Key Moments:

- Alibaba reported fiscal Q4 revenue of 236.45 billion yuan, falling short of the 237.24 billion yuan expected by analysts.

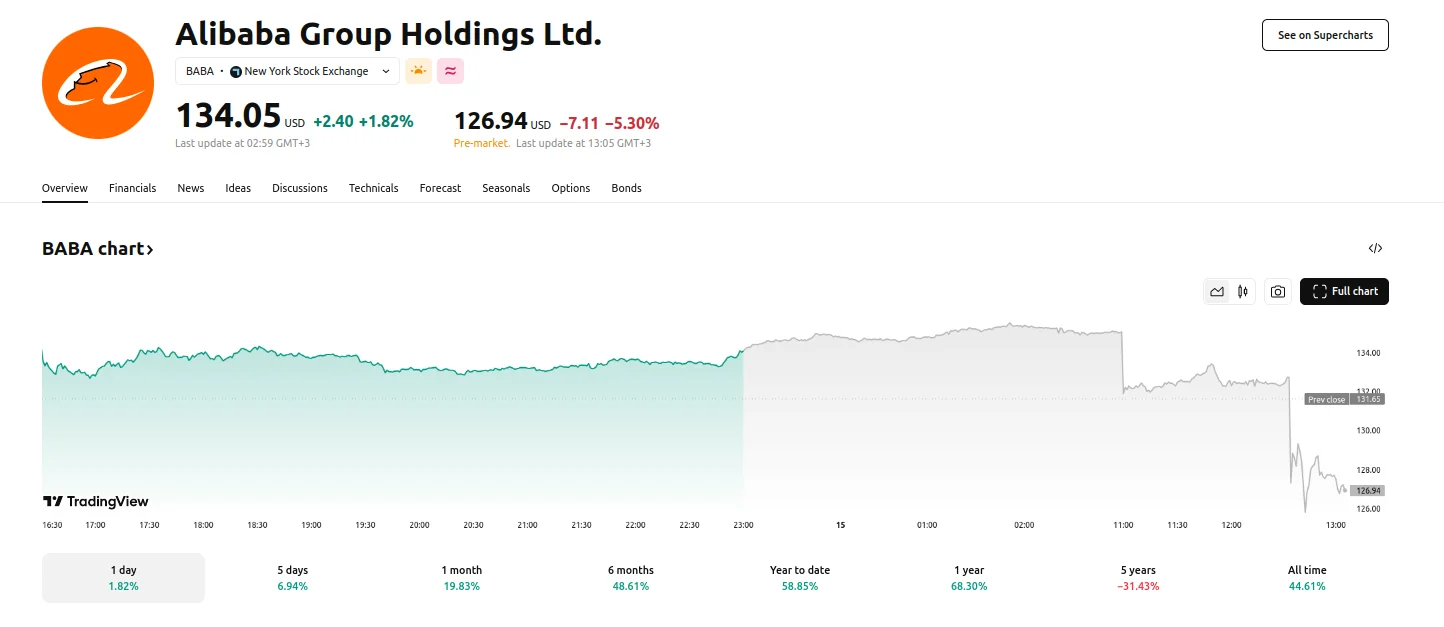

- Shares listed in the US dropped more than 5% in pre-market trading, retreating to $126.94.

- Consumers in China have become increasingly frugal, triggering fierce pricing battles among major e-commerce competitors.

Revenue Disappointment Hits Shares

Alibaba Group (NYSE: BABA) released its fiscal fourth-quarter results on Thursday, disclosing revenue that came in below analyst expectations. The company posted revenue of 236.45 billion yuan ($32.79 billion) for the quarter, narrowly missing the 237.24 billion yuan ($32,92 billion) LSEG forecasts.

The market reacted swiftly. After an initial drop to around $132 on Thursday, the decline accelerated and saw shares plunge more than 5.30% to $126.94 during pre-market hours. Despite the steep drop, the stock had already risen over 50% year-to-date before the latest earnings release.

Consumer Caution and Competitive Pressures

Alibaba continues to face headwinds as Chinese households remain cautious with their spending. Persistent economic sluggishness and high unemployment have led more shoppers to seek out discounts and lower prices before making purchases. This conservative consumer behavior has intensified price competition among China’s largest online retail players.

The e-commerce sector’s competitive dynamic has resulted in aggressive pricing strategies from key players, including Alibaba and JD.com (NASDAQ: JD). Each firm is vying to retain or grow market share by appealing to increasingly value-conscious customers.

Moreover, Alibaba’s revenue miss came just two days after JD.com reported Q1 sales above estimates, signaling momentum from expanding user numbers. March’s total revenue reached 301.08 billion yuan ($41.77 billion), a 15.8% jump from last year’s figures that contrasts with Alibaba’s performance. The companies’ financial data illustrates the uneven landscape among China’s top online marketplaces during a period of economic strain.