona via the EZ Complex is also pending in terms of regulatory approval. These efforts are part of Energy Fuels’ broader strategy to strengthen and scale its domestic production capabilities and expand its footprint in the critical minerals market.