Key Moments:

- Italy’s securities watchdog, CONSOB, imposed a 30-day suspension of UniCredit’s Banco BPM takeover bid.

- UniCredit has challenged government conditions surrounding the deal, calling them unfeasible.

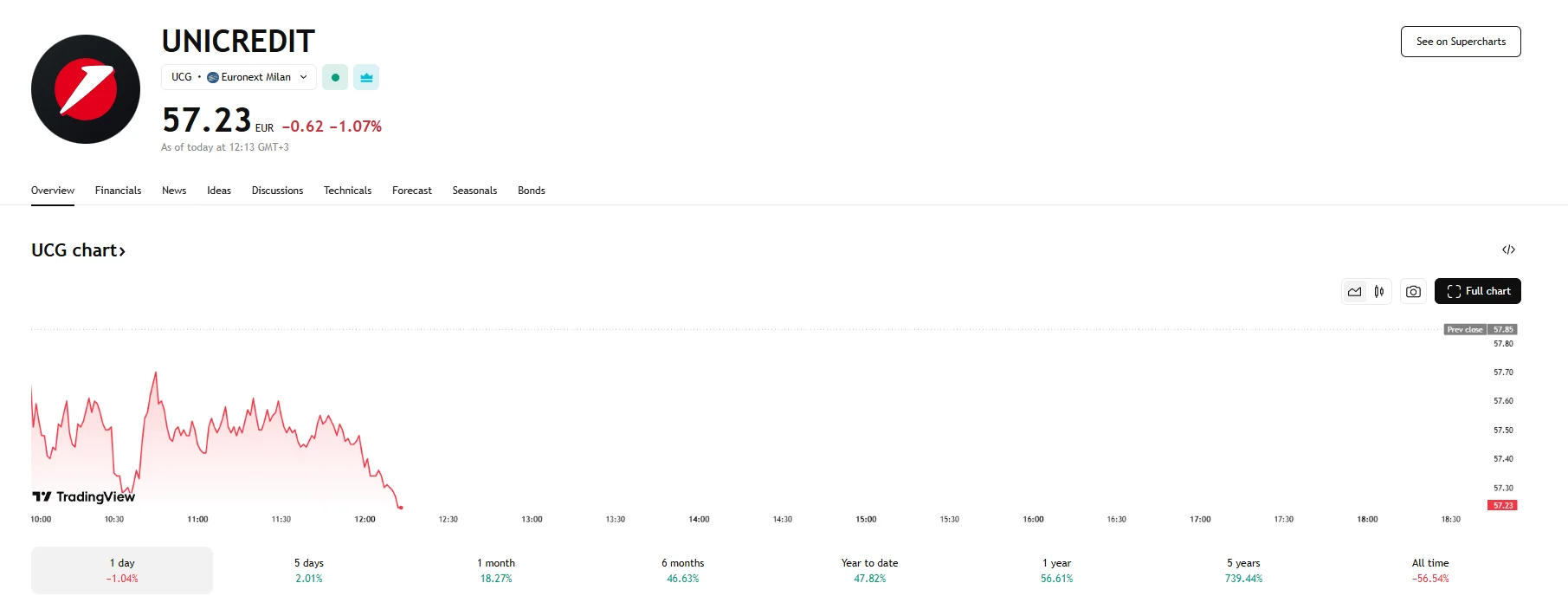

- UniCredit’s shares tumbled 1% on Thursday, while Banco BPM’s stock declined by around 0.7%.

Regulators Freeze UniCredit’s Acquisition Attempt

Italy’s securities regulator has paused UniCredit’s over $10 billion all-stock takeover offer for Banco BPM. The suspension, which will last 30 days, was announced following UniCredit’s request for the approval process to resume on the grounds of the government’s approval requirements being impossible to satisfy.

The news was not received well by investors, and negative sentiment pushed the stock price lower by 1.07% to €57.23. Banco BPM’s shares also fell by roughly 0.7%.

November witnessed UniCredit unveil its unexpected plans to acquire Banco BPM. The bid, UniCredit argued at the time, would expand its presence in Lombardy and strengthen its position among Italy’s top banking institutions.

The deal was put under regulatory scrutiny as early as April when Italy’s government presented its conditions for approval of the transactions. Invoking its “golden powers,” tools that enable state intervention in strategic company deals, it laid out specific prerequisites for the deal to proceed. UniCredit has publicly questioned the clarity and practicability of these conditions, emphasizing that they could hinder the merged group’s ability to manage credit and liquidity. Potential problems connected to the bank’s Russian presence were also brought up. Although UniCredit is in the process of scaling back operations in Russia and aims for an eventual exit, the process is still ongoing.

Market Communication Concerns Trigger Suspension

CONSOB stated on Wednesday that UniCredit’s challenge to the government’s conditions introduced new information that was not originally made public knowledge. According to the regulator, this prevented shareholders from making informed decisions regarding the offer, thus creating uncertainty and necessitating a temporary halt. Moreover, a government spokesperson reached out to Reuters on Wednesday and stated that the conditions were non-negotiable.

Banco BPM reacted by condemning the freeze as excessive, asserting that it deviated significantly from the Authority’s established procedures. The bank continued, arguing that the government’s decision significantly harms not just the targeted institution but also its shareholders and the broader market. Banco BPM also claimed that the lack of disclosure “should in itself cause the offer to lapse.”