Key Moments:

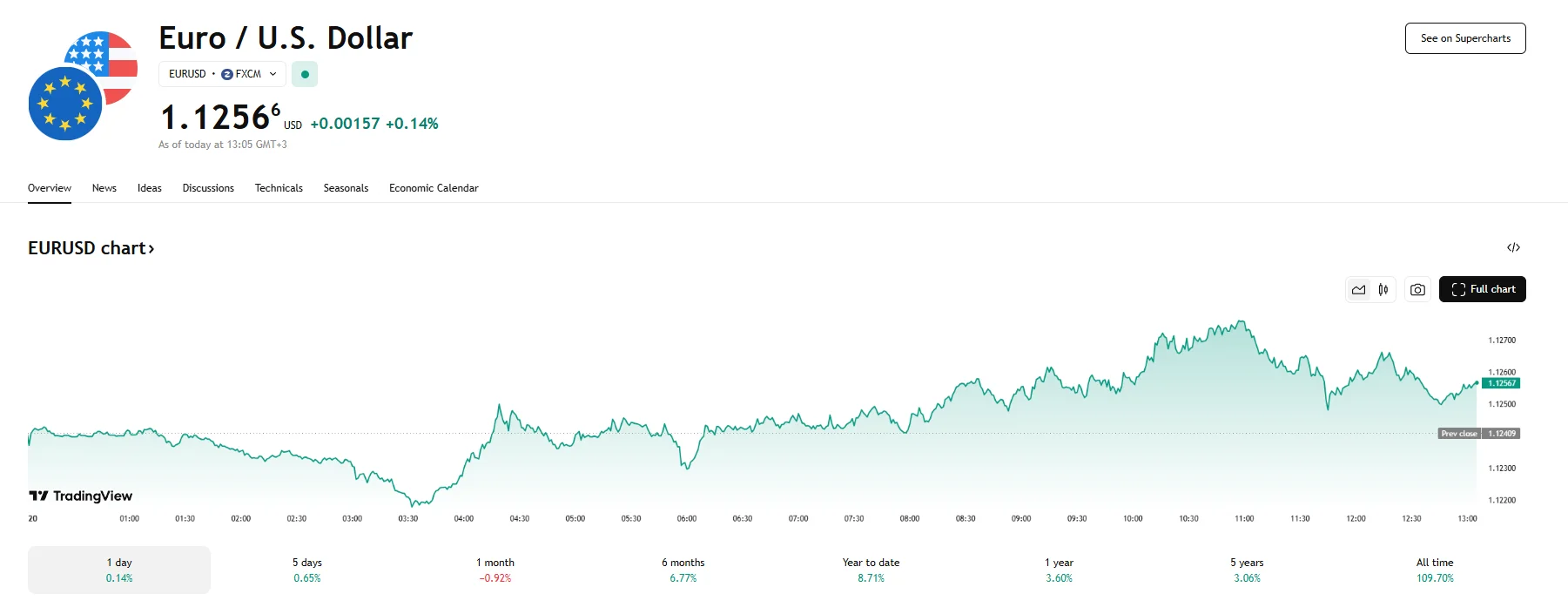

- The euro advanced 0.14% to 1.1256 against the greenback on Tuesday, extending yesterday’s gains.

- Moody’s downgrade of the US credit rating continued to weigh on the dollar’s momentum.

- Markets remained cautious ahead of central bank commentary.

Euro Gains for Second Consecutive Day

The euro extended its upside move on Tuesday, climbing above the 1.1250 mark after securing a positive close on Monday. However, despite these gains, the EUR/USD pair remained pinned just below the key resistance at 1.1270. A sustained break above that level is seen as a potential trigger for additional gains.

Dollar Struggles After Moody’s Downgrade

Investor sentiment around the dollar remained under pressure following Moody’s recent decision to lower its US credit rating to Aa1, down from the previous Aaa. The move triggered concerns about fiscal sustainability, which in turn have started to impact the FX market.

Traders have adapted a cautious approach, with mounting focus on the cost of servicing debt and the country’s budget deficit. In the previous year alone, interest payments on debt approached $900 billion against total receipts of $4.92 trillion. With spending at $6.75 trillion, the resulting deficit stood at $1.83 trillion.

Fed and ECB Officials in Focus as Markets Await More Clarity

In recent comments, Federal Reserve officials maintained a cautious tone. Raphael Bostic, Atlanta’s Fed President, has claimed that he anticipates a signal rate cut in 2025. Vice Chairman Philip Jefferson and Minneapolis Fed President Neel Kashkari, on the other hand, emphasized a patient approach, stressing the need for additional economic data before making rate decisions.

In Europe, ECB board member Isabel Schnabel noted inflation has slowed thus far, but warned of potential spikes as a result of US-imposed trade duties. Looking ahead, the traders will divert their attention to preliminary data regarding May’s Consumer Confidence Index, which is scheduled to be released on Tuesday.