Key Moments:

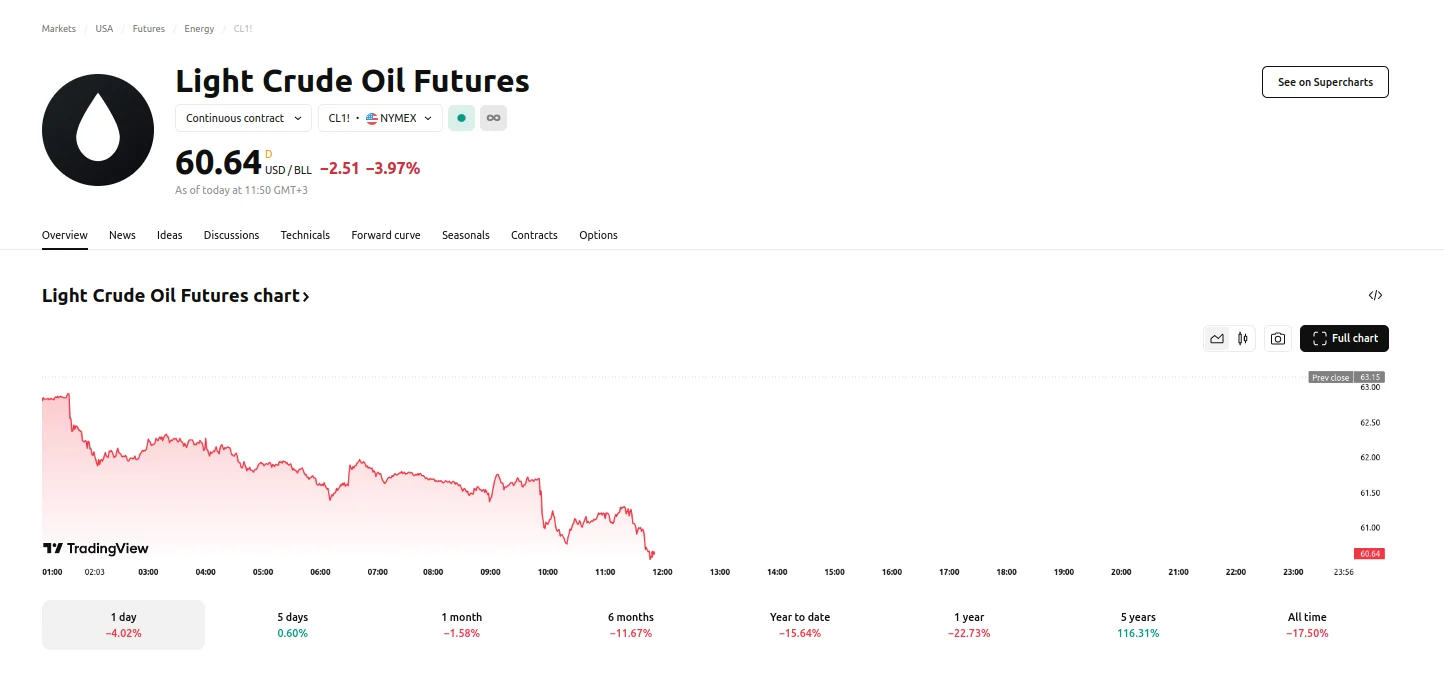

- WTI crude futures declined approximately 4% on Thursday.

- US crude inventories rose by a further 3.5 million barrels last week.

- President Trump reportedly conveyed his optimism regarding the forging of an agreement with Iran and claimed that Iranian officials have accepted the terms.

Crude Futures Hit by Fears of Oversupply

Thursday witnessed West Texas Intermediate oil futures extend a downward trend, registering a 3.97% drop after yesterday’s decline. WTI futures contracts were trading at $60.64 per barrel as investor sentiment soured on mounting concerns over a global supply shock, as OPEC still intends to raise output.

Further weighing on prices was a notable rise in US crude stockpiles. Data from the US Energy Information Administration (EIA) showed a 3.5 million-barrel build last week. This brought overall inventories to 441.8 million barrels, a sharp contrast to the 1.1 million barrels expected by analysts polled by Reuters. The 3.5 million figure reported by the EIA did not stray far from the American Petroleum Institute’s report, according to which 4.3 million were added to the stock.

However, it should be noted that OPEC now projects that oil supply growth from non-OPEC+ nations will rise by 800,000 barrels per day (bpd). This marks a decline from the group’s earlier forecast, according to which the increase would’ve hit 900,000 bpd.

Potential Breakthrough with Iran

The latest pressure on oil markets came after President Donald Trump announced progress in talks with Tehran. According to Trump, the deal was near its completion, and he noted that Iran had agreed to the terms. “We want them to succeed,” he added, and blamed the prior administration for the perceived loss of US standing in the Middle East.

His comments came one day after the administration hit the Iranian ballistic missile industry with new sanctions. Iran had also recently been sanctioned due to 20 entities’ alleged involvement in the enabling of illicit exports of Iranian oil to China.

The said sanctions could be lifted, however, should Iran and the US reach an agreement regarding the company’s nuclear weapon program. Iran’s Ali Shamkhani has indicated Tehran’s willingness to enter into a nuclear accord with the United States. As reported by the NBC, the deal’s framework involves Iran pledging to abstain from developing nuclear arms in return for the complete and immediate lifting of US sanctions. This served to further fuel supply concerns and bearish sentiment among crude oil traders.