Key Moments:

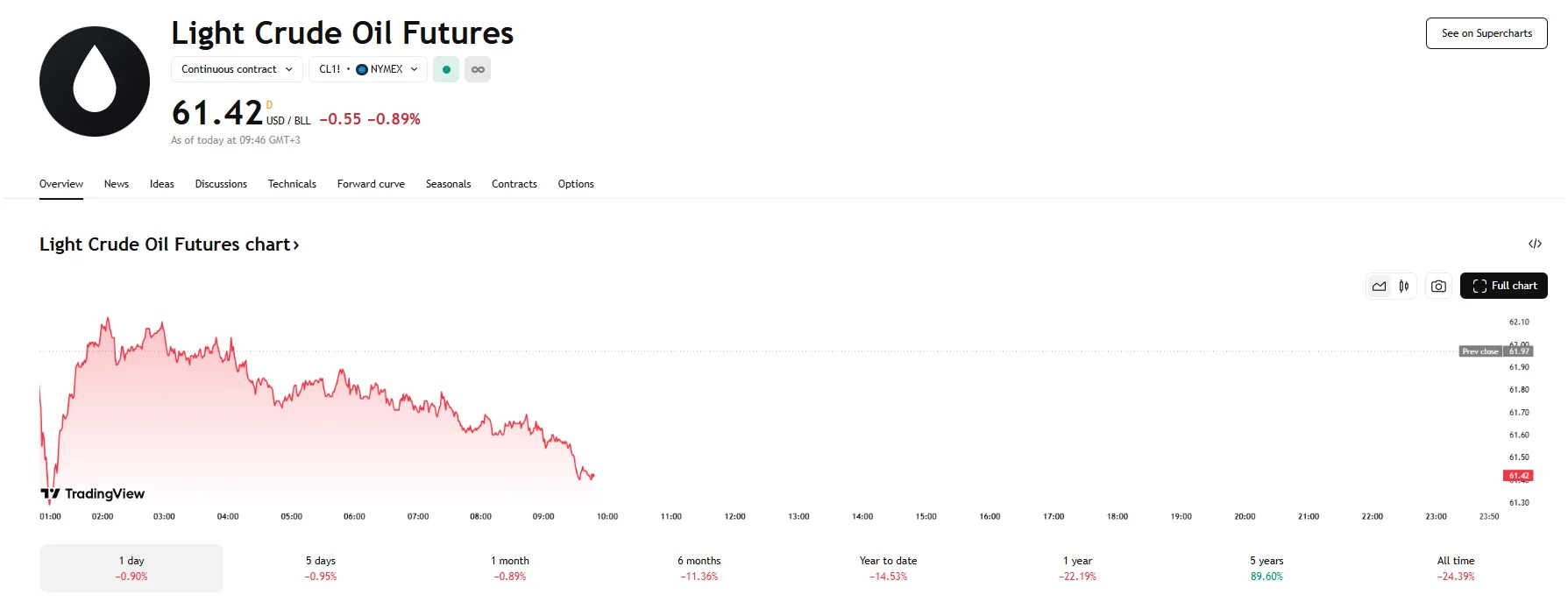

- Brent crude futures fell 56 cents to $64.85 on Monday. WTI oil also dropped, falling 0.89% to $61.42.

- Moody’s downgraded the United States’ creditworthiness due to rising national debt

- China’s factory output growth fell last month, as did the climb in retail sales. The former stood at 6.1%, while the latter dropped to 5.1%.

Crude Futures Retreat

Oil prices declined on May 19th amid concerns over the US economic outlook and weaker-than-expected demand signals from China. Brent crude futures fell by 0.86%, marking a drop to $64.85. US West Texas Intermediate (WTI) futures mirrored this decline, losing 55 cents and hitting $61.42.

US Credit Downgrade and China’s Economic Signals Weigh on Market Sentiment

Moody’s downgrade of the US sovereign credit rating on Friday, citing the ballooning $36 trillion national debt, cast a shadow over financial markets. The rating action could make it challenging for President Donald Trump to implement tax cuts. According to Phillip Nova senior market analyst Priyanka Sachdeva, the downgrade has contributed to a more cautious tone among investors despite not directly reducing oil demand.

Adding to gloomy sentiment, April witnessed China’s industrial output and retail sales growth decelerate, signaling potential headwinds for the global oil markets. As revealed by the Chinese National Bureau of Statistics, factory production climbed by 6.1%, down from March’s 7.7%. Meanwhile, retail sales grew by 5.1%, contrasting with the previous month’s 5.9% jump. The figures highlighted a challenging path to economic recovery for the biggest buyer of crude oil.

Geopolitical Tensions Cap Oil Losses

Unresolved Iran-US nuclear negotiations have helped contain further declines in oil prices. According to comments made by US Special Envoy to the Middle East Steve Witkoff, any agreement with Iran would need to include the country ceasing its uranium enrichment. Iranian officials rejected the demand.

Domestically, it appears American energy producers scaled back operations since last week saw the total number of active oil rigs fall by one to 473. As detailed by Baker Hughes, this marks the lowest rig count since the first month of 2025.