Key Moments:

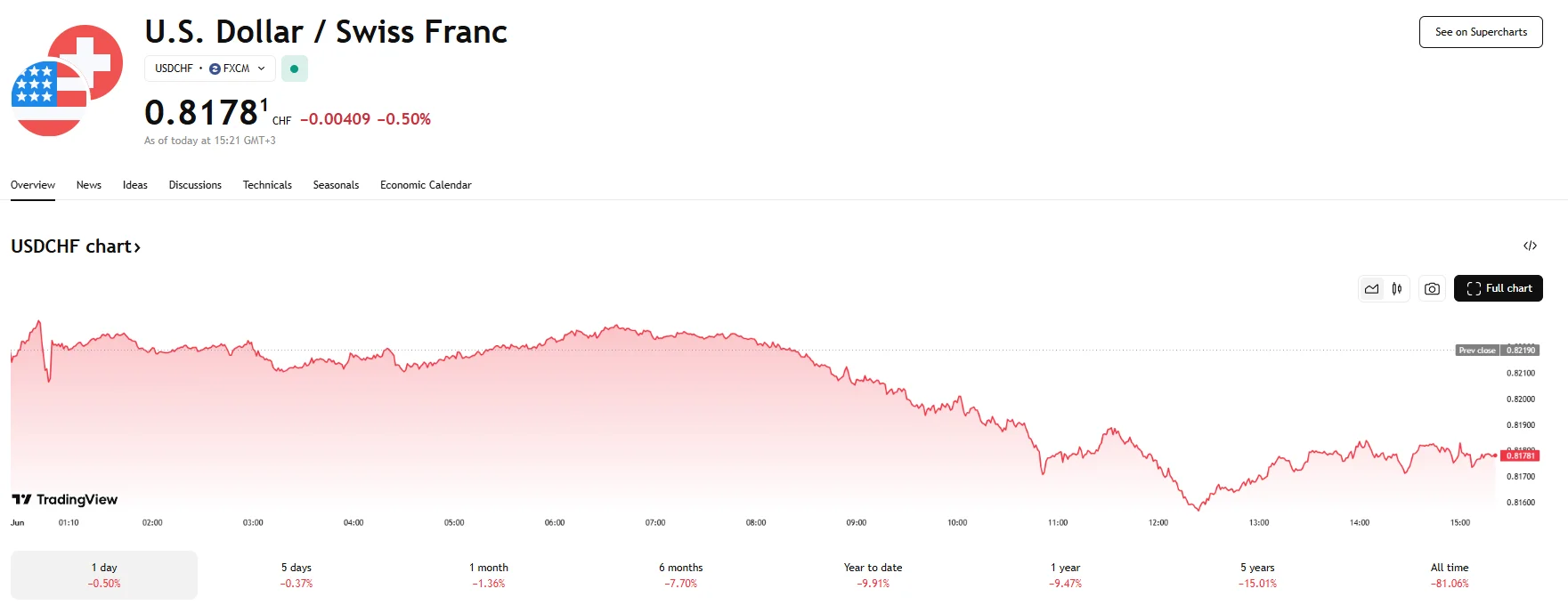

- The Swiss franc appreciated by 0.5% against the US dollar on Monday, climbing to its highest level in around a month.

- President Trump announced a tariff hike on steel and aluminum to 50%, effective June 4th.

- The SNB is expected to cut rates to zero on June 19th.

Frank Strengthens on Weaker Dollar and Safe-Haven Flows

The Swiss franc gained ground on Monday, managing to reach its highest valuation against the dollar since April 21st. The USD/CHF sank 0.5% to 0.8178 amid a decline in the dollar as traders turned to safe-haven assets. This shift in trader sentiment occurred as global trade and geopolitical risks re-emerged, providing fresh support for the Swiss currency.

The strength in the franc followed comments from President Donald Trump, who declared plans to double tariffs on steel and aluminum imports to 50% on Wednesday. Trump framed the move as a strategy to bolster the US steel sector. The announcement sparked concerns over the potential economic fallout for steel exporters such as India, which may face eroded competitiveness and financial strain. At the same time, US companies are bracing for higher input costs.

The administration’s move has reignited fears of tariffs having a negative impact on global supply chains. Moreover, the policy shift has drawn criticism from the European Union and other US trade partners.

Tariff-related tensions also intensified due to China’s dismissal of Trump’s claims that it had violated a trade agreement signed in Geneva the previous month. Simultaneously, the ongoing geopolitical conflict between Russia and Ukraine added another layer of uncertainty, further boosting demand for traditional safe-haven currencies such as the Swiss franc.

Domestically, investors are closely monitoring the Swiss National Bank’s upcoming interest rate decisions. At present, market participants predict that the SNB will slash rates to zero during its next monetary policy meeting.