Key Moments:

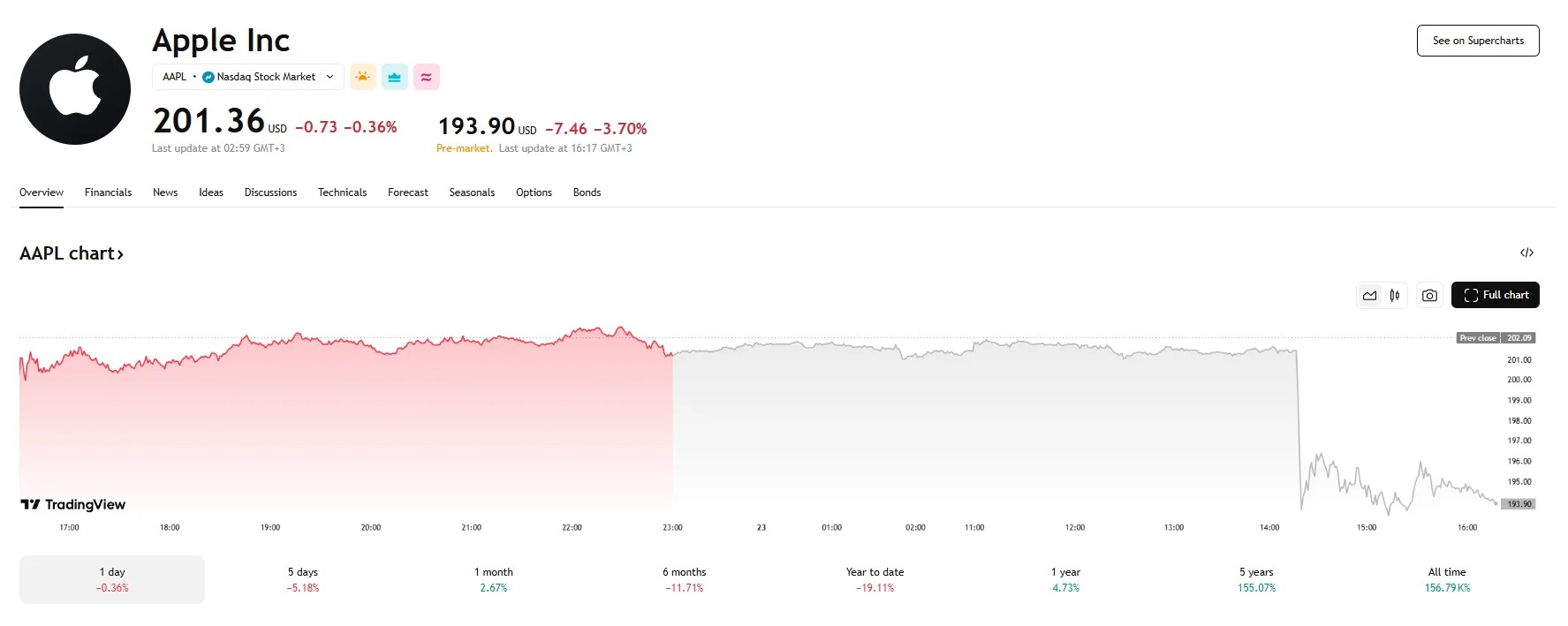

- Apple shares fell 3.7% during pre-market trading following President Donald Trump’s latest tariff threats.

- The company could face a 25% tariff on iPhones not produced in the United States.

- Analyst Dan Ives referred to Trump’s plan as a “fairy tale” and expects a full transition to domestic manufacturing to take five to ten years.

Apple Stock Hit by White House Tariff Demands

Apple’s shares took a sharp hit before Friday’s opening bell after President Donald Trump warned that iPhones assembled outside the United States could be subject to a 25% import tariff. The company’s shares dropped by over 3%.

In a Truth Social post, Trump stated that he had previously told Apple CEO Tim Cook that he expected iPhones sold in the US would be manufactured and assembled domestically rather than in India or any other location. He added that if that condition was not met, Apple would have to pay a tariff of “at least 25%” to the United States.

Trump’s Friday statements on tariffs extended beyond Apple, as the US president also expressed his intentions to target the EU with duties of 50% as discussions were “going nowhere.” European and US markets alike ticked lower as a result.

Apple’s Overseas Strategy in the Crosshairs

Trump’s focus on Apple’s manufacturing strategy comes as the company continues diversifying its supply chain to reduce dependency on China. His latest remarks follow earlier criticism voiced in Qatar, where he mentioned he took issue with Apple’s efforts to expand production in India. “I don’t want you building in India,” he reportedly told the Apple CEO.

Industry voices have expressed skepticism about Trump’s demand. Dan Ives, an analyst at Wedbush, deemed it an unfeasible “fairy tale.” According to his estimates, a full switch to US production could take up to years. Moreover, should it be successful, the cost of each device could soar to $3,500.

Enders Analysis’ Jamie MacEwan has also commented on Apple’s tariff woes, pointing out that the company’s Chinese production remains a concern. He highlighted that nearly half of Apple’s revenue hinges on China, which continues to present risks as trade tensions escalate.