Key Moments:

- USD/CAD extends decline, dipping over 0.10%.

- Stronger oil prices have pressured the pair

- The chances of a Fed rate cut went up following the disclosure of US economic data on Thursday.

Price Action Faces Resistance Below 1.4000

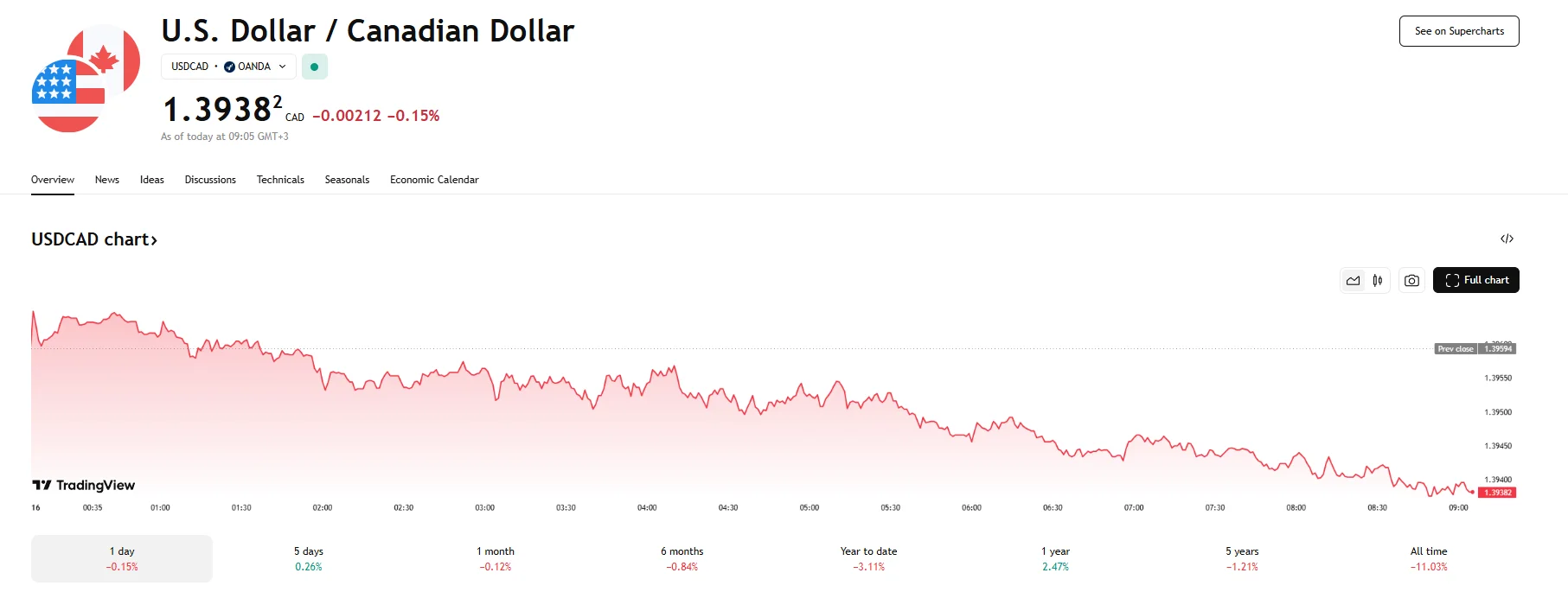

The USD/CAD resumed its downturn for a second straight session on Friday, slipping to 1.3938 and suffering a loss of 0.15%. Despite the pullback, the pair has continued to trade within a range established earlier this week.

Muted US economic results released Thursday have strengthened expectations for further rate reductions from the Federal Reserve. The figures include the US’s PPI falling 0.5%, while core wholesale prices dropped 0.4% on a monthly basis. Retail sales, on the other hand, climbed by 0.1%. Following the publication of this data, the greenback retreated.

At the same time, modest gains in crude oil prices are lending support to the Canadian dollar, which is closely tied to commodity performance. Typically, an increase in the price of oil corresponds with an appreciation in the value of the CAD, driven by heightened international demand for the Canadian dollar to facilitate oil transactions.

Technical Outlook Shows Mixed Signals

Today’s rates follow a recent downward movement that saw the USD/CAD reach a yearly low near the 1.3750 mark. While this recovery may represent a phase of consolidation toward bullish sentiment, inability to push past the 1.4000 area may serve to limit upward momentum.

The 1.3900 mark, meanwhile, could keep its current role as a cushion for now. However, a firm break beneath this level would open the door for a deeper pullback that may once again see the pair drop towards the lows observed in May.