Key Moments:

- Registrations of Tesla vehicles in Portugal dropped 68% in May year-over-year to 292 units. Overall EV sales in Portugal increased approximately 24% in the same period.

- The company’s performance also lagged behind in Sweden, where purchases of Tesla vehicles slumped by 53.7% compared to 2024.

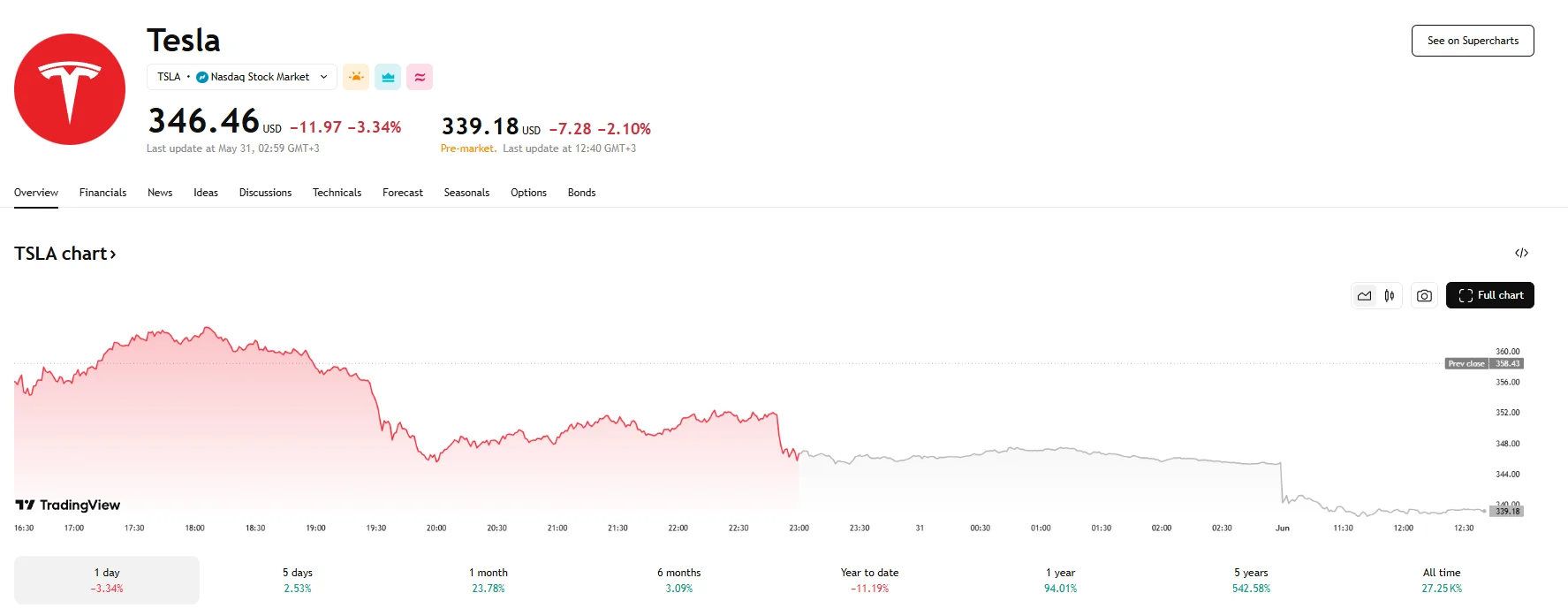

- Tesla’s stock price slid 2.1% to $339.18 in pre-market trading on Monday.

Portuguese Market Decline Underscores Broader Challenges

Tesla saw a steep downturn in new vehicle registrations in Portugal last month, with sales plunging by 68% in May year-over-year. The figures, as disclosed by the Portuguese automobile industry association ACAP, show Tesla delivered less than 300 units units during the month.

In contrast, Portugal’s light electric vehicle segment showed strength, with registrations climbing about 24% during the same timeframe. Despite this sector-wide momentum, Tesla’s market share faced notable erosion. Aggregate sales for the first five months of the year reflected a 36% slide from the prior-year period, totaling 2,739 vehicles.

Headwinds in Europe Mount Amid Shifting Competitive Dynamics

The EV maker continues to confront several obstacles across its European operations. CEO Elon Musk’s political positioning has raised eyebrows, particularly his reported engagements with far-right factions in the continent. Additionally, Tesla’s relatively limited and aging product lineup appears to be losing ground against traditional automakers and emerging Chinese entrants, which are introducing newer and often more competitively priced electric models.

Further weighing on sentiment, Tesla also experienced a 53.7% year-over-year decline in new car registrations in Sweden during May. This was one of the factors that likely contributed to the company’s share price slipping from the $340 mark during Monday’s pre-market hours.

The decline occurred as investor attention turned to the company’s forthcoming autonomous taxi initiative in Austin, Texas. Tesla had described this launch as pivotal during its April 22nd earnings call.

Despite today’s losses and last week’s drop of around 3.3%, Tesla’s stock has gained over 40% since the Q1 results’ publication. With expectations riding high on its robotaxi program, Tesla will likely need a flawless rollout to sustain its stock trajectory.

Currently, Tesla trades at around 180 times projected 2025 earnings. With this in mind, Future Fund Active ETF cofounder Gary Black, a long-standing Tesla supporter, decided to exit his Tesla position entirely. Although Black reiterated his $310 price target, he suggested the stock may be due for a breather.