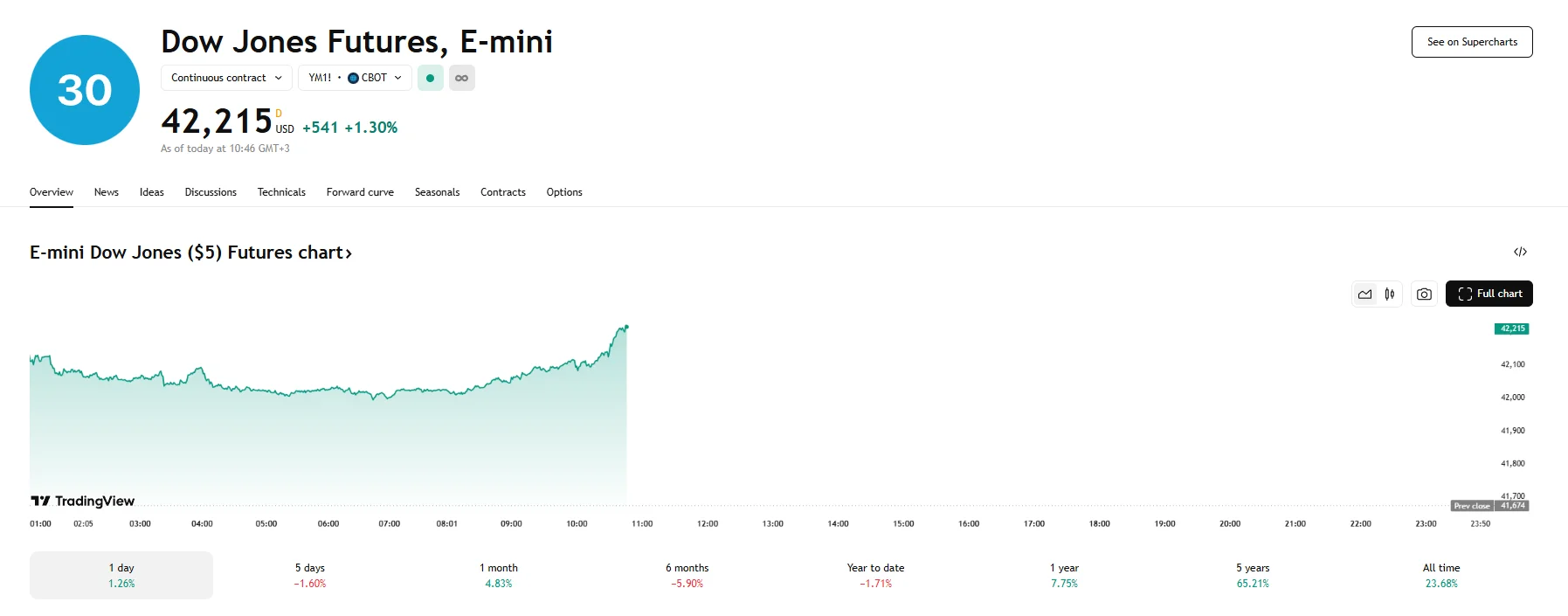

Key Moments:

- US stock futures jumped on Tuesday, with Dow Jones e-mini contracts rising by over 500 basis points.

- S&P 500 and Nasdaq 100 futures surged 1.48% and 1.68%, respectively.

- President Trump postponed his proposed 50% EU tariff to July 9th.

Tariff Reprieve Boosts Market Sentiment

US stock futures posted notable gains on Tuesday after Trump announced a temporary suspension of the proposed 50% tariff on goods imported from the European Union. The move, aimed at easing trade tensions, offered renewed optimism that a broader economic conflict could be avoided.

Dow Jones futures gained 541 basis points, a 1.30% climb that saw the benchmark hit 42,215. Nasdaq 100 e-minis also ticked higher, rising 1.68% by over 350 basis points to 21,327.50. S&P 500 futures, meanwhile, jumped 1.48% and reached 5,903.25.

This marked a positive turnaround after a volatile close to the prior week when markets dropped more than 2% in reaction to Trump’s earlier threat of a European Union tariff that had been set to go into effect on June 1st. The date was changed to July 9th following a conversation between European Commission President Ursula von der Leyen and US President Donald Trump over the weekend.

“The EU and US share the world’s most consequential and close trade relationship. Europe is ready to advance talks swiftly and decisively. To reach a good deal, we would need the time until July 9th,” Von der Leyen commented on social media platform X (formerly Twitter) on May 25th.

Outside of macro developments, individual company news also shaped sentiment. Nvidia is reportedly developing a new chip for the Chinese market, emphasizing the strategic importance of regional product tailoring amid regulatory challenges. Meanwhile, Tesla suffered a slowdown in European sales for the month of April, adding pressure to a stock already facing scrutiny from investors over demand concerns in key markets.

Investor attention is now shifting to policymaker commentary from the Federal Reserve ahead of the upcoming June FOMC meeting. Minneapolis Fed President Neel Kashkari is expected to give a speech on Tuesday, as is New York Fed President John Williams.