Key Moments:

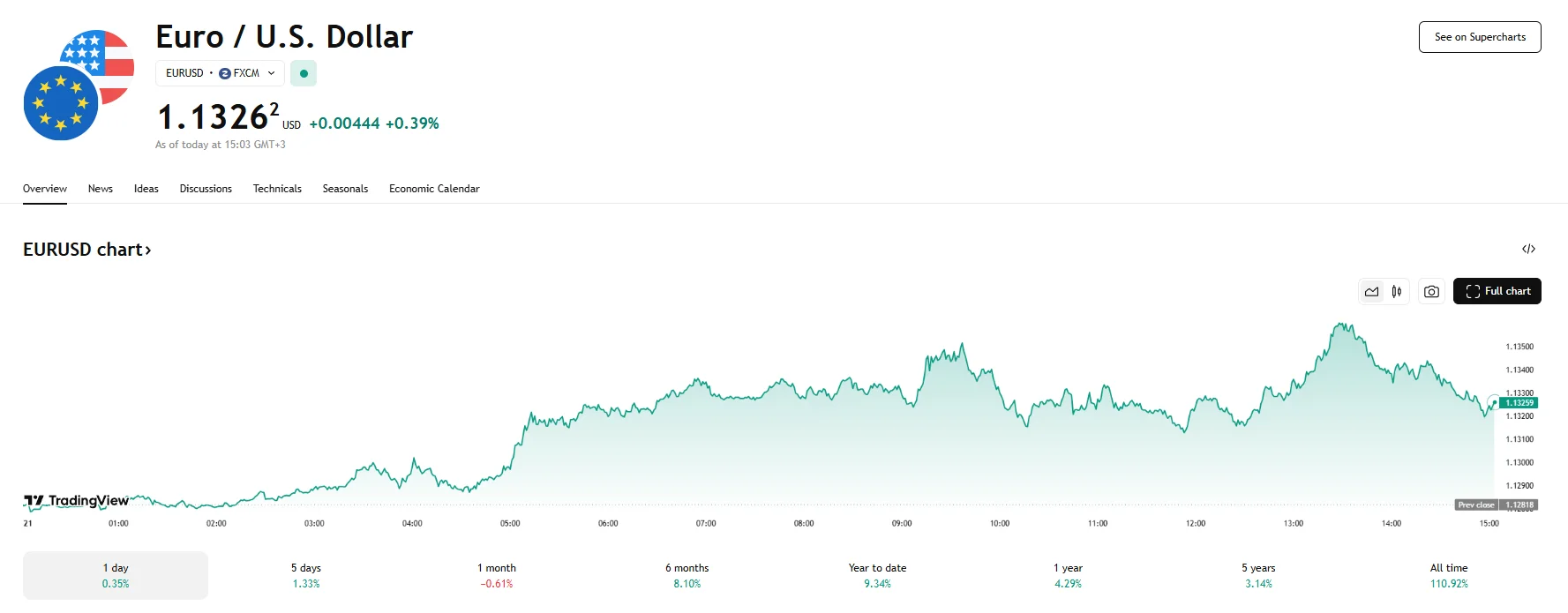

- EUR/USD surged by 0.4% on Wednesday.

- President Trump could not to gain Republican support for a new $3-$5 trillion tax-cut proposal.

- The euro rose following Trump’s commentary on a potential Russia-Ukraine ceasefire.

EUR/USD Extends Rally as Dollar Faces Persistent Headwinds

The euro climbed sharply against the US dollar on Wednesday, with the EUR/USD moving above the 1,1230 level. The pair briefly touched 1.1359 earlier in the session, notching its third consecutive day of gains. The pair benefited from ongoing selling pressure on the greenback, which has been weighed down by concerns about the United States’ fiscal trajectory and creditworthiness. As for the US Dollar Index, it pared some of its earlier losses but remained 0.37% lower at 99.640.

Credit Downgrade, Tax-Cut Uncertainty Weigh on Dollar

A major drag on the US dollar stemmed from Moody’s recent downgrade of the country’s sovereign credit rating to Aa1, citing rising fiscal imbalances and intensifying interest burdens as the key drivers behind its decision. Moody’s also expressed concern over the increasing national debt, which currently stands at $36 trillion, particularly as President Donald Trump pursues a new $3 to $5 trillion tax bill. However, Trump’s attempt to secure support for the tax proposal proved unsuccessful during a closed-door session on Tuesday. Opposition by Republican lawmakers was reportedly centred around provisions related to elevated deductions for state and local tax payments.

Euro Benefits From Geopolitical Optimism, ECB Rate Hopes

The euro’s strength was supported by the anticipation of a ceasefire between Russia and Ukraine. President Trump announced through Truth Social that negotiations would begin immediately in Vatican City.

In addition, traders have priced in an increased chance that the European Central Bank would lower interest rates next month. Although several ECB officials have voiced confidence that inflation is nearing the 2% target, some caution remains. ECB Governing Council member Klaas Knot stated on Tuesday that he could not rule out the possibility of another interest rate cut in June, but he also could not confirm it.