Key Moments:

- Deere posted second-quarter net income of $1.804 billion, down from $2.370 billion a year earlier.

- Worldwide net sales and revenues dropped $12.763 billion in Q2 2025, a 16% decline.

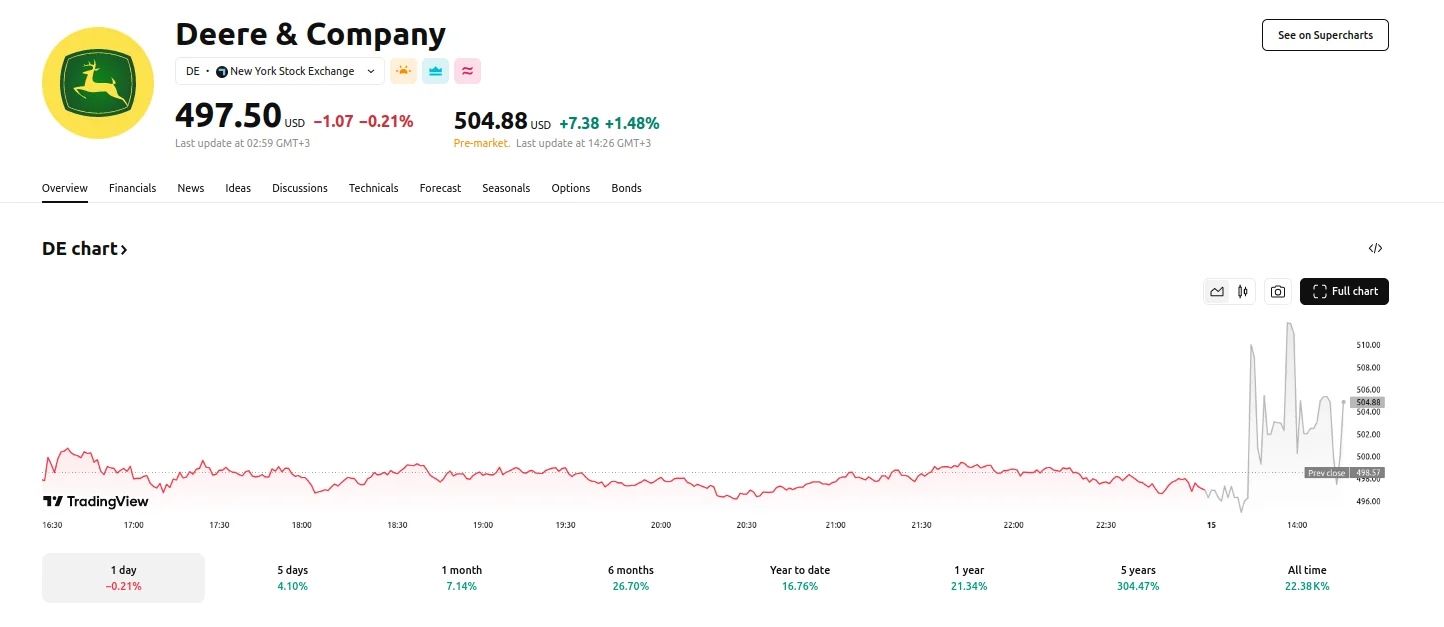

- The company’s shares rose 2.71% to $511 during Thursday’s pre-market trading session, before tumbling to $504.88, still 1.48% up from yesterday’s close.

Muted Demand Weighs on Deere’s Q2 Performance, Shares Fall From 2.71% Climb

On Thursday, Deere & Company reported its financial results for the second quarter ended April 27th, 2025, showing a notable drop in earnings and revenue due to macroeconomic headwinds and weaker demand for agricultural equipment. The company reported net income of $1.804 billion, or $6.64 per share, compared to $2.370 billion, or $8.53 per share, in the same period a year earlier.

For the first half of the fiscal year, Deere’s net income declined to $2.673 billion ($9.82 per share). The figure reflects a notable decline from last year’s $4.121 billion ( $14.74 per share). In addition, the company also suffered a drop when it came to its worldwide net sales and revenues, which dropped 16% to $12.763 billion for Q2 2025. For the six-month period, revenues came in at $21.272 billion, representing a 22% decline from the prior year.

Net equipment sales also fell, with the figure of $11.171 falling below the $13.610 billion reported a year earlier. For the first half of the year, net sales dropped from $24.097 billion to $17.980 billion.

The news caused fluctuations in the stock’s pre-market figures. Thursday initially saw Deere enjoy an increase in value, with its shares advancing by 2.71% to hit $511. However, the stock subsequently surrendered some of those gains, with its share price hitting $504.88.

Economic Conditions, Customer Behavior Shift, and Revised Earnings Outlook

Deere attributed the weakening in quarterly results to growing economic uncertainty and a decline in demand from farmers, many of whom are deciding to rent rather than purchase machinery due to high borrowing costs and softer crop prices. Production costs also jumped, in part due to the Trump administration’s tariffs, creating further pressure on large industrial manufacturers operating in global markets.

In response to current market dynamics, Deere updated its fiscal 2025 earnings guidance. The company revised its net income range from $5-$5.50 billion to estimates of $4.75 to $5.50 billion. CEO John May expressed confidence in the company’s future despite market difficulties. He highlighted ongoing investment in advanced offerings and manufacturing to deliver customer value. May further noted continued significant investment in the US market over the next decade, focusing on innovation, growth, and global cost-competitiveness.