Key Moments:

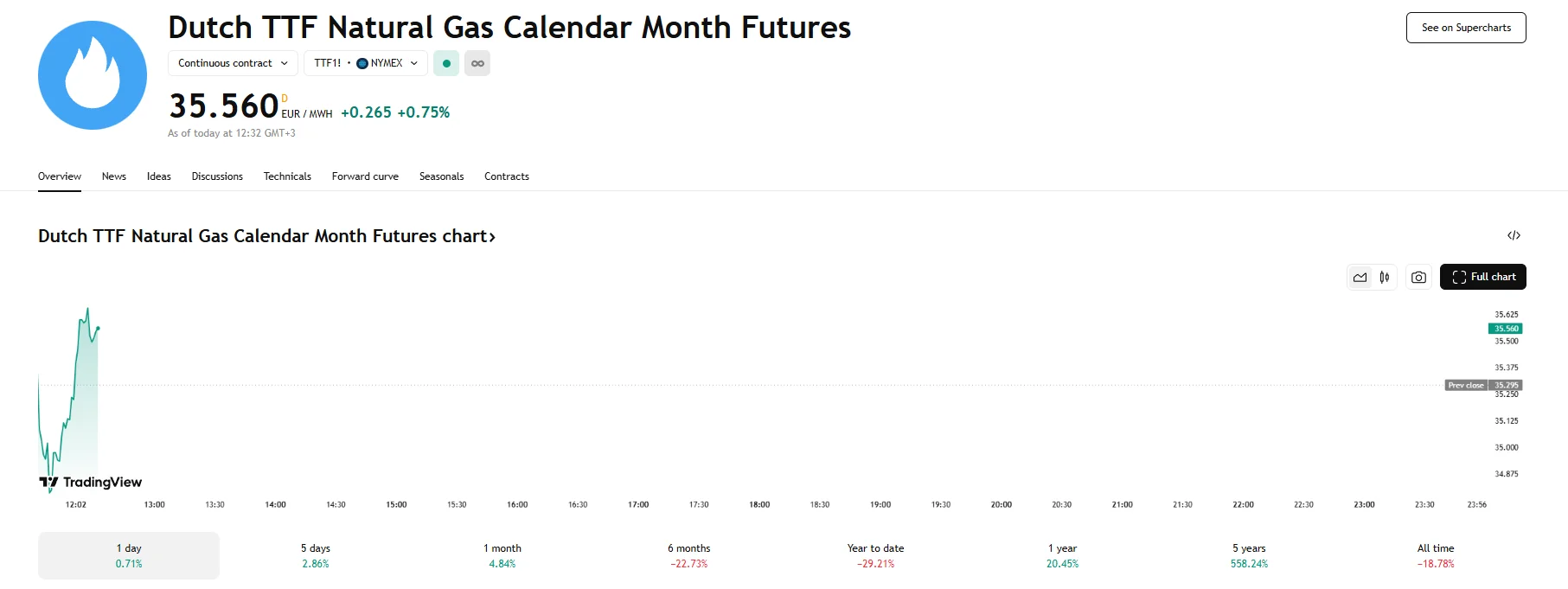

- Dutch TTF rose 0,75% to €35.56 on Friday.

- Gas demand for power generation jumped 173 GWh/day on expectations of weaker wind output.

- Peace talks between Russia and Ukraine in Istanbul attracted market attention.

Stability Defines Friday Gas Trade

European wholesale gas prices remained in a tight trading band on Friday morning, supported by a balanced supply-demand outlook. Market participants maintained a cautious stance, closely watching progress on peace efforts between Russia and Ukraine.

Denmark’s TTF natural gas calendar month futures contract climbed by 0.75%, with the figure recovering from an earlier low near €35.00 per megawatt hour (MWh). In the UK, NBP natural gas futures rose 0.8% to 85.15 GBX.

Forecasts indicated a decline in local distribution zone (LDZ) demand, which is typically associated with heating. Day-ahead LDZ demand fell by 116 GWh/day, while projections for next week showed a 67 GWh/day dip, bringing demand to 904 GWh/day. On the other hand, LSEG revealed that expectations of decreased wind power generation could aid demand for natural gas across the north-west European region, and is expected to rise to 173 GWh/day.

LSEG’s European gas research head, Wayne Bryan, announced in a morning briefing that their perspective had not shifted. He added that TTF day-ahead prices were expected to continue to fluctuate within the previously noted tight range, which he attributed to a steady equilibrium between supply and demand.

Markets also remained attentive to diplomatic developments as officials from Russia and Ukraine gathered in Istanbul for what was described as their first direct talks regarding a potential end to the war since 2022. However, Russian President Vladimir Putin did not participate in the officially designated delegation, dampening expectations of productive peace negotiations.