Key Moments:

- The euro slid 0.26% against the greenback on Thursday.

- May witnessed the Eurozone’s Composite PMI dip to 49.5, exerting pressure on the EUR/USD.

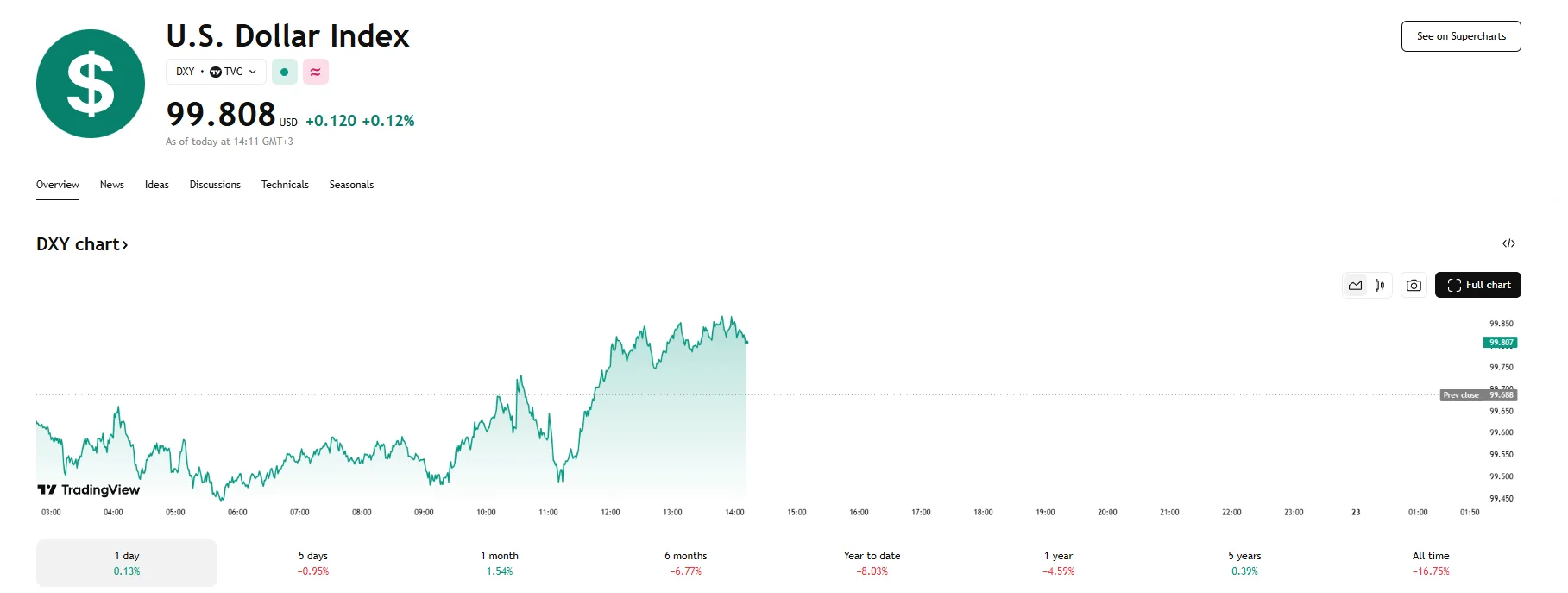

- The Dollar Index rose 0.12% following news of Trump’s tax and spending bill being passed in the US House.

Euro Tumbles After PMI Data Signals Economic Contraction

The euro lost some ground against the dollar on Thursday following the release of disappointing PMI figures from the Eurozone. A 0.26% drop pushed the EUR/USD to 1.1298, pausing a recent rally that saw the pair climb above 1.1350. The pair has yet to retreat below the 30-period simple moving average, however, with the Relative Strength Index holding above the neutral 50 mark.

The Composite PMI for May fell to 49.5 amid weakness in the services sector, marking a decline from the previous reading of 50.4. This downturn has sparked speculation that the European Central Bank could be forced to lower interest rates in June. However, any decisions will likely depend on further economic data, particularly concerning the effects of ongoing US trade policies.

Dollar Index Ticks 0.12% Higher Following US House Approval of Tax Bill

Despite the euro’s pullback, the dollar has struggled to gain strong momentum, weighed down by investor worries about US fiscal stability. Earlier in the week, Moody’s lowered the US government’s credit outlook to Aa1, citing concerning debt levels, which has undermined confidence in US assets.

However, the US Dollar Index edged up after President Donald Trump’s tax and spending legislation advanced in the House on Thursday and is expected to move to the Senate. Should the bill pass, it would significantly increase US federal debt, potentially exacerbating existing investor concerns.